Indy Pass Declares War as Ski Cooper Joins Powder Alliance, Supercharging Its Season Pass Coalition

With Ski Cooper's $379 season pass now delivering three-plus days each at 74 ski areas, Indy accuses the mountain of “gaming reciprocal agreements”

Two years ago, Patrick Fitzgerald, a father of four who lives near Pittsburgh, bought four Ski Cooper, Colorado season passes for his family. Three other families on his block also purchased several passes apiece.

Not one of the families ever went anywhere near Ski Cooper that winter.

They spent the season instead cashing in the reciprocal days available to Ski Cooper passholders at Seven Springs, Laurel, Hidden Valley, and Tussey in Pennsylvania; and at Holiday Valley in New York.

Fitzgerald and his neighbors had found a hack. Local season pass prices for that year had topped out at $675 for Seven Springs, $522 for Hidden Valley, $507 for Laurel, $570 for Tussey, and $1,103 for Holiday Valley. But the Ski Cooper pass, which included three days at each of those ski areas with no blackouts, sold for just $299. Fitzgerald skied 10 days total, for a per-visit cost of less than $30.

A great deal for skiers. But not one dollar of those Cooper passes went to any of the local ski areas.

I’ll take part of the credit and part of the blame here. Fitzgerald read about the Ski Cooper pass in this newsletter. I’d framed it as a sort of Indy Lite, a ridiculously inexpensive pass to a surrounded-by-giants Colorado fighter that came loaded with three days each at 48 partner mountains across every ski region of America. By 2022, that partner roster had jumped to 59 ski areas (and the price had ticked up to $329).

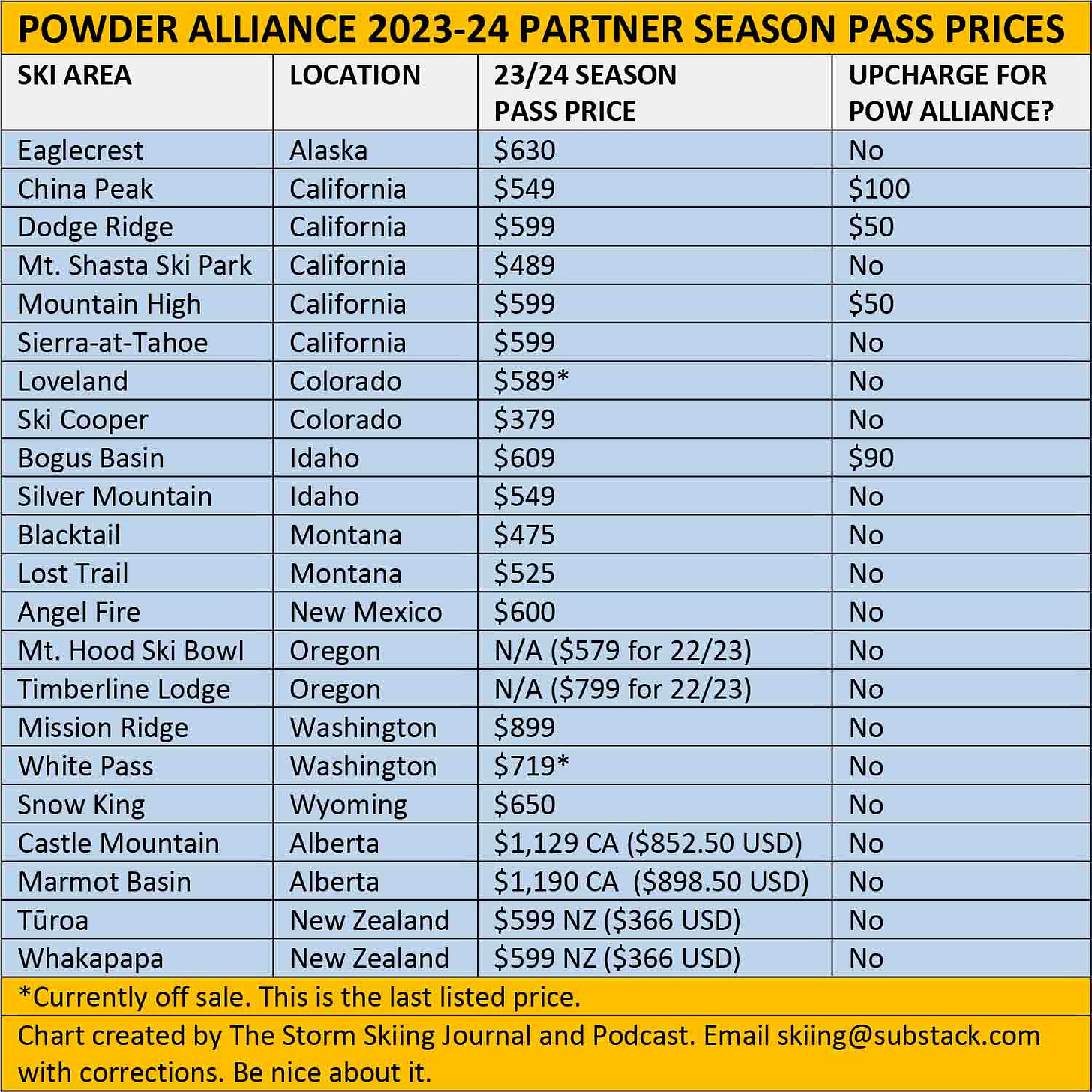

Last week, Ski Cooper supercharged its offering by joining the Powder Alliance for the 2023-24 ski season, instantly adding 15 new, mostly high-powered partners to its roster, including Sierra-at-Tahoe, Timberline Lodge, Silver Mountain, White Pass, and Marmot Basin. The mountain will also remain on the Freedom Pass, and will retain all but a handful of its independent 2022-23 partnerships. That gives Ski Cooper passholders access to 74 ski areas next season, for just $379:

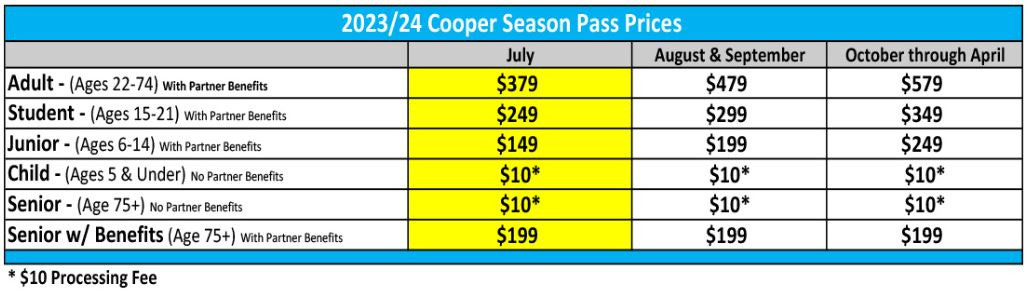

And here are the various price tiers:

Ski Cooper officials have been careful not to frame their season pass as a national multi-mountain product. “There are a handful of people, if they're in an area that's concentrated with our partners, that might get our pass,” Ski Cooper GM Dan Torsell told me in 2021. “‘We're just going to buy the Cooper pass. We can ski here and we can go out there.’ But honestly that's not the objective.”

But as Ski Cooper’s network has grown larger than even the Epic or Ikon passes – the ski area now hosts the largest group of reciprocal partners in skiing, with one of the lowest season pass prices in America – the Indy Pass has begun viewing Ski Cooper’s de-facto megapass as a threat both to its business and to its partners.

“We need to start talking about the gorilla in the room,” said Indy Pass owner Erik Mogensen. “The Ski Cooper pass is intentionally gaming reciprocal agreements to the detriment of all independent operators.”

This is war. Or what passes for war in the normally congenial ski industry (Ski Cooper did not respond to repeated requests for comment). Ski Cooper has created a product that directly competes with Indy Pass, but without the revenue-sharing (each time an Indy passholder redeems a ticket, the ski area receives a payout; Indy Pass keeps 15 percent of passholder revenue to cover operating and marketing costs and distributes the other 85 percent among its partners, paying them a percentage of their window rates for each visit). The mountain has pushed the bounds of what reciprocal agreements are and who they’re for. Partners, sensing a one-way deal, are growing suspicious and, in some cases, fleeing the pass.

But Ski Cooper has also created a compelling product, a complement to the Epic or Ikoners’ pass quiver, or an exploratory passport for the wintertime rambler who’s burned out on octopus lifts and parking lots the size of Mars. And new ski areas keep joining. Neither the nationwide network nor the low price nor the fact that Cooper keeps all of the revenue has pushed many longtime partners away.

Ski Cooper has hacked out an improbable niche in the U.S. ski industry: this little mountain crammed between Vail, Beaver Creek, Copper Mountain, and Breckenridge simultaneously offers one of the best single-mountain season pass deals and one of the best multi-mountain pass deals in the country. Whether Ski Cooper’s intention was to create a fifth national ski pass or not is beside the point: with the Indy Pass off sale, the Ikon Pass priced higher each year, the Epic Pass chronically oversold, and the Mountain Collective hyper-focused on Mt. Gigantors, Ski Cooper currently offers the best multi-mountain value ski pass in North America. But is it a sustainable strategy, or a bubble bound to pop?

Not just another small-mountain season pass

Hundreds of ski areas partner on reciprocal agreements, of course, and money is never (as far as I know), exchanged between resorts for such visits. Bogus Basin and Eaglecrest are both also members of Powder Alliance and Freedom pass, and, with independent agreements, offer passholders lift tickets to 50 and 51 ski areas, respectively. But two important factors separate Ski Cooper’s pass from its competitors’:

An extremely low price – Bogus Basin’s pass is $699 (its early-bird price was just $549) and Eaglecrest’s is $630, to Cooper’s $379. Ski Cooper’s pass is the lowest-priced among the 20 North American Powder Alliance members, whose average season pass price is $651. And Ski Cooper’s season pass is nearly $100 cheaper than the next-closest Powder Alliance partner – Blacktail, Montana, which has no other reciprocals outside of the Powder Alliance and weekday access to sister resort Mission Ridge:

A national footprint beyond the few Freedom Pass offerings in the Midwest and New England - Ski Cooper hosts this map on its website to showcase the breadth of its partner roster:

A brewing mutiny: “They do not share in revenues”

Despite an ever-growing roster, communications with more than a dozen current or former Ski Cooper reciprocal partners suggest a brewing mutiny. Many Powder Alliance members seemed caught off guard by news of Cooper’s bargain pass, though they appeared to have little recourse for the 2023-24 ski season (Powder Alliance ski areas vote to admit any new member resort, so this oversight suggests a lack of due diligence on the members’ parts).

None of the Powder Alliance members would vent their frustrations on the record, and many resort leaders expressed solidarity with Cooper and confirmed that they had just signed three-year reciprocal contracts.

More than one partner currently listed on Ski Cooper’s roster said they intended to withdraw from the relationship prior to the 2023-24 ski season, however.

One of these is longtime Indy Pass partner Soldier Mountain, Idaho. “We will be withdrawing,” owner and general manager Paul Alden wrote in a text message on Sunday. “Cooper is now a direct competitor to Indy. They do not share in revenues,” unlike Indy Pass.

Those Indy Pass payouts appear to be substantial. While Indy closely guards revenue, Mogensen provided a never-before-shared stat to The Storm: “The average payout across our alpine partners was almost $80,000 last year. That adds up over all partners, and over the next decade.”

This, says Mogensen, is the sort of sustained revenue that independent ski areas need to compete. “Indy Pass brings a meaningful option to fight back against the domination of Epic and Ikon, not only in the consumer and brand space, but, just as important, it is putting real cash in the bank for independent ski areas.

“This is especially important because the conglomerates in skiing have astounding access to capital. Capital projects, and the cost of money itself, is becoming exponentially more expensive, and giving your main product away for free is a puzzling solution to the biggest disadvantage independents need to overcome.”

To underscore just how unusual Ski Cooper’s pass coalition is, Alden said that he intends to maintain Soldier’s other reciprocal agreements, which for the 2022-23 ski season included Bogus Basin, Bridger Bowl, Cherry Peak, Eagle Point, Hogadon Basin, Lee Canyon, Pebble Creek, Pine Creek, Sleeping Giant, Snow King, White Pine, and four small ski areas in Wisconsin (Soldier has yet to announce next season’s reciprocal partners, and Lee Canyon, newly purchased by Mountain Capital Partners, is unlikely to continue its vast menu of reciprocals, and has instead joined MCP’s Power Pass).

Indy Pass officials do not seem alarmed by traditional regional reciprocals. “We are less concerned with who is on what pass for next year and far more concerned about how the Indy Pass can support independent operators for the next 10 years,” Mogensen said. “With that long-term goal guiding every decision that Indy makes, of course we support common-sense reciprocal agreements as a marketing tool for any operator.”

“The partnership boils down to what is best for our customers.”

Still, some ski areas that have weighed joining both Indy and Ski Cooper have decided that the latter arrangement works better for them. “Mount Pleasant is again excited to partner with Ski Cooper to be a part of their Cooper pass,” said Mount Pleasant, Pennsylvania General Manager Andrew Halmi. “The partnership boils down to what is best for our customers. We feel as though the Cooper pass provides our season pass holders with an excellent opportunity to explore Colorado and all that Ski Cooper has to offer and without an increase to our pass price. The Indy Pass is an excellent pass program. However, after discussing both with our season passholders, the Ski Cooper partnership is the more desired product. We had a fair number of our passholders travel to Ski Cooper this winter and the response was tremendous. We fully expect redemptions to increase.”

Fitzgerald - the Pennsylvania skier who’d purchased Ski Cooper passes for his family - echoed the notion that reciprocals could be good marketing vehicles for ski areas over the long term. “The three neighbors all really liked Holiday Valley,” he said. “None of them had gone before they had the Cooper pass. Two of the families went back this winter. My wife really liked it too and we went back up this winter. The Cooper deal was pretty successful for Holiday Valley.”

The 2021-22 ski season was the only time Fitzgerald and his neighbors purchased Cooper’s pass. Vail Resorts bought Seven Springs, Hidden Valley, and Laurel in December 2021 and pulled its resorts out of the Ski Cooper pass for the next season. Independent Holiday Valley withdrew that year as well. “If Vail hadn’t bought the local hills and they stayed on that Cooper pass, I probably would have made a trip out there at some point,” Fitzgerald says. He now buys Epic Passes.

Direct competitors

Indy has reason for concern. The passes share 33 resort partners, up from 15 just two years ago. And while the Cooper pass offers fewer mountains overall, it delivers three days per resort to Indy’s two, and very few blackout dates outside of the Powder Alliance. Here’s how Indy and Cooper’s rosters stack up state by state:

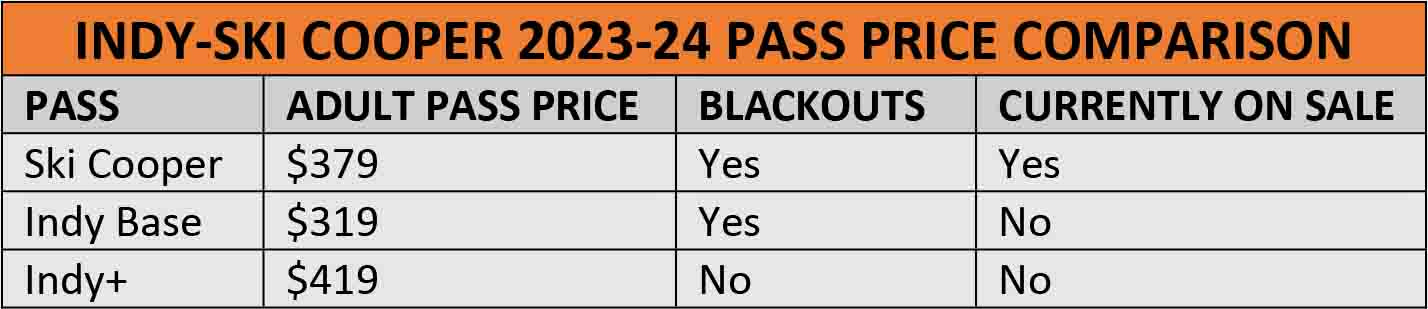

And here’s how the most recent prices compare:

As it happens, Indy Passes went off sale in April, following record sales. That makes this a fortuitous moment for Ski Cooper, and for anyone who missed the March early-bird megapass sales. Epic, Ikon, and Mountain Collective prices have all increased. Bargain hunters in Pennsylvania or New England are going to want to scoop up Vail’s Northeast Value or Northeast Midweek passes, but there’s an opening in the West. There is no comparable multi-mountain deal to Ski Cooper’s western stable: $379 for access to 40 ski areas, including everything on the Powder Alliance.

But the Indy Pass will be back on sale before winter, and with even more alpine partners than the 105 that the coalition offered last season (104 have already committed to return – all but Snow Valley, which Alterra purchased and added to the Ikon Pass).

“We have been very busy signing up new resorts during the offseason,” Indy Pass founder and president Doug Fish told The Storm. “Passholders and partners can expect significant growth with new participating areas and resorts. Because of that continuing growth, we do expect to offer a limited amount of additional passes this fall. We will support our partners by prioritizing add-on passes for season pass holders and our growing waitlist. We encourage anyone looking for an Indy Pass to get on that waitlist ASAP.” (You can join the waitlist here.)

Again, Ski Cooper officials insist that they are not selling a national ski pass. But skiers know a bargain when they see one, and right now, this is one of the best deals in skiing.

So who’s out? And why?

To understand where the Ski Cooper pass may be headed, it’s important to understand who left, and why: