Alterra Buys Snow Valley, California; Adds Ski Area to Big Bear Resort

Acquisition is Alterra’s first since 2019; mountain will join Ikon Pass Feb. 20; remains on Indy Pass through 2022-23 ski season

This is not like the Poconos, not like Virginia or North Carolina, where skiing waited for the dawn of industrial snowmaking, for the 1960s and ‘70s and ‘80s. Here, towering above Los Angeles – Los Angeles, where the average January high is 68 degrees Fahrenheit – Mountain High opened for skiing 99 years ago. In 1924. It is the fourth-oldest active ski area in the country.

At one time there were more than a dozen ski areas in Southern California. Today we have seven individual, active, reliably operating public ski areas in the region. Or maybe we have three. It depends on how you count them. Three of them are Mountain High East (formerly Holiday Hill), West, and North (formerly Ski Sunrise/Table Mountain), which all operate as Mountain High Resorts. One is raucously independent Mount Baldy.

And, as of last Friday, when Colorado-based Alterra Mountain Company announced the acquisition of Snow Valley and jammed it together with Bear Mountain and Snow Summit, three of them operate as Big Bear Resort.

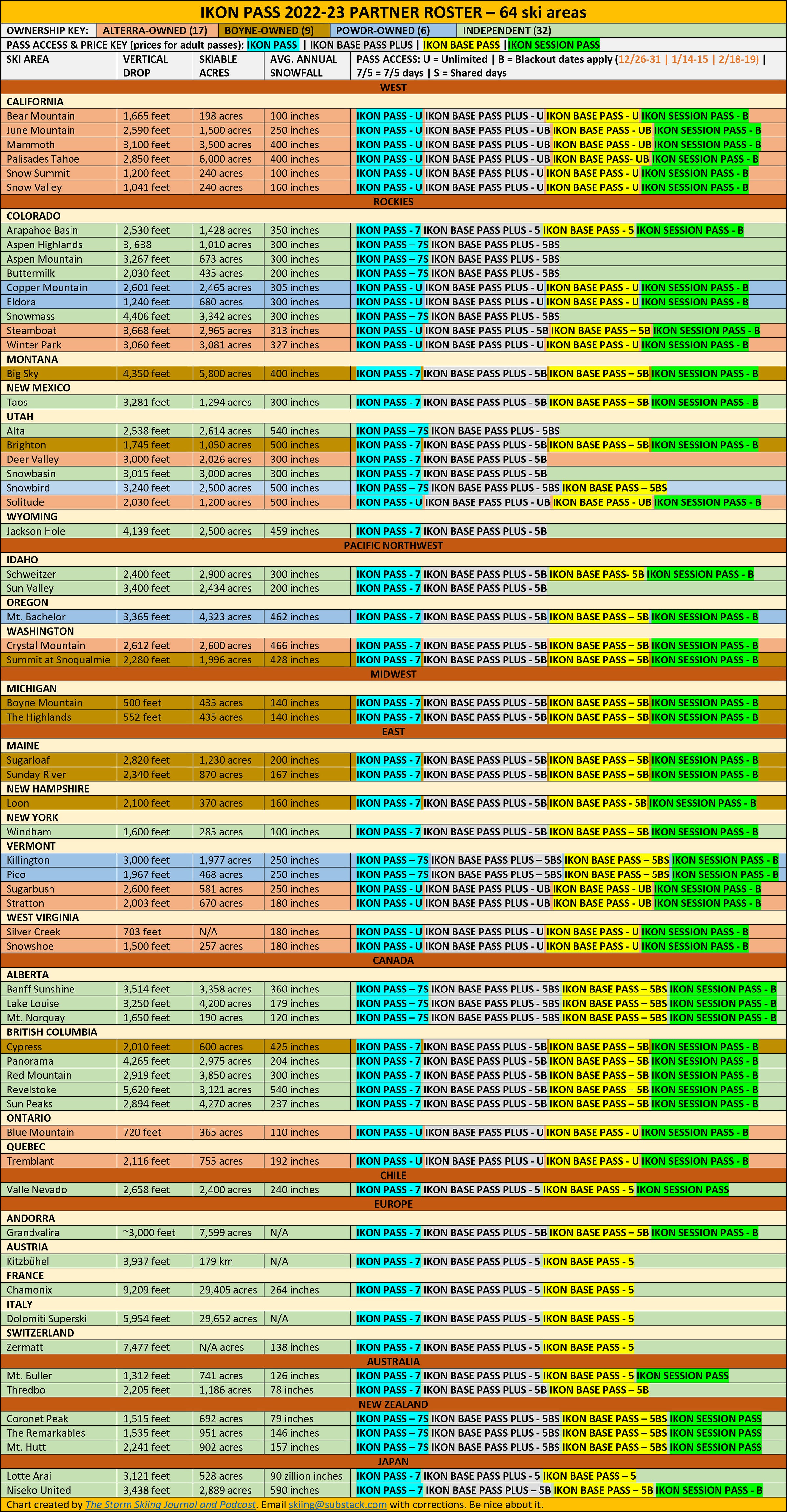

The purchase strengthens the company’s Ikon Pass, which will be valid for unlimited access at Snow Valley beginning Monday, Feb. 20, and drops another California ski area onto a roster that already includes Mammoth, June, Palisades Tahoe, Bear Mountain, and Snow Summit. Here’s Alterra’s owned portfolio with the addition of Snow Valley:

And here’s an updated Ikon Pass roster:

Seated just a dozen miles west of Snow Summit and Bear Mountain, Snow Valley could help mitigate crowds at Southern California’s busiest ski areas, offering skiers gentler slopes and a more welcoming learning environment than either of Alterra’s other two local properties can offer.

The Snow Valley addition “makes a lot of sense for Big Bear Mountain Resort,” said Ski California President Michael Reitzell. “It will help them spread the traffic across the three resorts on the Ikon pass. Snow Valley is a unique resort, and different from BBMR.”

Snow Valley is Alterra’s first acquisition since Sugarbush, Vermont in 2019. The addition of a small, city-adjacent ski area suggests a potential strategy shift for the company, whose owned and partner network has so far focused mostly on large, destination resorts.

Ripple effects will be immediate. This is the second sale of a California ski area in the past two months, continuing a years-long consolidation process that has put half of the state’s ski areas under just four owners. The Snow Valley purchase leaves Alterra’s largest competitor, Vail Resorts, with few options to capture direct market share in the nation’s second-largest city. And it likely subtracts one ski area from both the Indy Pass and the Freedom Pass for the 2023-24 ski season (both will remain valid at Snow Valley through the end of the current ski season).

The sale could also be monumental for Snow Valley, a thousand-footer seated on the eastern hem of metropolitan Los Angeles. The mountain has a schizophrenic past, investing in flourishes such as the region’s only six-seater chairlift while slowly stripping lifts and snowmaking off large chunks of terrain.

Here’s a deeper look at Snow Valley, and what Alterra’s purchase means for the Ikon Pass, for Southern California skiers, for Alterra’s competitors, and for California skiing in general:

Snow Valley 101

About Snow Valley

Base elevation: 6,800 feet

Summit elevation: 7,841 feet

Vertical drop: 1,041 feet

Skiable acres: 240 acres

Trails: 31

Average annual snowfall: 160 inches

Lift fleet: 7 lifts (1 six-pack, 3 triples, 2 doubles, 1 carpet)

Distance to (travel times are on clear roads with no traffic):

Snow Summit – 13 miles; approximate travel time 23 minutes

Big Bear – 15 miles; approximate travel time 30 minutes

[Bear Mountain and Snow Summit sit 2.4 miles and seven minutes apart]

And here, for context, are breakdowns of Snow Valley’s new sister resorts:

About Bear Mountain

Base elevation: 7,140 feet

Summit elevation: 8,805 feet

Vertical drop: 1,665 feet

Skiable acres: 198 acres

Trails: 29

Average annual snowfall: 100 inches

Lift fleet: 12 lifts (2 high-speed quads, 1 fixed-grip quad, 2 triples, 3 doubles, 4 carpets)

About Snow Summit

Base elevation: 6,800 feet

Summit elevation: 7,841 feet

Vertical drop: 1,200 feet

Skiable acres: 240 acres

Trails: 32

Average annual snowfall: 100 inches

Lift fleet: 15 lifts (2 high-speed quads, 2 fixed-grip quads, 2 triples, 4 doubles, 5 carpets)

What I’ve written in the past

I broke down Snow Valley when the ski area joined the Indy Pass in July 2021:

The notion of skiing in Southern California is incongruous, like finding a BDSM dungeon in the back room of a Chuck E Cheese. But there, towering off the eternal springtime of the Pacific Coast, is a clutch of big, snowy ski areas. For their proximity to gleaming Los Angeles, they are surprisingly relaxed and rusty as a whole, but they deliver a decent season: Snow Valley operated for 154 days during the 2020-21 campaign; Mt. Baldy GM Robby Ellingson told me on The Storm Skiing Podcast last year that [his] mountain often stayed open into May.

Whatever you think of SoCal skiing, it is an important market. There’s a reason Alterra owns Big Bear, a pair of ski areas just half an hour down the road from Snow Valley: there are a lot of skiers there. This is Ikon Pass country, funneling LA skiers up to Mammoth and Squaw and out to Salt Lake and Colorado. Indy signing Snow Valley won’t change that, but it’s an important addition nonetheless: few skiers in the nation’s second-largest city had much practical reason to consider an Indy Pass before. Now they may at least look at it, their two days at Snow Valley being a warmup for a roadtrip up into the Indy resorts in Utah and the Upper Rockies. …

I can only guess at what skiing Snow Valley is like. This is one of the oddest ski areas I’ve ever seen – it looks like a Midwest ski area turned on its side, with successive peaks stacked one atop the other in a wobbly ice cream cone pattern. It’s quirky and weird, with lifts – including, improbably, a high-speed six-pack – flying all over the place and few, if any, ways to ski the full vertical in one go. Fortunately, quirky and weird is exactly my preference.

A brief history of Snow Valley

Two clusters of ski areas hang over Los Angeles. To the northeast, along everwinding State Highway 2, sits Mountain High and the partially defunct Mt. Waterman. Mt. Baldy is also in the vicinity, just eight miles from Mountain High over the mountains, but 57 miles by car.

The second cluster sits east of the city, along equally windy highway 18. Snow Valley is first, followed west-to-east by Snow Summit and Bear Mountain. They make sense as a unit, but they operated separately for decades. Snow Summit and Bear merged into Big Bear Mountain Resorts in 2002. Mammoth bought them both in 2014, and all three, along with June, became part of Alterra three years later.

Snow Valley, however, has been independent for nearly a century. The ski area either opened in 1924 or 1937, depending upon your source. The mountain’s modern history dates to 1974, when Midwestern industrialist W.R. Sauey became part-owner of the resort. The ski area then added seven new lifts over the next 12 years and continually upgraded the snowmaking system. In 2017, the resort, wanting to make “a big splash” for its 80th anniversary, debuted the only six-pack chairlift in Southern California.

This chairlift, says Ski California President Michael Reitzell, was symbolic of Sauey’s passion for Snow Valley. “Kevin Somes, Snow Valley’s GM, always conveyed to me how much W.R. loved the resort,” he said. “That he poured enough capital to put a high-speed six-pack in showed as much.”

Once Sauey passed away in 2020, however, a sale became inevitable, says Reitzell. “His family, who inherited the resort, was less familiar with it, even though they had a strong leader in Kevin.”

Still, from a pure skier’s point of view, Snow Valley has wilted over the decades, systematically removing chairlifts and shrinking its inbounds footprint. An Inland Valley Daily Bulletin article from a decade ago documented this contraction:

A skier with a good memory who last visited [Snow Valley] in the early-to-mid-1990s would have good reason today to be a bit perplexed. Back then, the resort operated 13 chairlifts, including two, a triple and a double, that scaled its signature expert hill, Slide Peak, where snowmaking e equipment was installed at about the same time.

Slide, the incline of which ranges from 30 to 35 degrees on about 400 to 500 vertical feet, is the feature that makes Snow Valley entertaining for skiers and snowboarders who like steep, bumpy terrain. When it’s closed, as it has been for most of this season, Snow Valley appeals primarily to those of marginal to limited ability or who enjoy the obstacles of the freestyle park.

Two decades ago, an equally precipitate run on the western flank of the area plunged beneath chair 5 to a parking lot that seems big enough to swallow Rhode Island. Chair 7 climbed a slope that has since been incorporated into the freestyle area. Chairs 4 and 10 were thriving.

Today, chairs 4 and 10 (one of the two Slide Peak lifts), though still on the trailmap, have been idle for years. Chair 7 was yanked out of the ground and sold.

Worst of all, the snowmaking equipment on Slide Peak has been out of service for so long that resuscitation would require major investment, which the current volume of business cannot justify. And the bottom-most tower supporting the cable of the chair 5 lift was removed years ago in a snowshoe hare-brained scheme to create an area for snow play, which was subsequently transplanted a few hundred yards east.

The resort’s 1997 trailmap shows Snow Valley at full power:

The deconstruction has continued in the decade since that article. Chairs 2 and 8, while still on the trailmap, have not run for at least five years, according to Zenovia Baldeon, Snow Valley’s guest services and tickets supervisor. Slide Peak is now explicitly an all-natural-snow area.

All of which is a bit of a drag. Alterra, Reitzell says, should be a good steward who will “likely brings some capital to Snow Valley that should help upgrade the resort in a number of ways. I look forward to seeing what Alterra plans for Snow Valley’s future.”

My current take

The addition of Snow Valley is great for Alterra, great for local Ikon Pass holders, great for the mountain, and potentially great (or not) for the ski area’s longtime passholders.

Alterra gets: a relief valve for its furiously overcrowded Bear Mountain and Snow Summit ski areas; a megapass lock on the Los Angeles market; and an oasis of mild terrain.

Ikon passholders get: a third unlimited option for local turns between runs to Mammoth, Tahoe, and the Wasatch; a pitstop a dozen miles closer to civilization that cleaves a bit of the torque off the mountain drive up to Big Bear; and further affirmation that they purchased the best megapass in existence.

Snow Valley gets: guaranteed(-ish) stability in the maw of climate change; a potential investment firehose to replace its eight Yan lifts that are a combined 339 years old; and the attention and status that comes with Ikon Pass membership.

Snow Valley skiers get: sudden access to the best multi-mountain roster in skiing; the hope of lift and snowmaking upgrades; and, on the potential downside, a lot of new friends and what will likely be a huge increase in their season pass price, which debuted at just $329 for the 2022-23 ski season.

The rest of us get: the irritation of trying to understand why three distinct ski areas are lumped together as a single “destination,” in Alterra-Speak; another 5,000-word breakdown from The Storm Skiing Journal of a ski area that 98 percent of skiers outside of its immediate vicinity have never heard of; and the realization that there is only one active ski area in America to carry the shockingly unimaginative name “Snow Valley.”

So what should Alterra invest in first?

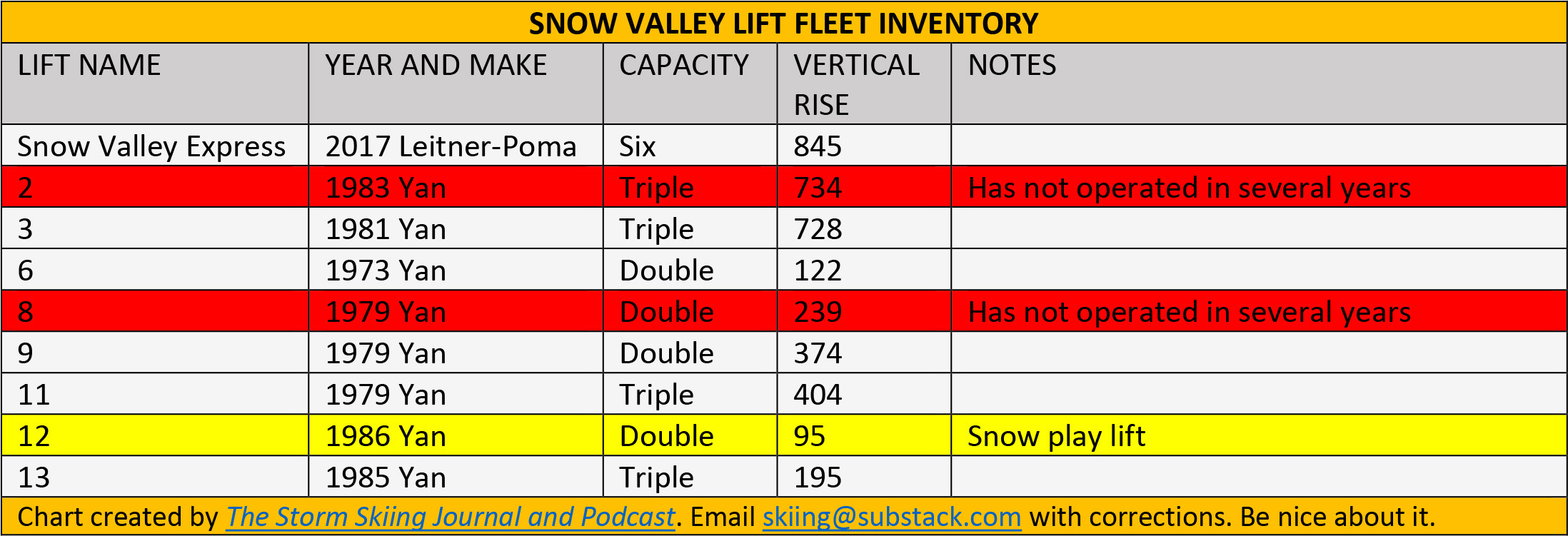

The problem with having one high-speed lift is that it basically means that you have one lift. Everyone crowds there and the other lifts are like the asparagus on the all-you-can-eat pizza buffet. Asparagus is fine if there are no other options and you’re hungry, but you can’t put it beside pizza and expect it to be consumed by anything other than the garbage can. I witnessed this at Gunstock and Crotched - each of which have a single high-speed lift flanked by empty-queued fixed-grip chairs - just a few days ago. Nub’s Nob GM Ben Doornbos told me that this dynamic is why his ski area declined to upgrade one of its eight chairlifts to a detach. And this, right now, is Snow Valley’s lift fleet:

It’s a little funny. Like seeing a Ferrari parked outside of a trailer home. It’s fine if you want to live that way, but it’s a little incongruous, you know?

So what to upgrade? I’m not sure. It’s a weird mountain, like three small ski areas stacked one on top of the other. Maybe lifts 2 and 6 combine into a quad with a midstation? Or hey, how about finish this expansion the resort proposed circa 1980?

In its five-ish-year history, Alterra has not aggressively upgraded workaday lifts, focusing instead on megaprojects such as Palisades Tahoe’s base-to-base gondola and the Wild Blue gondy at Steamboat. But eventually the company will have to focus on some less Ikonic lift upgrades.

“As we do with all our destinations, we are excited to invest essential capital to enhance the on-site employee and guest experience to further strengthen our offerings to skiers and riders in Southern California,” said Alterra President and CEO Jared Smith.

Maybe that means new lifts. Or maybe it just means more and better snowmaking, or running guns back up Slide Peak or bringing back lift 5. One low-dollar suggestion: how about clamping some safety bars onto those old Yans? I know the Brobots don’t like them, but us tourists appreciate the seatbelt, especially when we’re skiing with our kids.

Is the battle for LA over?

I keep saying that the Ikon Pass has the best ski area roster of any multi-mountain pass because it does. Only three of the pass’ 63 ski areas top out under 1,000 vertical feet, and all three are regional destinations: Boyne Mountain, The Highlands, and Blue Mountain, Ontario. Compare that to the Epic Pass, which carries 18 sub-thousand-foot bumps, only one of them – Seven Springs – a regional destination (Liberty and Whitetail could also slide in there).

But Vail may have the smartest roster of any multi-mountain pass. Look at just about any large cold-weather city in the country, and Vail has picked up a resort within a two-hour drive: New York, Philadelphia, Baltimore, D.C., Boston, Cleveland, Columbus, Cincinnati, Louisville, Indianapolis, Detroit, Chicago, Milwaukee, Minneapolis, St. Louis, Kansas City. The Ikon Pass, grand as it is, has gigantic holes – it has four U.S. resorts between New England and Colorado. The Epic Pass has 19.

This dynamic is flipped in Los Angeles, the second-largest city in America, with a metro population of 12.5 million (San Diego adds another 3.3 million) and zero Vail Resorts. The closest are in Tahoe, a long drive (or a short flight to Reno) north. With the Snow Summit purchase, Alterra now owns three of the five viable ski areas seated along the city’s mountain halo. The first two were kind of an accident: Big Bear and Snow Summit came with Mammoth, which purchased them in 2014 to cement the LA market. Snow Valley just underscores the obvious: if you live in Los Angeles and have any intention of skiing locally, you buy an Ikon Pass. No contest.

So that leaves us with two questions: will Vail try to compete for Los Angeles? And is Alterra’s latest LA purchase an indication of a strategy shift to build its own hub-and-spoke network?

First, Vail. What could they buy to secure that LA real estate? They have three options:

1) Mountain High

By sheer size and variety, Mountain High stacks up favorably against Bear Mountain or Snow Summit. The ski area is really three ski areas, which I broke down in my podcast conversation with area CEO Karl Kapuscinski last year. It’s probably not for sale. Mountain High’s parent company, Invision Capital, purchased China Peak just last month, and Dodge Ridge in 2021. Kapuscinski told me in December that they would definitely be interested in adding “another two or three properties.”

So why even include Mountain High on this list? Vail has an awfully fat checkbook, and a history of buying properties that no one thought were for sale, like Triple Peaks (Okemo, Sunapee, Crested Butte) in 2018 and Peak Resorts a year later.

“You always listen, you never close the door on anything,” Kapuscinski told me on Monday when I asked what he would do if Vail called with an offer. “But right now, we’re trying to grow our own brand.” He added that Vail had never reached out to him to ask about purchasing any of his resorts.

2) Mt. Baldy

This place is so weird. An hour from downtown LA on clear roads, 2,100 vertical feet, more acreage (800) than Mountain High and Big Bear combined – all served by four old Mueller double chairs. Baldy has limited snowmaking, but the lifts spin into May some years. It’s always either mediocre or amazing. Like a spectacular old Victorian rotting in the woods, it would likely cost more to renovate than to buy – a strategy that Vail hates. But it would be worth it if they can figure out a way to get more water up there and blow out the snowmaking system.

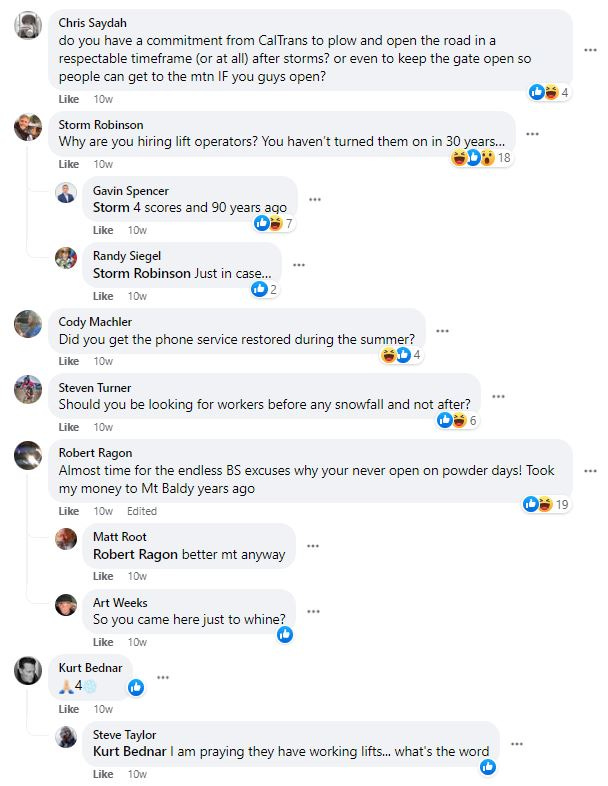

3) Mt. Waterman/Kratka Ridge

This is the most improbable, but if anyone has the resources to resuscitate this derelict duo seated along California highway 2, it’s Vail Resorts. Waterman pretends like it’s an active ski area, posting hopeful let’s-do-this Facebook updates after every storm, but it hasn’t opened for skiing since at least 2020. The comments are typically scathing:

Down the highway, Kratka Ridge sits abandoned, a single-seat chairlift standing still (I explored this area last summer; it was a mystifying experience). While the place has no active operator, the U.S. Forest Service still lists this as an active ski area lease. Twenty-four years ago, an investment group tried to develop Kratka and Waterman into LA’s next super-resort:

A group of investors has agreed to buy the Mt. Waterman and Snowcrest [Kratka Ridge] ski areas in Angeles National Forest and plans to link the two to create a ski complex that could eventually become a serious competitor to ski resorts in the Big Bear area.

Mt. Waterman Acquisition Holdings Inc. filed applications this week for U.S. Forest Service permits to operate the two neighboring ski areas in the San Gabriel Mountains about 15 miles northeast of La Canada Flintridge, Ranger Terry Ellis said Friday.

Ellis said he expects the permits will be approved quickly. The two ski areas are on land owned by the National Forest Service and operated by their respective owners under Forest Service permits.

Barry Stubblefield, one of the investors buying the ski areas, said the La Canada Flintridge-based company’s acquisition of the two resorts is “a done deal” that awaits only the Forest Service approval to become final.

Stubblefield said the new owners have a five-year plan that calls for linking Waterman and Snowcrest, installing much-needed snow-making systems at both, making extensive improvements to the lodges and parking areas, and adding 16 or 17 more ski lifts.

Waterman and Snowcrest could be linked by developing about 80 to 100 acres of an area between the two called Buckhorn Springs. That would create about 300 skiable acres when combined with the existing 150 skiable acres at Mt. Waterman and the 58 acres at Snowcrest, Stubblefield said.

In terms of size, that would put the combined resort on a par with Big Bear ski areas such as 230-acre Snow Summit and 240-acre Snow Valley.

In an era of regional water scarcity and environmental activism, the rebirth of Waterman and Kratka Ridge as an urban megaresort feeding Vail’s big-timers is about as probable as a merger of the U.S. and Canada. The battle for Los Angeles is over. Alterra won.

Has Alterra’s acquisitions approach shifted to smaller targets?

Which bring us back to our second question: is Snow Valley Alterra’s entrée into the urban ski area? Perhaps.

“The acquisition of Snow Valley Mountain Resort is a continuation of our ongoing mission to build a premier portfolio of great mountains in robust markets,” said Smith.

“Robust” markets does not necessarily mean city markets, but there are clues that Alterra plans to build a feeder network. Parent company KSL has purchased Camelback and Blue Mountain – two Pennsylvania ski areas that sit approximately two hours from Philadelphia and New York City – over the past two years. Each got a brand-new six-pack this season – could the company be modernizing these resorts and prepping them for the crowds that Ikon Pass access would bring?

Yes, of course they could be. Or not. I don’t know if Alterra is trying to play fill-in-the-suburban-dots-on-the-map. But I know that they should. Vail dominates the middle of the country from a pass-presence point of view. Why? There are Snow Valleys within a couple hours of nearly every cold-weather city in America that Alterra could buy. A ski industry source tells me that there are 180,000 Ikon Passes in metropolitan Los Angeles. It’s clear why: the Big Bear-to-Mammoth-to-Palisades Tahoe pipeline. Why not replicate that success elsewhere?

“Overall, the consolidation does not concern me”

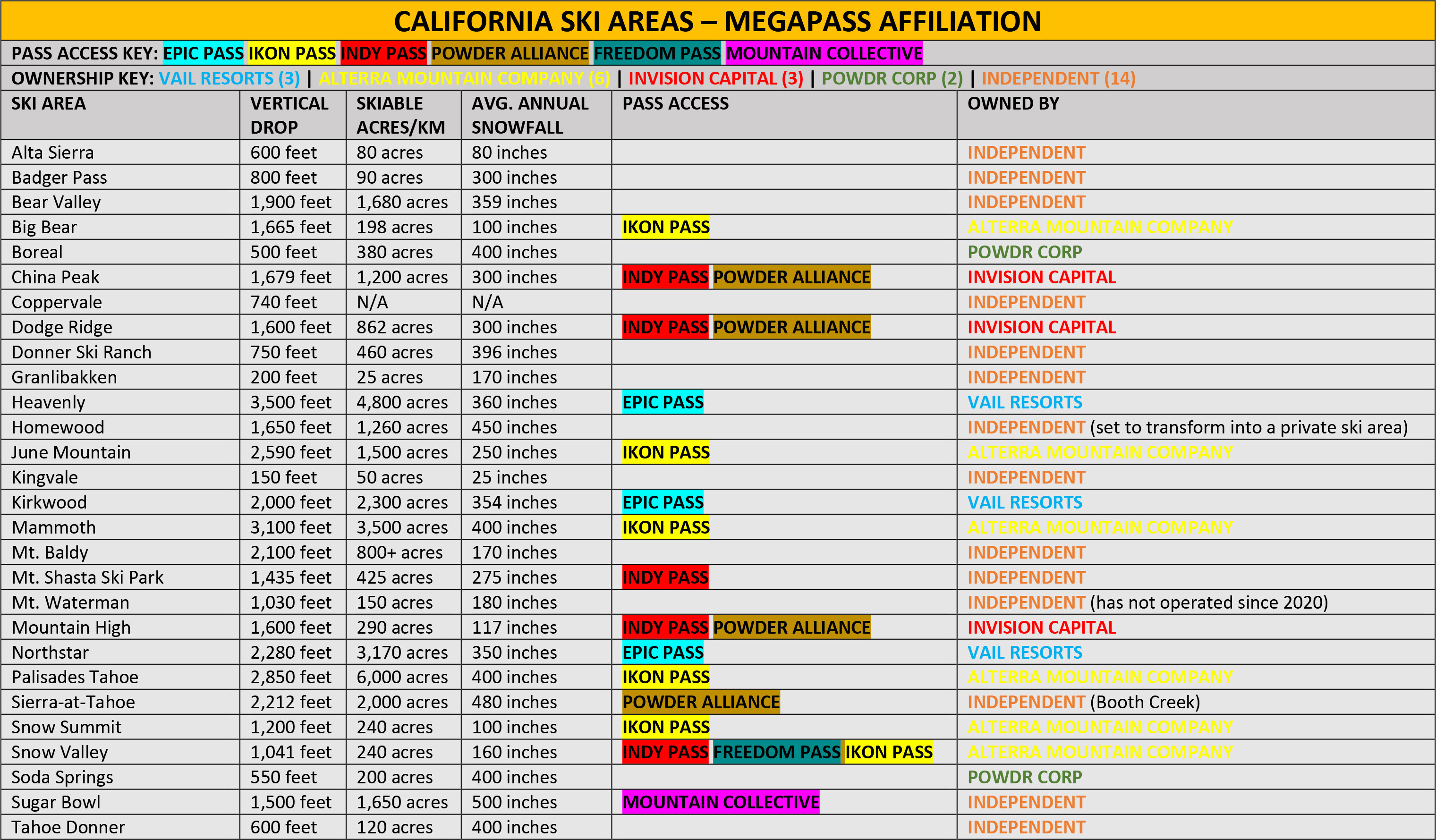

Alterra’s purchase of Snow Valley evenly splits California’s 28 active ski areas between conglomerate-owned mountains and independents. Here’s an overview:

Should we be worried? “Overall, the consolidation does not concern me,” said Reitzell, the Ski California president. “Every move in the recent past only makes the California ski industry stronger.” Though he joked that other factors may be at play. “As does 400 to 500 inches of snow in mid-January.”

But here’s one thing to consider: Snow Valley has long sold the most affordable season pass in the region. Last year’s early-bird price was just $329. It’s still on sale for only $399. Passholders could add an Indy Pass on for just $179 at spring prices, giving them a de-facto megapass for $499.

Contrast that to an Ikon Base Pass, which started at $769 and hit $919 before going off sale in December. Alterra still offers discounted local passes at several of its mountains: Big Bear and Snow Summit ($519 early-bird price), June ($519), Winter Park ($599), Snowshoe ($449), and Silver Creek ($219). Snow Valley will likely get lumped into the Big Bear Pass, which is very affordable, but nearly $200 more than skiers paid just a year earlier for their Snow Valley-only pass.

That likely price hike, among other reasons, is why Kapuscinski, who’s run Mountain High since the 1990s, welcomed Snow Valley’s sale to Alterra. “When I first started this, there was four other areas you had to compete against in the marketplace, and four different messages you had to go against,” he said. “So this makes it pretty simple. It's David and Goliath. It really simplifies the whole marketing message. It’s the Wal-Mart of ski resorts versus the friendly family corner hardware store.”

Kapuscinski confirmed that he had considered purchasing Snow Valley himself and had submitted what he called a “soft bid,” but declined to enter a bidding war against Alterra. He estimates that the Colorado-based company now controls 90 percent of the Southern California ski market. Still, “we felt that we'd rather see them there than a third competitor that we'd have to then craft other messaging around,” Kapuscinski said.

As Ikon gains, Indy and Freedom anticipate losses

Snow Valley’s Baldeon confirmed that “for the remainder of the season, there are no changes to our pass partner perks.” That means that both Indy and Freedom Pass holders can redeem their tickets without hassle, even after Ikon Passes activate next month.

Representatives from both coalitions seemed resigned to losing their Southern California partner. “If we only lose resorts when they’re purchased by one of the big four, I’ll take it,” said Indy Pass President and founder Doug Fish, referring to Vail, Alterra, Boyne, and Powdr. Indy’s current roster numbers 104 alpine ski areas besides Snow Valley.

The loss of Snow Valley will not leave Indy without an LA-area partner, however, as Mountain High joined the coalition, along with sister resort Dodge Ridge, in August. This move, Kapuscinski said, was a direct reaction to the impending Snow Valley sale. “We wanted to differentiate ourselves from Big Bear Resorts,” he said. “Alterra offers a great product, but this is an opportunity for us to further distance ourselves from that corporate environment and create an independent brand.”

Freedom Pass, meanwhile, will keep its duct-taped coalition together somehow, as it has for more than a decade. “We are excited for our Freedom Pass partner Snow Valley and encourage our Freedom Pass skiers and riders to make plans to visit while the opportunity exists this season,” said Troy Hawks, administrator of the Freedom Pass and the marketing and sales director at Sunlight Mountain, Colorado. “Freedom Pass agreement renewals will begin in the weeks to come. At this time, we have not had contact with staff at Snow Valley, but we do anticipate they may fall off of the Freedom Pass. We will certainly share any news that we hear as it unfolds and are grateful for the many seasons of partnership with Snow Valley.”

Please stop combining distinct ski areas into one ski area because it makes sense on the org chart

One of the more annoying outcomes of consolidation is this tendency to lump nearby resorts into a single “destination.” I understand why operators do this from a management and administrative point of view, but it’s confusing for consumers. The Ikon Pass website, for example, lists Summit at Snoqualmie as rocking a 2,280-foot vertical drop. But that statistic is only correct for Alpental, one of the resort’s four distinct sections, and the only one that has no ski link between the others. The vertical drops of Summit East, Central, and West ski areas are all less than half that of Alpental’s, but visitors to Ikon’s website have no way of knowing this. I’m not sure how many skiers show up at the Summit ski areas and wonder what the hell they’re missing, but it must be more than zero:

Similarly, Alterra has always lumped its Snow Summit and Bear Mountain ski areas together as “Big Bear.” While the two ski areas sit side-by-side, and only a mile separates their borders, there is no trail or lift connection between them. Alterra has never made it obvious that this destination is in fact two separate ski areas, and the addition of Snow Valley, eight air miles and 13 road miles to the west, is likely to further complicate things:

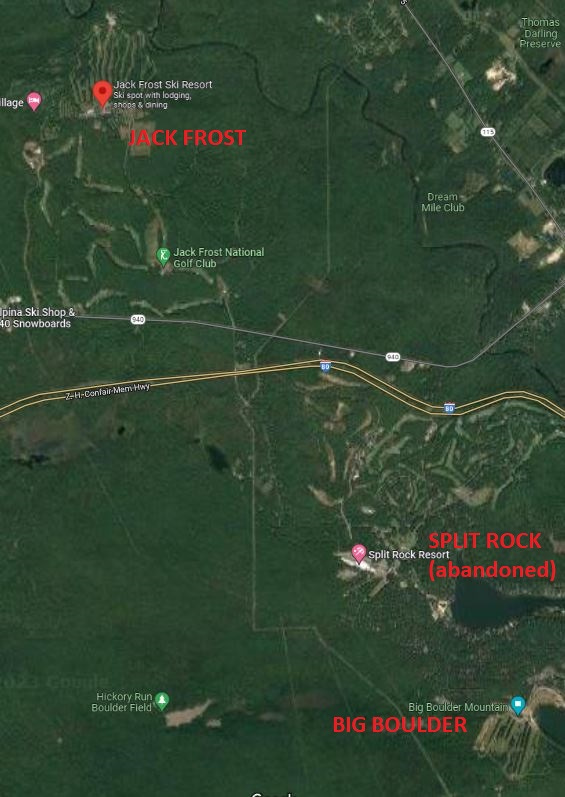

Vail does this combine-separate-ski-areas thing as well, linking its Jack Frost and Big Boulder ski areas in Pennsylvania, even though they are a 12-mile drive apart and serve completely different demographics:

Same with Boston Mills and Brandywine, which at one point Google Maps had a hard time pinpointing as separate ski areas (the issue seems to be fixed):

Other instances of separate ski areas lumped into one are Snowshoe, West Virginia; Mountain High; Snowriver, in Michigan’s Upper Peninsula; and Shanty Creek, in Michigan’s Lower Peninsula. Sugarbush, Palisades Tahoe, and Park City are at least knitted together with a gondola connection. But when ski areas aren’t connected by trails or lifts, it’s confounding at best and deceptive at worst. Each of these ski areas have separate vertical drops, skiable acreage totals, and, in some cases, average annual snowfalls. Skiers think of them as distinct entities, but the NSAA counts them as one in its annual tally of active ski areas. No one seems to know that the hell is going on, including the ski areas who run them. Can we fix this?

The Storm publishes year-round, and guarantees 100 articles per year. This is article 5/100 in 2023, and number 391 since launching on Oct. 13, 2019. Want to send feedback? Reply to this email and I will answer (unless you sound insane, or, more likely, I just get busy). You can also email skiing@substack.com.

Thanks for always going deep with details Stuart, great read. While consolidation never "feels good" this deal makes a ton of sense for Alterra.

Great analysis! Not only does this move block Vail, it also makes it that much harder for MCP to break into the SoCal market to try to attract skiers to their soon-to-expand Brian Head. I'm curious if there's any potential to revive Snow Forest. I know California environmental law is challenging, but there's little need for tree-cutting and still more water available at Big Bear.