Who

Rob Katz, Chairperson and Chief Executive Officer, Vail Resorts

Recorded on

August 8, 2025

About Vail Resorts

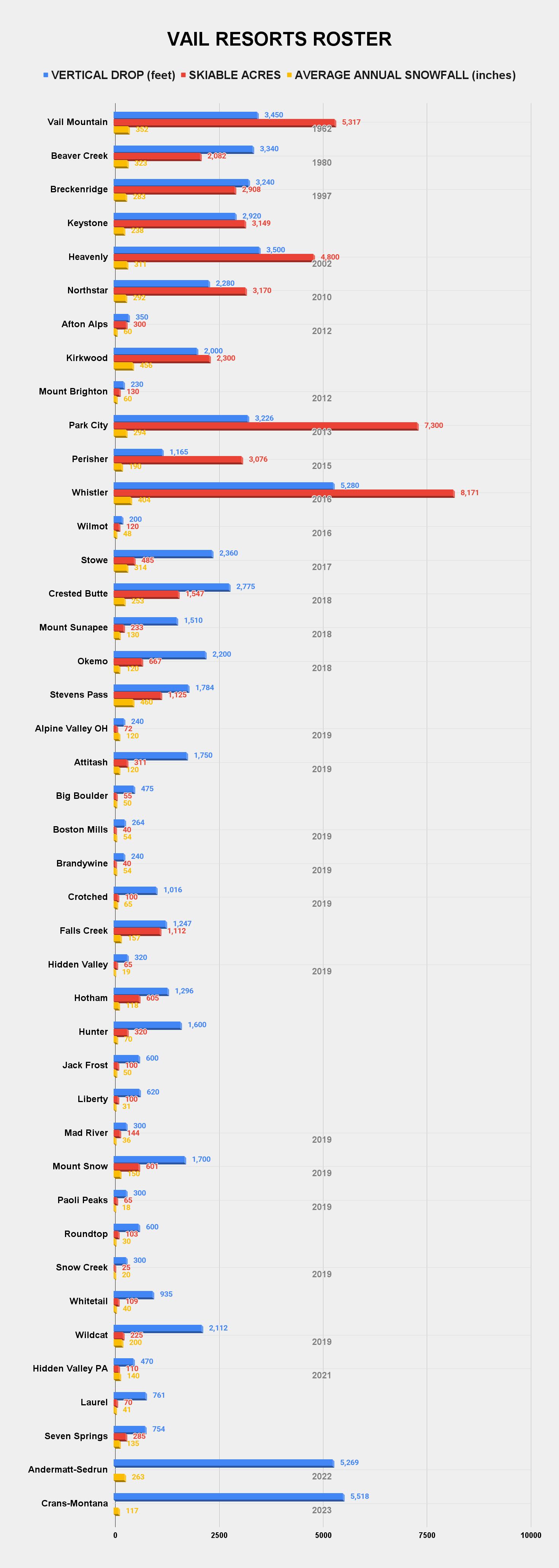

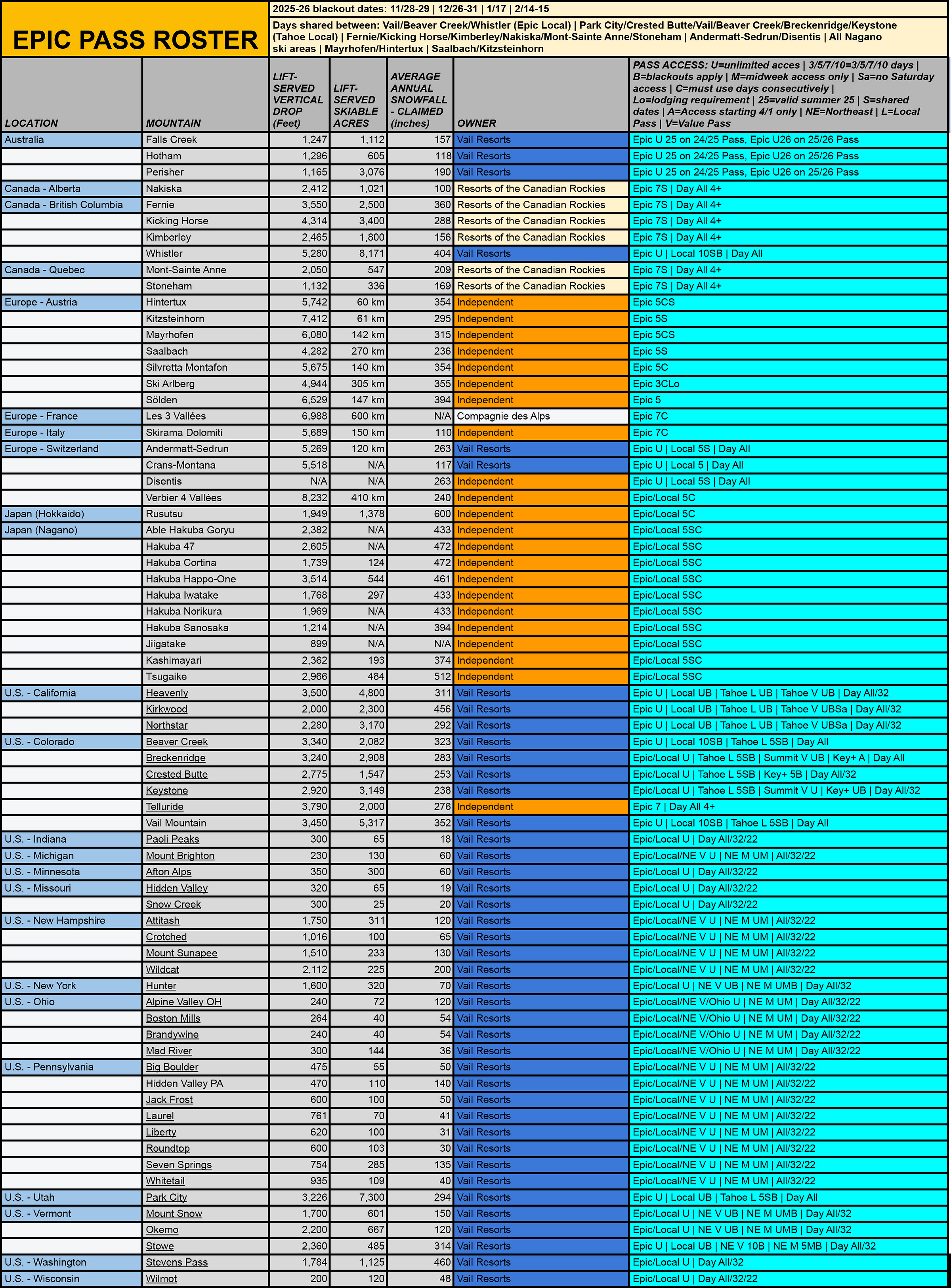

Vail Resorts owns and operates 42 ski areas in North America, Australia, and Europe. In order of acquisition:

The company’s Epic Pass delivers skiers unlimited access to all of these ski areas, plus access to a couple dozen partner resorts:

Why I interviewed him

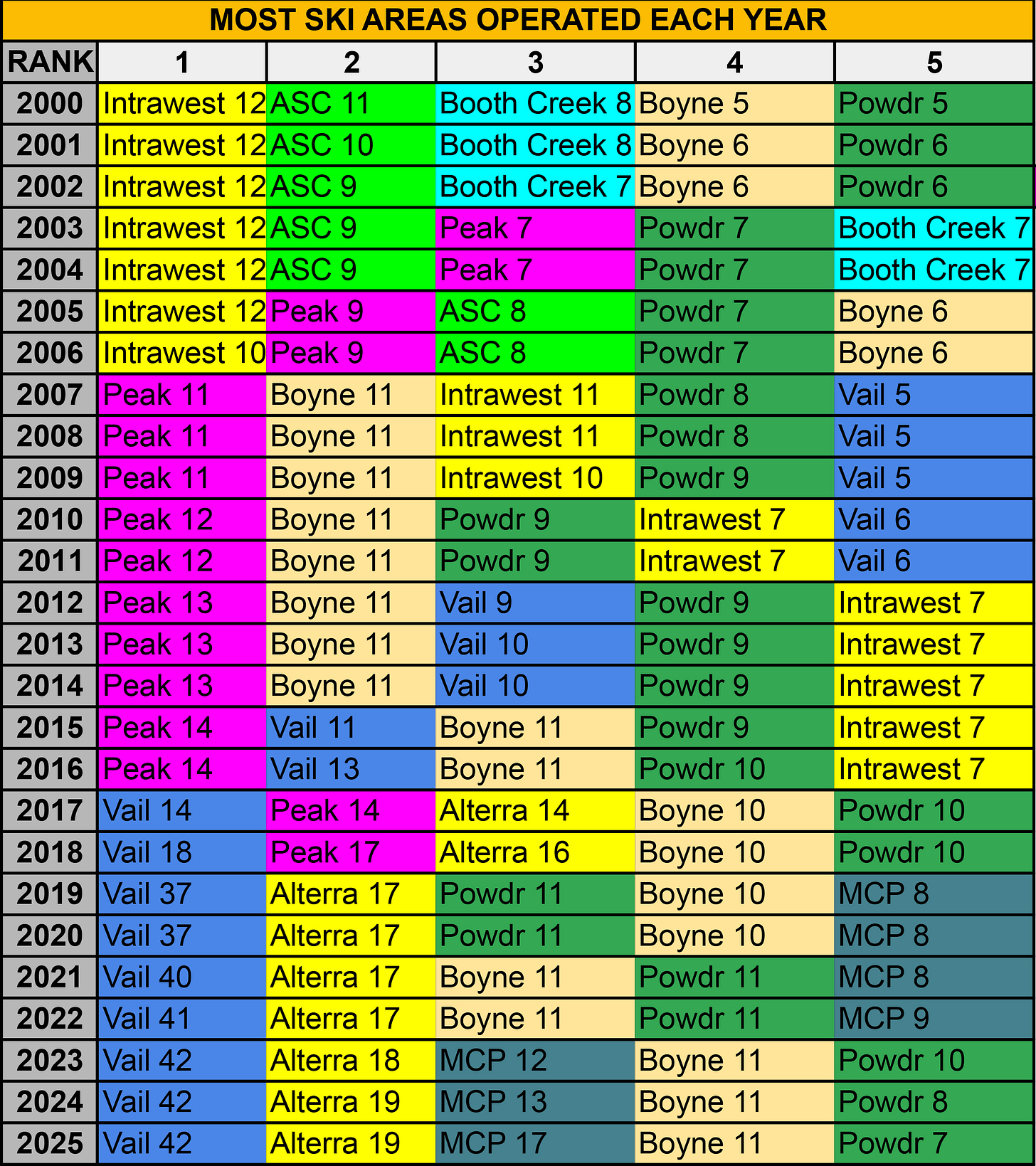

How long do you suppose Vail Resorts has been the largest ski area operator by number of resorts? From how the Brobots prattle on about the place, you’d think since around the same time the Mayflower bumped into Plymouth Rock. But the answer is 2018, when Vail surged to 18 ski areas – one more than number two Peak Resorts. Vail wasn’t even a top-five operator until 2007, when the company’s five resorts landed it in fifth place behind Powdr’s eight and 11 each for Peak, Boyne, and Intrawest. Check out the year-by-year resort operator rankings since 2000:

Kind of amazing, right? For decades, Vail, like Aspen, was the owner of some great Colorado ski areas and nothing more. There was no reason to assume it would ever be anything else. Any ski company that tried to get too big collapsed or surrendered. Intrawest inflated like a balloon then blew up like a pinata, ejecting trophies like Mammoth, Copper, and Whistler before straggling into the Alterra refugee camp with a half dozen survivors. American Skiing Company (ASC) united eight resorts in 1996 and was 11 by the next year and was dead by 2007. Even mighty Aspen, perhaps the brand most closely associated with skiing in American popular culture, had abandoned a nearly-two-decade experiment in owning ski areas outside of Pitkin County when it sold Blackcomb and Fortress Mountains in 1986 and Breckenridge the following year.

But here we are, with Vail Resorts, improbably but indisputably the largest operator in skiing. How did Vail do this when so many other operators had a decades-long head start? And failed to achieve sustainability with so many of the same puzzle pieces? Intrawest had Whistler. ASC owned Heavenly. Booth Creek, a nine-resort upstart launched in 1996 by former Vail owner George Gillett, had Northstar. The obvious answer is the 2008 advent of the Epic Pass, which transformed the big-mountain season pass from an expensive single-mountain product that almost no one actually needed to a cheapo multi-mountain passport that almost anyone could afford. It wasn’t a new idea, necessarily, but the bargain-skiing concept had never been attached to a mountain so regal as Vail, with its sprawling terrain and amazing high-speed lift fleet and Colorado mystique. A multimountain pass had never come with so little fine print – it really was unlimited, at all these great mountains, all the time - but so many asterisks: better buy now, because pretty soon skiing Christmas week is going to cost more than your car. And Vail was the first operator to understand, at scale, that almost everyone who skis at Vail or Beaver Creek or Breckenridge skied somewhere else first, and that the best way to recruit these travelers to your mountain rather than Deer Valley or Steamboat or Telluride was to make the competition inconvenient by bundling the speedbump down the street with the Alpine fantasy across the country.

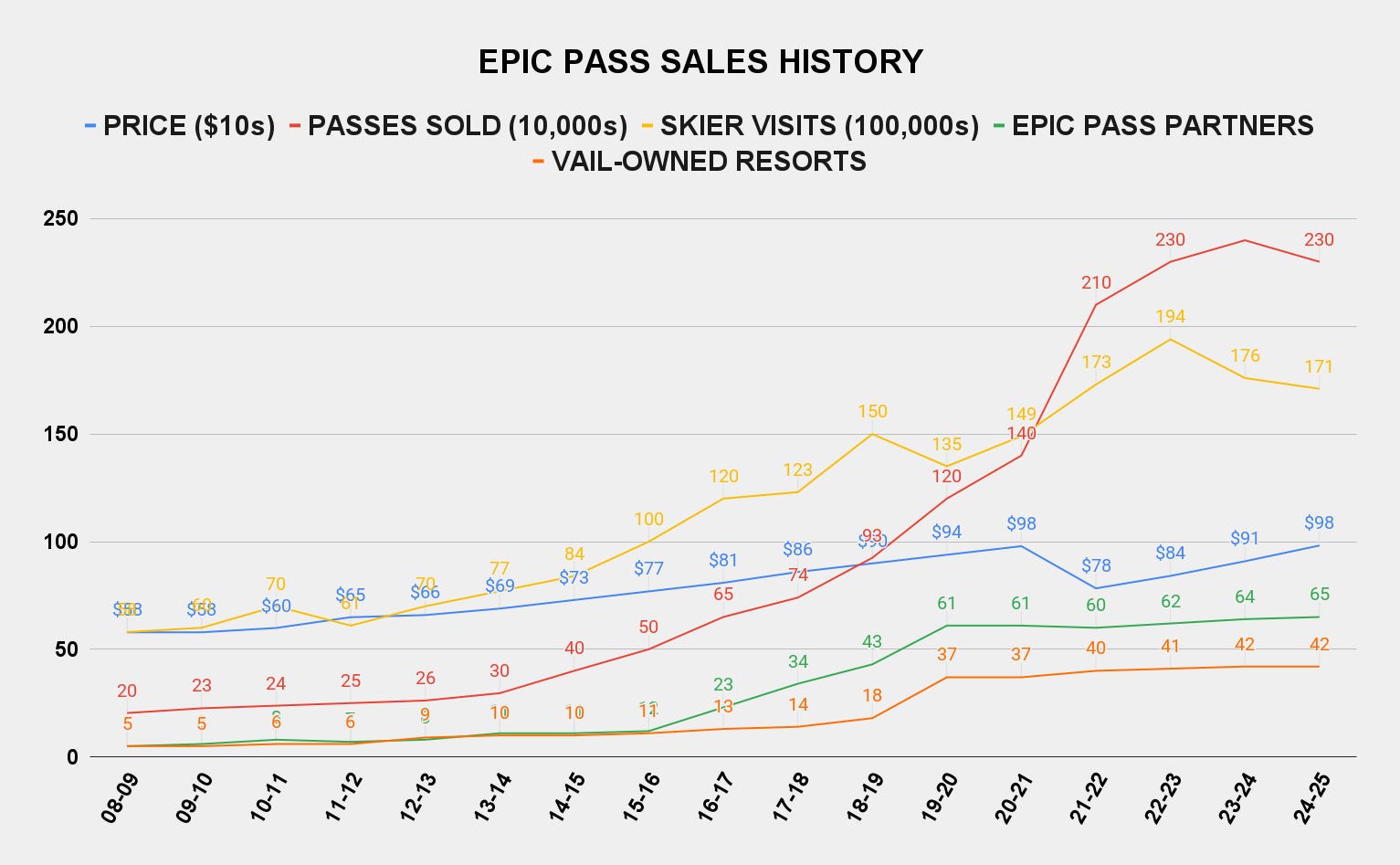

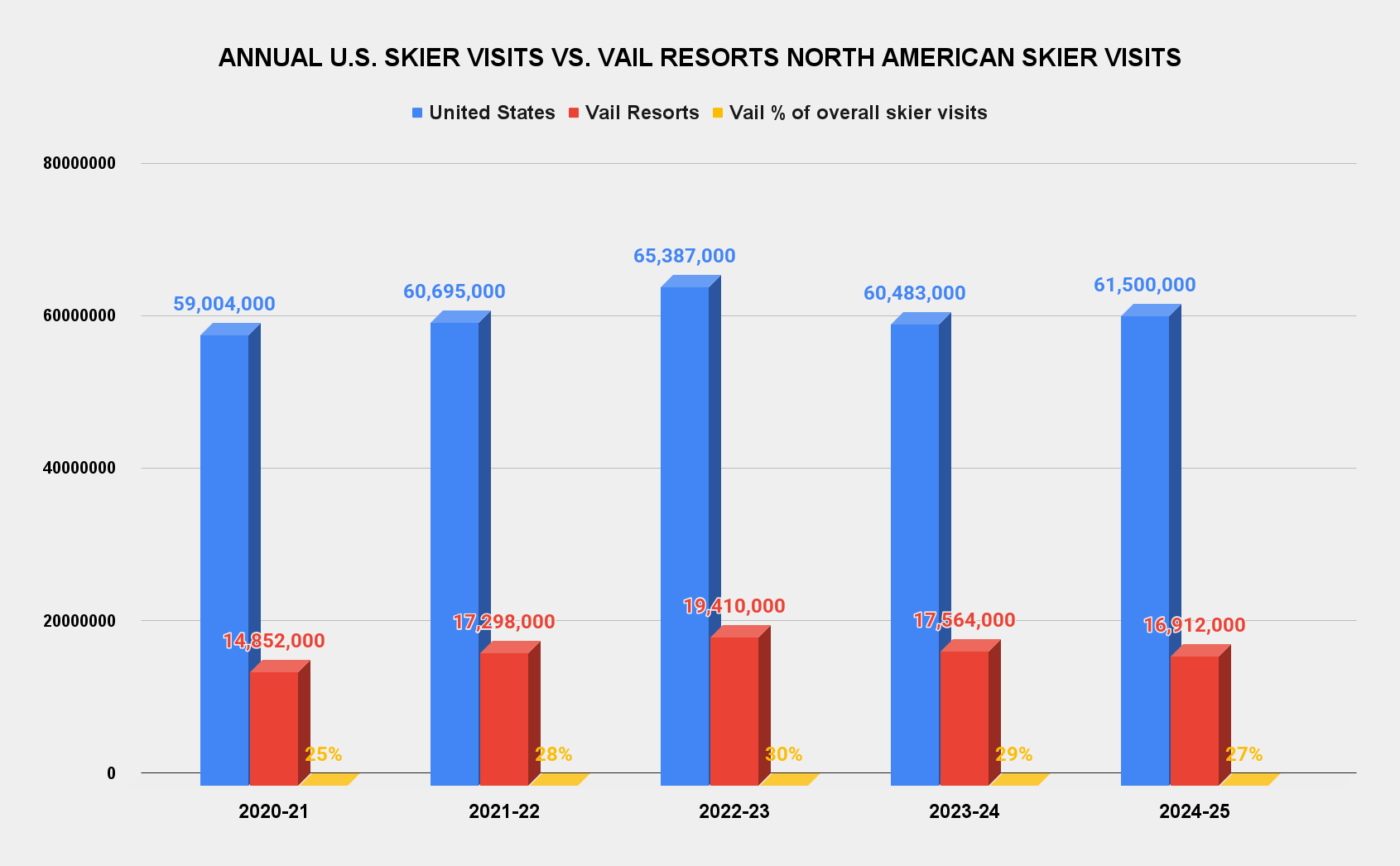

Vail Resorts, of course, didn’t do anything. Rob Katz did these things. And yes, there was a great and capable team around him. But it’s hard to ignore the fact that all of these amazing things started happening shortly after Katz’s 2006 CEO appointment and stopped happening around the time of his 2021 exit. Vail’s stock price: from $33.04 on Feb. 28, 2006 to $354.76 to Nov. 1, 2021. Epic Pass sales: from zero to 2.1 million. Owned resort portfolio: from five in three states to 37 in 15 states and three countries. Epic Pass portfolio: from zero ski areas to 61. The company’s North American skier visits: from 6.3 million for the 2005-06 ski season to 14.9 million in 2020-21. Those same VR metrics after three-and-a-half years under his successor, Kirsten Lynch: a halving of the stock price to $151.50 on May 27, 2025, her last day in charge; a small jump to 2.3 million Epic Passes sold for 2024-25 (but that marked the product’s first-ever unit decline, from 2.4 million the previous winter); a small increase to 42 owned resorts in 15 states and four countries; a small increase to 65 ski areas accessible on the Epic Pass; and a rise to 16.9 million North American skier visits (actually a three percent slump from the previous winter and the company’s second consecutive year of declines, as overall U.S. skier visits increased 1.6 percent after a poor 2023-24).

I don’t want to dismiss the good things Lynch did ($20-an-hour minimum wage; massively impactful lift upgrades, especially in New England; a best-in-class day pass product; a better Pet Rectangle app), or ignore the fact that Vail’s 2006-to-2019 trajectory would have been impossible to replicate in a world that now includes the Ikon Pass counterweight, or understate the tense community-resort relationships that boiled under Katz’s do-things-and-apologize-later-maybe leadership style. But Vail Resorts became an impossible-to-ignore globe-spanning goliath not because it collected great ski areas, but because a visionary leader saw a way to transform a stale, weather-dependent business into a growing, weather-agnostic(-ish) one.

You may think that “visionary” is overstating it, that merely “transformational” would do. But I don’t think I appreciated, until the rise of social media, how deeply cynical America had become, or the seemingly outsized proportion of people so eager to explain why new ideas were impossible. Layer, on top of this, the general dysfunction inherent to corporate environments, which can, without constant schedule-pruning, devolve into pseudo-summits of endless meetings, in which over-educated and well-meaning A+ students stamped out of elite university assembly lines spend all day trotting between conference rooms taking notes they’ll never look at and trying their best to sound brilliant but never really accomplishing anything other than juggling hundreds of daily Slack and email messages. Perhaps I am the cynical one here, but my experience in such environments is that actually getting anything of substance done with a team of corporate eggheads is nearly impossible. To be able to accomplish real, industry-wide, impactful change in modern America, and to do so with a corporate bureaucracy as your vehicle, takes a visionary.

Why now was a good time for this interview

And the visionary is back. True, he never really left, remaining at the head of Vail’s board of directors for the duration of Lynch’s tenure. But the board of directors doesn’t have to explain a crappy earnings report on the investor conference call, or get yelled at on CNBC, or sit in the bullseye of every Saturday morning liftline post on Facebook.

So we’ll see, now that VR is once again and indisputably Katz’s company, whether Vail’s 2006-to-2021 rise from fringe player to industry kingpin was an isolated case of right-place-at-the-right-time first-mover big-ideas luck or the masterwork of a business musician blending notes of passion, aspiration, consumer pocketbook logic, the mystique of irreplaceable assets, and defiance of conventional industry wisdom to compose a song that no one can stop singing. Will Katz be Steve Jobs returning to Apple and re-igniting a global brand? Or MJ in a Wizards jersey, his double threepeat with the Bulls untarnished but his legacy otherwise un-enhanced at best and slightly diminished at worst?

I don’t know. I lean toward Jobs, remaining aware that the ski industry will never achieve the scale of the Pet Rectangle industry. But Vail Resorts owns 42 ski areas out of like 6,000 on the planet, and only about one percent of them is associated with the Epic Pass. Even if Vail grew all of these metrics tenfold, it would still own just a fraction of the global ski business. Investors call this “addressable market,” meaning the size of your potential customer base if you can make them aware of your existence and convince them to use your services, and Vail’s addressable market is far larger than the neighborhood it now occupies.

Whether Vail can get there by deploying its current operating model is irrelevant. Remember when Amazon was an online bookstore and Netflix a DVD-by-mail outfit? I barely do either, because visionary leaders (Jeff Bezos, Reed Hastings) shaped these companies into completely different things, tapping a rapidly evolving technological infrastructure capable of delivering consumers things they don’t know they need until they realize they can’t live without them. Like never going into a store again or watching an entire season of TV in one night. Like the multimountain ski pass.

Being visionary is not the same thing as being omniscient. Amazon’s Fire smartphone landed like a bag of sand in a gastank. Netflix nearly imploded after prematurely splitting its DVD and digital businesses in 2011. Vail’s decision to simultaneously chop 2021-22 Epic Pass prices by 20 percent and kill its 2020-21 digital reservation system landed alongside labor shortages, inflation, and global supply chain woes, resulting in a season of inconsistent operations that may have turned a generation off to the company. Vail bullied Powdr into selling Park City and Arapahoe Basin into leaving the Epic Pass and Colorado’s state ski trade association into having to survive without four (then five) of its biggest brands. The company alienated locals everywhere, from Stowe (traffic) to Sunapee (same) to Ohio (truncated seasons) to Indiana (same) to Park City (everything) to Whistler (same) to Stevens Pass (just so many people man). The company owns 99 percent of the credit for the lift-tickets-brought-to-you-by-Tiffany pricing structure that drives the popular perception that skiing is a sport accessible only to people who rent out Yankee Stadium for their dog’s birthday party.

We could go on, but the point is this: Vail has messed up in the past and will mess up again in the future. You don’t build companies like skyscrapers, straight up from ground to sky. You build them, appropriately for Vail, like mountains, with an earthquake here and an eruption there and erosion sometimes and long stable periods when the trees grow and the goats jump around on the rocks and nothing much happens except for once in a while a puma shows up and eats Uncle Toby. Vail built its Everest by clever and novel and often ruthless means, but in doing so made a Balkanized industry coherent, mainstreamed the ski season pass, reshaped the consumer ski experience around adventure and variety, united the sprawling Park City resorts, acknowledged the Midwest as a lynchpin ski region, and forced competitors out of their isolationist stupor and onto the magnificent-but-probably-nonexistent-if-not-for-the-existential-need-to-compete-with Vail Ikon, Indy, and Mountain Collective passes.

So let’s not confuse the means for the end, or assume that Katz, now 58 and self-assured, will act with the same brash stop-me-if-you-can bravado that defined his first tenure. I mean, he could. But consumers have made it clear that they have alternatives, communities have made it clear that they have ways to stop projects out of spite, Alterra has made it clear that empire building is achieved just as well through ink as through swords, and large independents such as Jackson Hole have made it clear that the passes that were supposed to be their doom instead guaranteed indefinite independence via dependable additional income streams. No one’s afraid of Vail anymore.

That doesn’t mean the company can’t grow, can’t surprise us, can’t reconfigure the global ski jigsaw puzzle in ways no one has thought of. Vail has brand damage to repair, but it’s repairable. We’re not talking about McDonald’s here, where the task is trying to convince people that inedible food is delicious. We’re talking about Vail Mountain and Whistler and Heavenly and Stowe – amazing places that no one needs convincing are amazing. What skiers do need to be convinced of is that Vail Resorts is these ski areas’ best possible steward, and that each mountain can be part of something much larger without losing its essence.

You may be surprised to hear Katz acknowledge as much in our conversation. You will probably be surprised by a lot of things he says, and the way he projects confidence and optimism without having to fully articulate a vision that he’s probably still envisioning. It’s this instinctual lean toward the unexpected-but-impactful that powered Vail’s initial rise and will likely reboot the company. Perhaps sooner than we expect.

What we talked about

The CEO job feels “both very familiar and very new at the same time”; Vail Resorts 2025 versus Vail Resorts 2006; Ikon competition means “we have to get better”; the Epic Friends program that replaces Buddy Tickets: 50 percent off plus skiers can apply that cost to next year’s Epic Pass; simplifying the confusing; “we’re going to have to get a little more creative and a little more aggressive” when it comes to lift ticket pricing; why Vail will “probably always have a window ticket”; could we see lower lift ticket prices?; a response to lower-than-expected lift ticket sales in 2024-25; “I think we need to elevate the resort brands themselves”; thoughts on skier-visit drops; why Katz returned as CEO; evolving as a leader; a morale check for a company “that was used to winning” but had suffered setbacks; getting back to growth; competing for partners and “how do we drive thoughtful growth”; is Vail an underdog now?; Vail’s big advantage; reflecting on the 20 percent 2021 Epic Pass price cut and whether that was the right decision; is the Epic Pass too expensive or too cheap?; reacting to the first ever decline in Epic Pass unit sales numbers; why so many mountains are unlimited on Epic Local; “who are you going to kick out of skiing” if you tighten access?; protecting the skier experience; how do you make skiers say “wow?”; defending Vail’s ongoing resort leadership shuffle; and why the volume of Vail’s lift upgrades slowed after 2022’s Epic Lift Upgrade.

What I got wrong

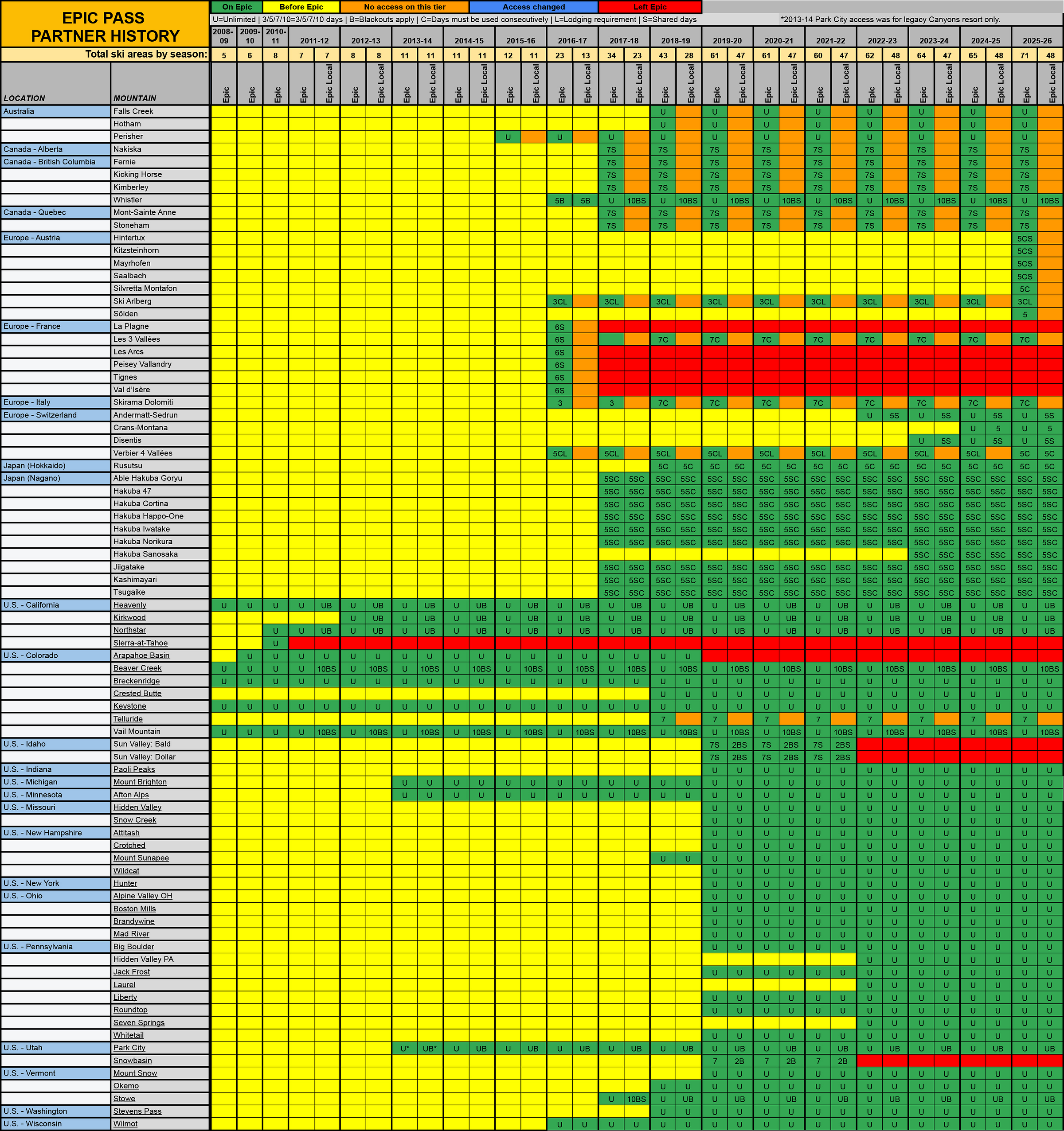

I said that the Epic Pass now offered access to “64 or 65” ski areas, but I neglected to include the six new ski areas that Vail partnered with in Austria for the 2025-26 ski season. The correct number of current Epic Pass partners is 71 (see chart above).

I said that Vail Resorts’ skier visits declined by 1.5 percent from the 2023-24 to 2024-25 winters, and that national skier visits grew by three percent over that same timeframe. The numbers are actually reversed: Vail’s skier visits slumped by approximately three percent last season, while national visits increased by 1.7 percent, per the National Ski Areas Association.

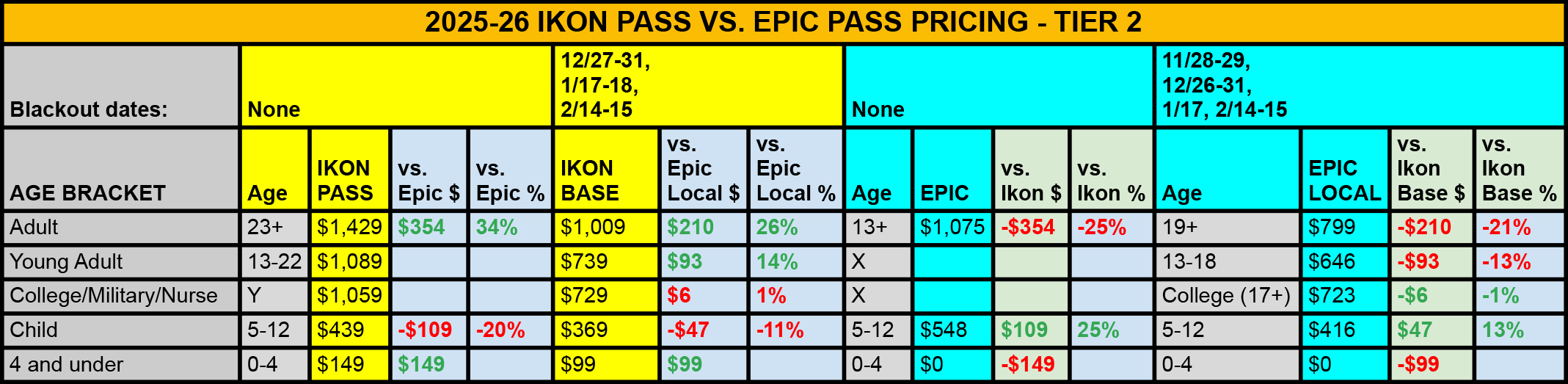

I said that the $1,429 Ikon Pass cost “40% more” than the $799 Epic Local – but I was mathing on the fly and I mathed dumb. The actual increase from Epic Local to Ikon is roughly 79 percent.

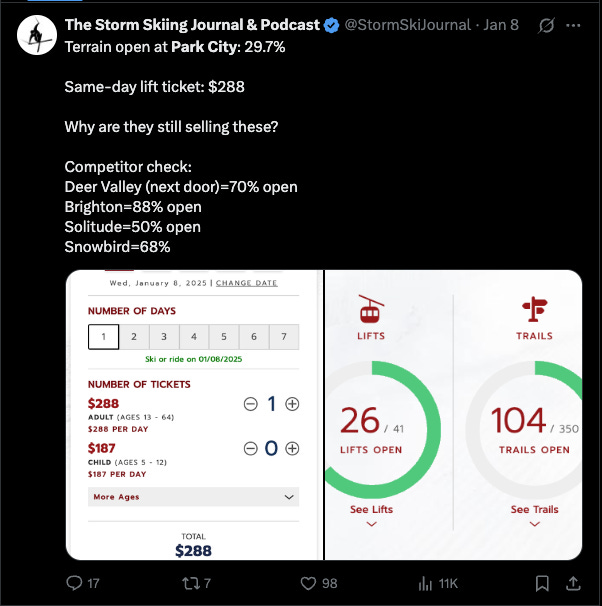

I claimed that Park City Mountain Resort was charging $328 for a holiday week lift ticket when it was “30 percent-ish open” and “the surrounding resorts were 70-ish percent open.” Unfortunately, I was way off on the dollar amount and the timeframe, as I was thinking of this X post I made on Wednesday, Jan. 8, when day-of tickets were selling for $288:

I said I didn’t know what “Alterra” means. Alterra Mountain Company defines it as “a fusion of the words altitude and terrain/terra, paying homage to the mountains and communities that form the backbone of the company.”

I said that Vail’s Epic Lift Upgrade was “22 or 23 lifts.” I was wrong, but the number is slippery for a few reasons. First, while I was referring specifically to Vail’s 2021 announcement that 19 new lifts were inbound in 2022, the company now uses “Epic Lift Upgrade” as an umbrella term for all years’ new lift installs. Second, that 2022 lift total shot up to 21, then down to 19 when Park City locals threw a fit and blocked two of them (both ultimately went to Whistler), then 18 after Keystone bulldozed an illegal access road in the high Alpine (the new lift and expansion opened the following year).

Questions I wish I’d asked

There is no way to do this interview in a way that makes everyone happy. Vail is too big, and I can’t talk about everything. Angry Mountain Bro wants me to focus on community, Climate Bro on the environment, Finance Bro on acquisitions and numbers, Subaru Bro on liftlines and parking lots. Too many people who already have their minds made up about how things are will come here seeking validation of their viewpoint and leave disappointed.

I will say this: just because I didn’t ask about something doesn’t mean I wouldn’t have liked to. Acquisitions and Europe, especially. But some preliminary conversations with Vail folks indicated that Katz had nothing new to say on either of these topics, so I let it go for another day.

Podcast Notes

On various metrics

Here’s a by-the-numbers history of the Epic Pass:

Here’s Epic’s year-by-year partner history:

On the percent of U.S. skier visits that Vail accounts for

We don’t know the exact percentage of U.S. skier visits belong to Vail Resorts, since the company’s North American numbers include Whistler, which historically accounts for approximately 2 million annual skier visits. But let’s call Vail’s share of America’s skier visits 25 percent-ish:

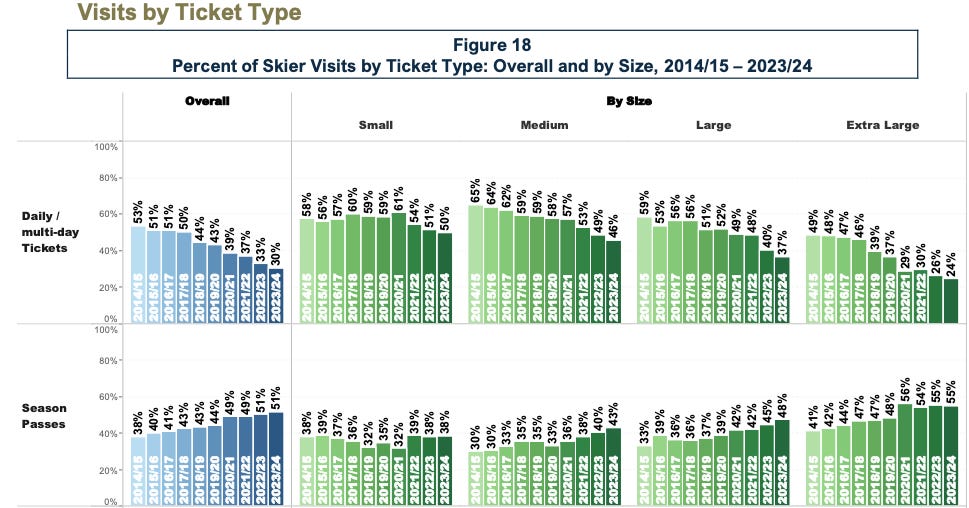

On ski season pass participation in America

The rise of Epic and Ikon has correlated directly with a decrease in lift ticket visits and an increase in season pass visits. Per Kotke’s End-of-Season Demographic Report for 2023-24:

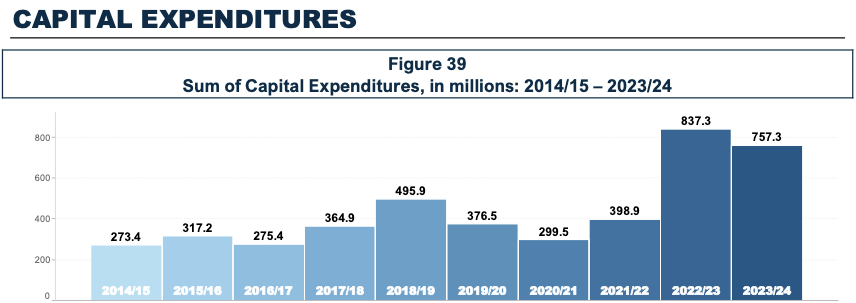

On capital investment

Similarly, capital investment has mostly risen over the past decade, with a backpedal for Covid. Kotke:

The NSAA’s preliminary numbers suggest that the 2024-25 season numbers will be $624.4 million, a decline from the previous two seasons, but still well above historic norms.

On the mystery of the missing skier visits

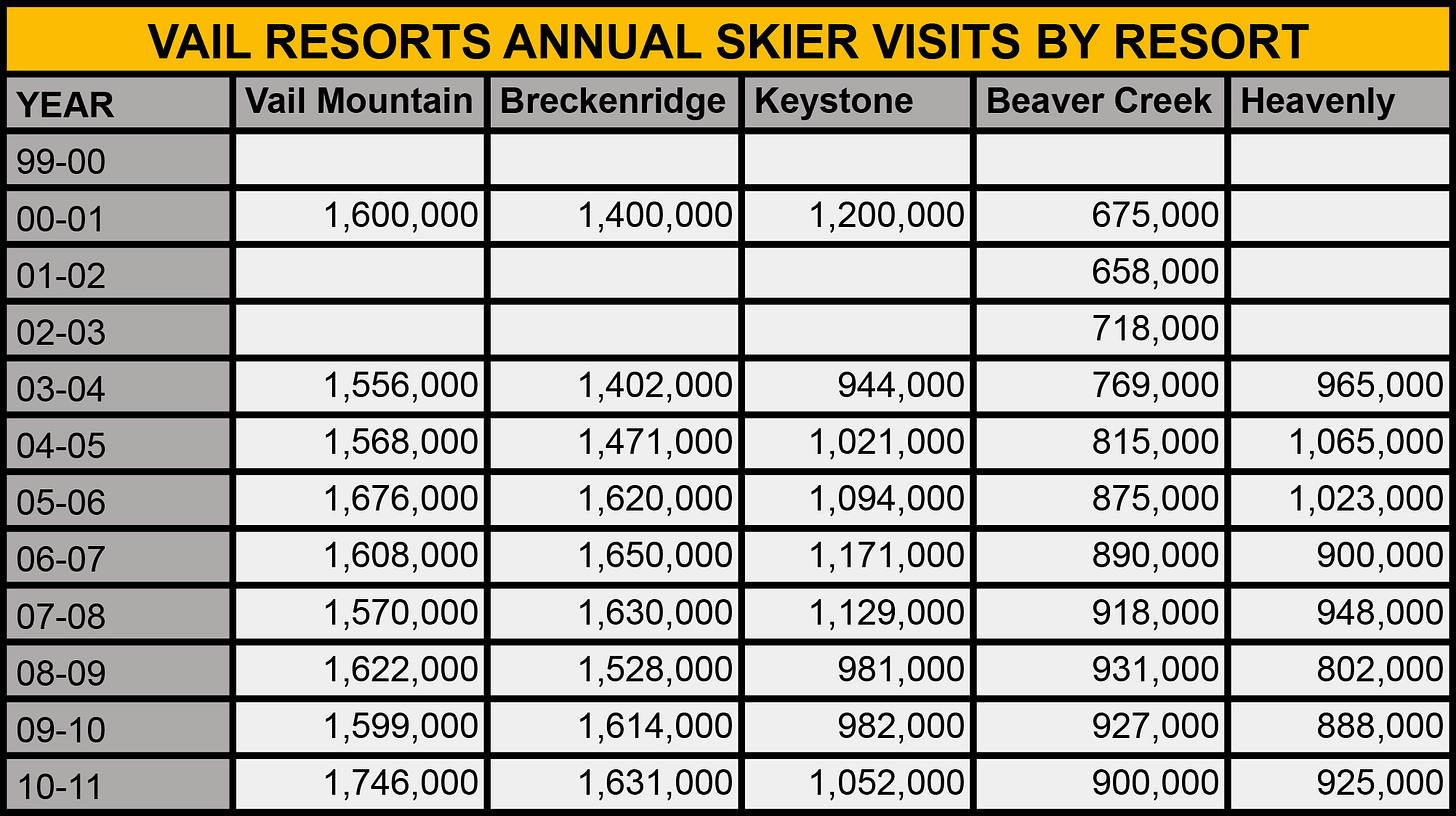

I jokingly ask Katz for resort-by-resort skier visits in passing. Here’s what I meant by that - up until the 2010-11 ski season, Vail, like all operators on U.S. Forest Service land, reported annual skier visits per ski area:

And then they stopped, winning a legal argument that annual skier visits are proprietary and therefore protected from public records disclosure. Or something like that. Anyway most other large ski area operators followed this example, which mostly just serves to make my job more difficult.

On that ski trip where Timberline punched out Vail in a one-on-five fight

I don’t want to be the Anecdote King, but in 2023 I toured 10 Mid-Atlantic ski areas the first week of January, which corresponded with a horrendous warm-up. The trip included stops at five Vail Resorts: Liberty, Whitetail, Seven Springs, Laurel, and Hidden Valley, all of which were underwhelming. Fine, I thought, the weather sucks. But then I stopped at Timberline, West Virginia:

After three days of melt-out tiptoe, I was not prepared for what I found at gut-renovated Timberline. And what I found was 1,000 vertical feet of the best version of warm-weather skiing I’ve ever seen. Other than the trail footprint, this is a brand-new ski area. When the Perfect Family – who run Perfect North, Indiana like some sort of military operation – bought the joint in 2020, they tore out the lifts, put in a brand-new six-pack and carpet-loaded quad, installed all-new snowmaking, and gut-renovated the lodge. It is remarkable. Stunning. Not a hole in the snowpack. Coming down the mountain from Davis, you can see Timberline across the valley beside state-run Canaan Valley ski area – the former striped in white, the latter mostly barren.

I skied four fast laps off the summit before the sixer shut at 4:30. Then a dozen runs off the quad. The skier level is comically terrible, beginners sprawled all over the unload, all over the green trails. But the energy is level 100 amped, and everyone I talked to raved about the transformation under the new owners. I hope the Perfect family buys 50 more ski areas – their template works.

I wrote up the full trip here.

On the megapass timeline

I’ll work on a better pass timeline at some point, but the basics are this:

2008: Epic Pass debuts - unlimited access to all Vail Resorts

2012: Mountain Collective debuts - 2 days each at partner resorts

2015: M.A.X. Pass debuts - 5 days each at partner resorts, unlimited option for home resort

2018: Ikon Pass debuts, replaces M.A.X. - 5, 7, or unlimited days at partner resorts

2019: Indy Pass debuts - 2 days each at partner resorts

On Epic Day vs. Ikon Session

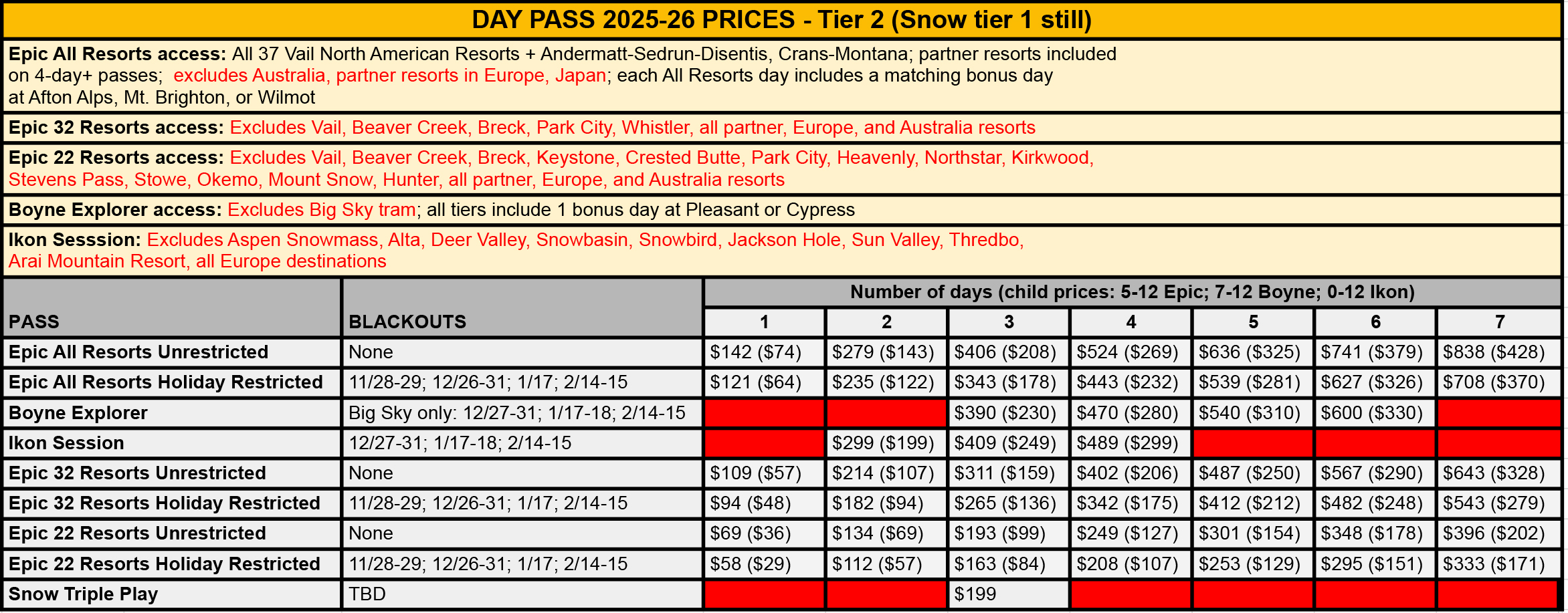

I’ve long harped on the inadequacy of the Ikon Session Pass versus the Epic Day Pass:

On Epic versus Ikon pricing

Epic Passes mostly sell at a big discount to Ikon:

On Vail’s most recent investor conference call

This podcast conversation delivers Katz’s first public statements since he hosted Vail Resorts’ investor conference call on June 5. I covered that call extensively at the time:

On Epic versus Ikon access tweaks

Alterra tweaks Ikon Pass access for at least one or two mountains nearly every year – more than two dozen since 2020, by my count. Vail rarely makes any changes. I broke down the difference between the two in the article linked directly above this one. I ask Katz about this in the pod, and he gives us a very emphatic answer.

On the Park City strike

No reason to rehash the whole mess in Park City earlier this year. Here’s a recap from The New York Times. The Storm’s best contribution to the whole story was this interview with United Mountain Workers President Max Magill:

On Vail’s leadership shuffle

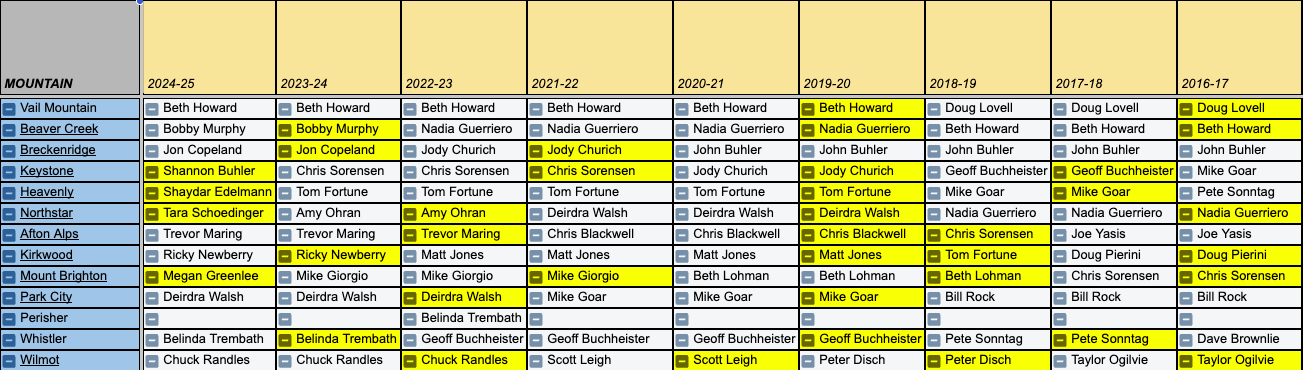

I’ll write more about this at some point, but if you scroll to the right on Vail’s roster, you’ll see the yellow highlights whenever Vail has switched a president/general manager-level employee over the past several years. It’s kind of a lot. A sample from the resorts the company has owned since 2016: