Ski Cooper Releases 2022-23 Partner Map: 3 Days Each at 59 Ski Areas, Including 11 New Ones

Pricing to come in June; Passes on Sale July 1

[UPDATE, May 19: after the publication of this story, Saddleback pulled out of the partnership with Ski Cooper. The text remains unchanged because it was accurate at the time of publication. Giants Ridge, Minnesota, has also now joined the coalition.]

Since launching The Storm in October 2019, I’ve written exactly 300 articles, including the one you’re reading now. The fourth most popular was this analysis of Ski Cooper’s phenomenal season pass deal last July:

The $299 ($249 for renewals) pass was, I wrote at the time, “the largest and most straightforward reciprocal lift ticket coalition in North America”: three days each at 48 partners, with almost no blackouts. Plus a season pass at the top of the Rockies. This was a true national pass, I wrote, which, “in its price point, access model, and geographic breadth … competes most closely with the Indy Pass.”

While the point was explicitly not, Ski Cooper General Manager Dan Torsell told me at the time, to create a national ski pass, the bargain price, combined with the fact that the ski area mailed them, has created exactly that. It’s unclear how many Ski Cooper passholders never visited the ski area. Anecdotally, the pass turned out to be a particularly appealing option for skiers near Michigan’s Upper Peninsula (UP) and in Western Pennsylvania. One Pittsburgh-area skier told me that four families on his block had bought the Ski Cooper pass last season, to take advantage of the three days each at nearby Seven Springs, Laurel, and Hidden Valley, plus the monster Holiday Valley, three hours and change north.

No one will be skiing Seven Springs on a Ski Cooper pass in 2023 – Vail bought the western Pennsylvania trio in December and, of course, shuffled them over to its Epic Pass. But Ski Cooper released its 2022-23 partner list this week, unveiling 11 new partners and 59 total. More will likely be added, Ski Cooper Director of Marketing and Sales Dana Johnson told me, prior to the July 1 on-sale date. The terms mirror last year’s: passholders will receive three days at each partner. Only Diamond Peak (which offers four free days) and Brundage have blackouts. Passholders at these partner resorts receive, in turn, three no-blackout days at Ski Cooper. Six 2021-22 partners, including the three Vail resorts, dropped out of the coalition. The mountain will release prices in early June.

The new partners are Bear Creek, Blue Knob, and Mount Pleasant of Edinboro in Pennsylvania; Beech Mountain, North Carolina; Saddleback, Maine; Whitecap Mountains, Wisconsin; Snowstar, Illinois; Terry Peak, South Dakota; White Pine, Wyoming; Mt. Shasta Ski Park, California; and Mt. Spokane, Washington. The addition of Saddleback, which gives Ski Cooper its first marquee New England partner, is particularly compelling in a region that has largely resisted the West’s reciprocal mania.

Aside from Seven Springs, Laurel, and Hidden Valley, the former partners who do not appear on this year’s roster are Holiday Valley, New York; Lookout Pass, on the border of Idaho and Montana; and, as previously announced, Powder Mountain, Utah.

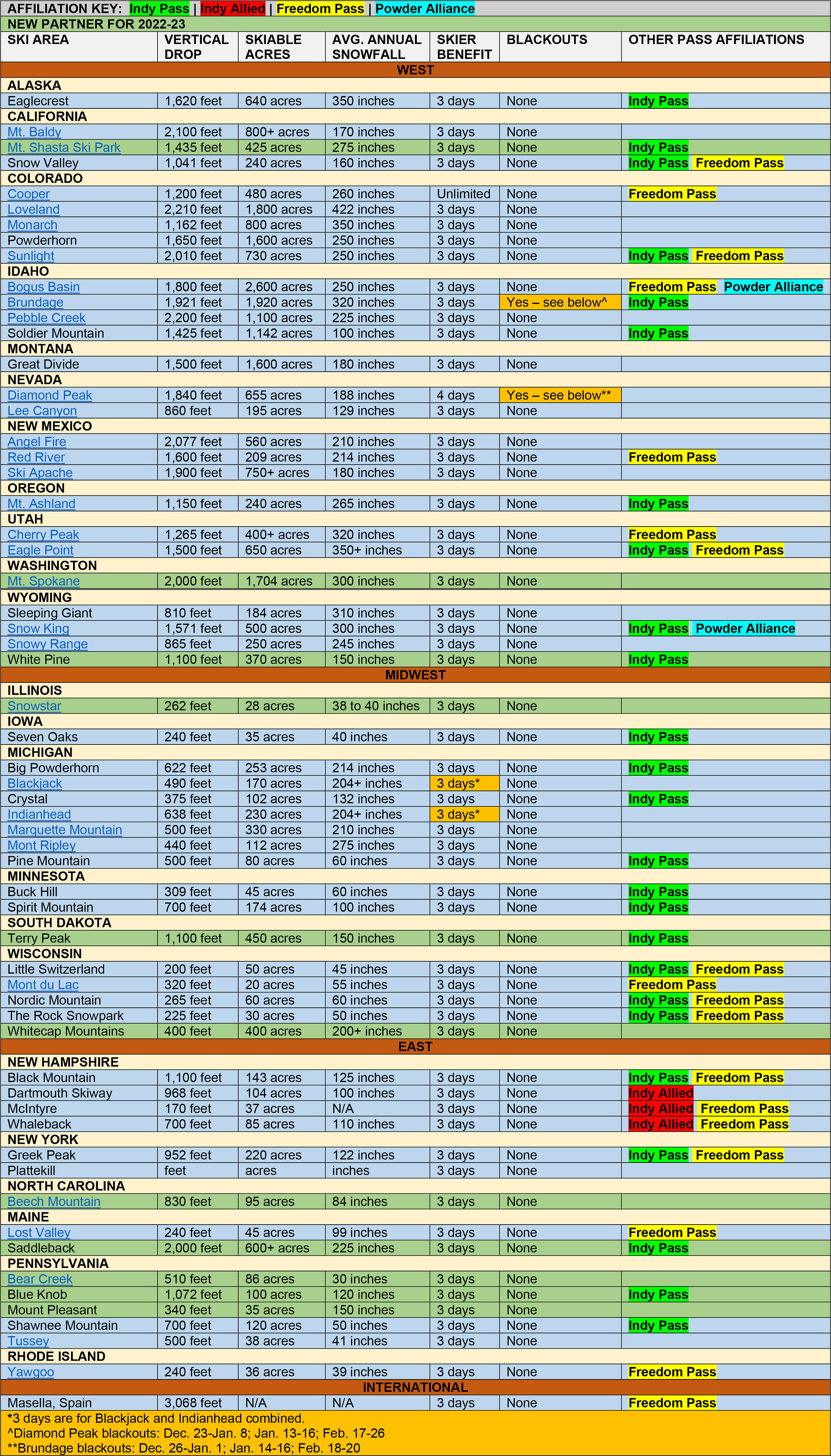

Even with those substantive losses, the roster is impressive. Here’s how it breaks down [best viewed on desktop]:

Ski Cooper’s coalition remains the most robust reciprocal partner network in America (I’ve tracked them all here). A close examination of the roster reveals how muddled and intertwined the nation’s various passes have become with one another – Ski Cooper now shares 25 partners with the Indy Pass, and an additional three recently joined Indy’s new Allied discount program. Here’s a more detailed, mountain-by-mountain, state-by-state look at Ski Cooper’s 2022-23 coalition, with various pass affiliations and basic mountain stats broken down:

Whether Ski Cooper’s bargain pseudo-megapass represents the future of an industry drawing inexorably together like some snowy reverse Pangea or the final inflation of an unsustainable reciprocal ticket bubble remains to be seen. For now, this is a hell of a product, and one that skiers ought to consider right alongside the Epic, Ikon, Mountain Collective, and Indy Passes (several other ski areas, including Loveland, Monarch, Snow King, Bogus Basin, Lee Canyon, and Mont du Lac – among many others – have built similarly robust coalitions, which I inventoried last month):

There are a lot of skiers this pass could make sense for: Ikon or Epic Pass holders in Colorado looking for weekend and holiday hideouts; anyone within a half day’s drive of the UP or eastern Pennsylvania; the rambling and adventurous who prefer slow lifts with no lines to fast lifts with lines you could mistake for the crowd at a Yeezy sneaker drop. There are 175 days of non-Cooper skiing on this pass. It’s not hard to figure out how to have a good time with that level of access. Here’s a closer look at this year’s pass, including a detailed look at each of the 11 new partners:

The new partners: important additions in every market

The addition of Saddleback, as noted above, is huge, but the 11 new partners are interesting in all kinds of ways. Beech Mountain drops a drawbridge into the wiry and weird Southeast, where a thriving ski culture persists largely cut off from the rest of the American ski zeitgeist. While the loss of Seven Springs, Laurel, Hidden Valley, and Holiday Valley demoted this pass from an automatic buy in western Pennsylvania, the addition of Bear Creek now makes it a compelling option for skiers on the other side of the state, particularly after last season’s late addition of Shawnee Mountain. Mt. Spokane is an underrated 2,000-footer teetering on the eastern edge of Washington’s vast drylands. Whitecap is one of the rowdy secrets of the Upper Midwest. It’s an eclectic and interesting lineup, thrilling for the variety- and novelty-loving among us:

BEAR CREEK, PENNSYLVANIA

Overview: 510-foot vertical drop, 86 skiable acres, 6 lifts (3 quads, 2 carpets), 23 runs, 30 inches average annual snowfall

My Take: Gentle and modest, with a strong set of terrain parks and a trio of modern fixed-grip quads, Bear Creek is exactly what you would expect to find in Pennsylvania. The snowmaking is outstanding, as it needs to be to sustain existence in this sector of the mid-Atlantic. This pairs well with Cooper partner Shawnee Mountain, granting passholders six ski days within an hour and 15 minutes of one another. This is a fun little bump, erected on a set of knolls with trails weaving up and over and around them in interesting knots. I hit this one on a 70-degree corn snow T-shirt day last year. I had a good time even as I’ll acknowledge that I’m not in an enormous hurry to get back.

BLUE KNOB, PENNSYLVANIA

Overview: 1,072-foot vertical drop, 100 skiable acres, 4 lifts (2 triples, 2 doubles), 34 runs, 120 inches average annual snowfall

My take: If a trailmap told the full story of a mountain, Blue Knob would be the most gripping saga in Pennsylvania. Nearly 1,100 feet of vert, the lower half a rippling playground of bumps and glades. It’s more rough-and-tumble Vermont than gentle, milquetoast PA.

It’s all, mostly, an illusion. Blue Knob is one of the most mis-managed mountains in the country. The lower mountain is so rarely open that I’m not certain why it’s even present on the trailmap. Ninety percent of the time, you get a handful of runs off the longer triple chair. Even after a two-foot dump in January, the whole lower section of the mountain remained idle. The potential here is enormous: Blue Knob could be the rowdy mingling spot for the rad and ready, the Magic Mountain of the Mid-Atlantic, a hideout for Epic Pass refugees who’ve lost interest in Seven Springs. But the place needs heavy investment, most of all in wall-to-wall snowmaking, if it hopes to be viable through our ever-more-tenuous winters. I desperately want to love Blue Knob, but I am repeatedly and profoundly disappointed with its failure to provide anything resembling a competent ski experience.

That said, at least Cooper found some sort of replacement for the exit of its Epic trio. The Pennsylvania network now flows nicely from east to west, from Shawnee and Bear Creek through steep and crowded Tussey to Blue Knob to Mount Pleasant (though the last one is a bit far, as noted below). If by some miracle this place finds competent management, a skier could craft a really nice season out of these five Pennsylvania ski areas and three days each at wily and snowy Greek Peak and Plattekill, not so far to the north.

MOUNT PLEASANT OF EDINBORO, PENNSYLVANIA

Overview: 340-foot vertical drop, 35 skiable acres, 2 lifts (1 triple, 1 J-bar), 10 runs, 150 inches average annual snowfall

My take: I’m on the record as a major fan of this place, and my podcast interview with General Manager Andrew Halmi laid out all the reasons you should be too:

A few of the major points I made in that article:

…Mount Pleasant is the Spud Webb of Pennsylvania skiing, the unassuming 5’6” kid who wins the NBA Slam Dunk Contest (that actually happened). The ski area is, first of all, well-positioned, seated less than 17 miles off the shores of the Lake Eerie snow factory. The ski area often leads the state in snowfall, with up to 200 inches in a bomber year. Again, this is in Pennsylvania. Every ski area in the Poconos combined doesn’t get 200 inches some years.

Second, while it’s separated from its in-state ski-area homeboys by at least three hours of highway, Mount Pleasant is quite well-positioned from a business point of view. Eerie, population 97,000-ish, is just 20 miles away. The county has around 270,000 residents altogether. Other than Peek’n Peak, stationed 32 miles away across the New York state line, Mount Pleasant has those skiers all to itself.

But neither of those things is the essential ingredient to Mount Pleasant’s improbable survival amid the graveyard of lost ski areas haunting Pennsylvania’s mountains. Cliché alert: the secret is the people. Launched as a notion in the 70s and crushed by the snow droughts and changing economy of the 80s, Mount Pleasant hung on through the 90s, barely solvent as a ski club running on the clunky machinery of faded decades. When the current owners bought the joint in the mid-2000s, it was a time machine at best and a hospice patient at worst, waiting to be guided toward the light.

Since then, the place has punched its way out of the grave, and it’s now a thriving little ski area, with a modern triple chair and improving snowmaking. The owners, Doug and Laura Sinsabaugh, are local school teachers who have poured every dollar of profit back into the ski area. They have invested millions and, according to Halmi, never put a cent in their own pockets. They’ve shown remarkable resilience and ingenuity, installing the chairlift – which came used from Granite Peak, Wisconsin – themselves and slowly, methodically upgrading the snowmaking plant. …

I liked Mount Pleasant a lot more than I was expecting to. Not that I thought I would dislike it. I am a huge fan of small ski areas. But many of them, admirable as their mission is, are not super compelling from a terrain point of view, with a clear-cut hillside stripped of the deadly obstacles (read: trees), that their first-timer clientele may have a habit of smashing into. What I found was a neat little trail system woven through the woods. It’s a layout that encourages exploration and find-your-own lines inventiveness.

Mount Pleasant doesn’t really sync with anything else on the Cooper Pass – while it’s the pass’ fifth partner in the state, it’s not close to any of them: Tussey and Blue Knob lie more than three hours east. Still, it’s nice to see this snowy little rock get some run. Following our podcast conversation in March, I was hoping Mount Pleasant would join Indy Pass. I still hope they do. But this is an interesting move for a ski area that has been a committed loner for years.

BEECH MOUNTAIN, NORTH CAROLINA

Overview: 830-foot vertical drop, 95 skiable acres, 8 lifts (3 quads, 3 doubles, 1 carpet, 1 ropetow), 17 runs, 84 inches average annual snowfall

My take: North Carolina skiing is an amazing thing. Improbable, befuddling, curious: how? One word: elevation. The base of Beech Mountain sits at 4,675 feet, higher than any summit in New England. Sugarloaf tops out at 4,237 feet. Killington at 4,241. Cannon at 4,180. Beech reaches more than a mile into the sky, hitting 5,506 feet at the top of the lifts. This oasis-in-the-sky setup explains why you’ll often see North Carolina resorts Cataloochee (4,660-foot base elevation) or 1,200-vertical-foot Sugar Mountain (4,100-foot base) blow the doors open in October, beating even The Beast to go. Cataloochee’s earliest opening dates in recent years were Nov. 2, 2014 and Nov. 3, 2019, according to Snowpak.com.

The mountain seems well-cared for. Once it completes a brand-new fixed-grip quad installation this summer, Beech Mountain “will feature six modern Doppelmayr lifts,” according to Lift Blog. North Carolina has just six ski areas, but it’s an important feeder market with a rapidly growing, ever-wealthier population. One of the big boys will buy something here at some point and drop it onto the Epic or Ikon pass, funneling those Charlotte and Ashville megabucks north and west. In the meantime, the Ski Cooper bonus days at Beech (or the Cataloochee days on the Indy Pass), provide a nice excuse to explore one of the country’s most isolated and unique ski regions.

SADDLEBACK, MAINE

Overview: 2,000-foot vertical drop, 600+ skiable acres, 7 lifts (1 detachable quad, 3 quads (once the new Sandy lift goes in over the summer), 1 T-bar, 1 ropetow, 1 carpet), 68 runs, 225 inches average annual snowfall

My take: Well would you look at this. The Ski Cooper pass just got real interesting in New England. Saddleback is an anchor property, a 2,000-footer with steep terrain, big ambitions, and a multi-year comeback story that may serve as a model for other modernize-or-die large ski areas choking on the exhaust fumes of their rapidly growing neighbors. In Saddleback’s case, it’s sandwiched in the Great In-Between, with Sugarloaf to the north and Sunday River to the south. As Boyne prepares to pump tens of millions in new lifts, terrain, and snowmaking into its two Maine titans, Saddleback needs to find ways to differentiate itself and draw the non-Ikon crowd.

Heading into season three since its 2020 re-opening, the mountain seems to be finding its comfortable carrying capacity. Last month, Saddleback lifted all Indy Pass blackout dates for next season. Opening the ski area for three no-blackout days on a reciprocal pass further acknowledges that the mountain has room to spare.

“I have been to Ski Cooper and felt an immediate connection to the values, and the quality of skiing,” Saddleback General Manager and CEO Andy Shepard told me. “I thought it would be a fun way to promote a kindred spirit and hope some of our guests find their way to Ski Cooper at some point in their skiing career.”

Cooper passholders up for an eastern adventure should start here. Saddleback is a serious mountain, with a modern and growing lift fleet and more average snowfall than most New England ski areas outside of Northern Vermont. For eastern-based skiers, this addition alone is worth the price of the pass – Saddleback walk-up lift tickets went for $99 last year. A four-pack for 2022-23 is $249, and an anytime three-pack is $199. Tack on a few days at Black Mountain or Lost Valley, and you’re breaking even on your Cooper pass investment.

WHITECAP, WISCONSIN

Overview: 400-foot vertical drop, 400 skiable acres, 5 lifts (1 quad, 3 doubles, 1 surface lift), 43 runs, 200+ inches average annual snowfall

My take: I really don’t understand, frankly, what the collective resorts of Michigan’s Upper Peninsula are doing. With three days each at Pine Mountain, Marquette Mountain, Mont Ripley, Big Powderhorn, and the combined Indianhead and Blackjack, Ski Cooper passholders can notch 15 days in the Midwest’s snowiest corridor while sending exactly zero dollars into the state. Add snowy and rowdy Whitecap, just across the Wisconsin border and only half an hour from Powderhorn, and this Rocky Mountain season pass is a must-buy for the Upper Midwest skier, whether they ever get within two states of Colorado. As a bonus, Spirit Mountain, which at 700 feet has one of the Midwest’s tallest vertical drops, is just two hours west of Whitecap.

Cooper’s latest Wisconsin partner carries a solid reputation among the Midwest hardcore. “They get more natural snow [than other Wisconsin ski areas] and their terrain is LEGIT,” Matthew Zebransky, the founder of the Midwest Skiers website, told me in a Facebook message. “Whitecap probably has some of the steepest stuff (outside of Bohemia) in the Midwest on their Eagles Nest peak. It has that similar UP vibe, where everything is kinda dated/needs updating, but the snow and terrain are great. Whitecap has very little snowmaking and relies heavily on natural snow (similar to those in the UP).”

Combine a Ski Cooper Pass with the $109 Bohemia Pass – which typically includes two days at Porcupine Mountains, the only other major UP ski area not on the Boho pass – and you can have a rambling, rowdy, hell of a winter. Zebransky told me that the Ski Cooper pass was “kinda becoming the go-to UP pass now.” If there is so much market power in a shared UP pass, then the GMs of those ski areas ought to organize a summit and figure out a way to keep some of that multi-mountain pass cash in the Midwest. Until they sort that out, pick this one up and enjoy it.

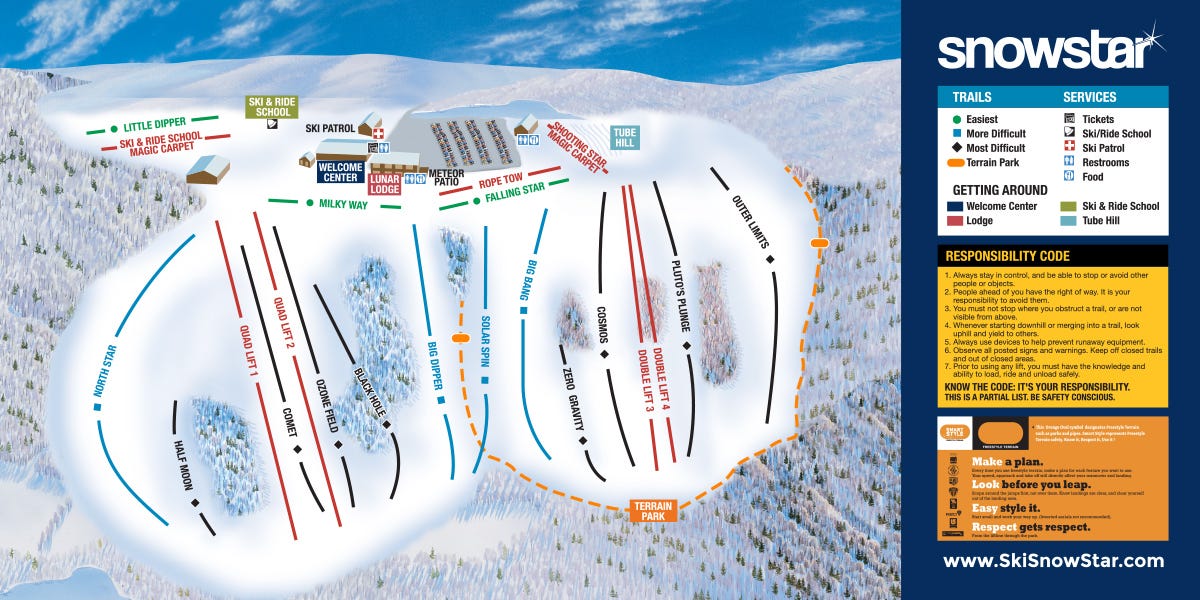

SNOWSTAR, ILLINOIS

Overview: 262-foot vertical drop, 28 skiable acres, 7 lifts (2 quads, 2 doubles, 1 ropetow, 2 carpets), 15 runs, 38 to 40 inches average annual snowfall

My take: A suspension of normal Ski Brah standards is necessary to appreciate the radness of lower Midwest skiing. The weather sucks. There’s almost no snow. There’s almost no vert. The seasons are very short. But what you do have is plenty of people, plenty of passion, and decades of experience turning suck into the best possible version of skiing in an improbable and inadvisable environment. Snowstar is Midwest can-do actualized into the tangible.

It’s also a well-appointed little ski area, with an impressive lift fleet rising off a ridge less than a mile from the Mississippi River and just outside Davenport, Iowa, population 102,099. If you live anywhere nearby, it would be counterproductive to snub this place. Any turns are better than waiting for vacation for big turns. A Milwaukee or Chicago skier could detour here on their way west to Cooper and its Colorado buddies. It’s also a nice stopover for the cross-country completist (count me among that group), working on their ski area checklist. For Cooper passholders, it’s a harmless and not super-consequential addition, but a fun one if you approach it with the right mindset.

TERRY PEAK, SOUTH DAKOTA

Overview: 1,110-foot vertical drop, 450 skiable acres, 5 lifts (3 high-speed quads, 1 triple, 1 carpet), 29 runs, 150 inches average annual snowfall

My take: Terry Peak just doesn’t quite fit anywhere. Its closest neighboring ski areas (besides the dysfunctional Deer Mountain, which is right next door but has not operated since 2017), are Meadowlark Lodge or Hogadon Basin, each three to four hours west, in Wyoming. At the same time, with its 5,930-foot base elevation and rippling pine vistas, it feels about as Midwestern as Tokyo – which is to say, not very. Terry Peak may be the loneliest, strangest ski area in America, with a trio of detach quads crawling up more than a thousand vertical feet of Black Hills beauty, a local’s bump with a decided lack of locals to ski it.

Which makes it a great place to ski, if you can get there. The best option for most of us is to make this a stopover on a cross-country roadie. It’s just 19 miles off Interstate 90, the same highway that runs west toward Seattle, and directly past another of Cooper’s new partners: Mt. Spokane. That’s an unlikely combo, but an Upper Midwest skier en route to a Colorado tour could conjure worse ideas than a beeline west to Terry Peak and then south down I-25 to the Front Range.

WHITE PINE, WYOMING

Overview: 1,100-foot vertical drop, 370 skiable acres, 2 lifts (2 triples), 29 runs, 150 inches average annual snowfall

My take: Wyoming skiing outside of Jackson Hole, Targhee, and Snow King is a curious thing. Everything’s small, far, and seemingly always teetering on the edge of solvency. White Pine fits all these categories, a bump lodged two hours east of Jackson Hole that sat out several winters in the 2010s as it tried to figure out what to do with itself.

Part of the strategy the ski area seems to have landed on is to make itself bigger, through an Indy Pass partnership and reciprocal deals with ski areas near (three days each at Hogadon Basin, Sleeping Giant, and Snow King), and far (three days each at Ski Cooper and Mt. Bohemia).

Maybe it’s helping. The place seems to be doing fine these days, and was in the process of being sold to new, local owners as of January. Anything in Jackson’s orbit not named Targhee is going to have to try extra hard. Even 500-acre Snow King looks like a mosquito bite in comparison. But with four Wyoming options now ladled onto the Cooper pass, this could be part of a fun little tour through the Square State*.

*I’m aware that this is not a real state nickname**

**But it should be^

^ “NO IT SHOULD NOT!!!”

“Oh sorry, Offended-By-Everything Bro, I didn’t see you there. Is your intentional purpose in life to never, ever have fun, and to just go around getting pissed off about everything for no other reason than to draw attention to yourself?”

“SO WHAT IF IT IS?”

“OK, just checking.”

MT. SHASTA SKI PARK, CALIFORNIA

Overview: 1,435-foot vertical drop (will increase to 2,000 feet once construction of the new quad is complete this summer), 425 skiable acres, 6 lifts (1 quad [under construction], 3 triples, 2 carpets), 67 runs, 275 inches average annual snowfall

My take: Outside of the Peaked Mountain sixer that will finally open a whole swath of former Cat-skiing terrain to the lift-served masses at Grand Targhee, Mt. Shasta Ski Park’s Gray Butte project is the most exciting offseason terrain project in U.S. American skiing. I broke this down in a post for paid subscribers last month:

A few days ago, Mt. Shasta Ski Park released plans for a new lift and terrain that would expand the current ski area back toward the summit. While the fixed-grip Gray Butte quad would still terminate below treeline, it would rise 1,154 vertical feet and add five new intermediate runs on 88 acres. …

The new top elevation of 7,500 feet would drop Mt. Shasta Ski Park into the 2,000-foot-vertical-drop club, tying it with Kirkwood for eighth-tallest in California. While the cut terrain would be intermediate, skiers could more easily access “epic terrain [and] our backcountry area” from the top, according to a post on the ski area’s Facebook page.

The full post includes maps and diagrams, along with some historical perspective, but the point is: in an era of forever-stalled expansion dreams, this plan materialized from nowhere, quickly skipped through approvals, and now there’s a lift sitting in the parking lot and crews felling trees on the mountain. The plan, as it turns out, was not quite as spontaneously contrived as I’d originally supposed – a reader provided me with significant background on past struggles to expand the ski area’s terrain. Nonetheless, it’s an exciting expansion at a remote ski area that could use some come-to-me vibes.

As far as the Cooper pass goes, Shasta pairs well with fellow partner Mt. Ashland (both are also on Indy Pass), which is two hours on a straight shot up Interstate 5. I’m not sure if Shasta has the potential to eventually become a Bachelor- or Hood-caliber ski center, but in a West Coast where new ski resort development is about as likely as a Winter Olympics in Miami, any expansion is a good start toward taking some of the pressure off elsewhere.

MT. SPOKANE, WASHINGTON

Overview: 2,000-foot vertical drop, 1,704 skiable acres, 8 lifts (1 triple, 5 doubles, 1 carpet, 1 additional surface lift), 67 runs, 300 inches average annual snowfall

My take: I’ve been wondering when we’d see Mt. Spokane appear on a headline roster. It’s just another one of those 2,000-footers haunting the west that no one who lives more than 50 miles away ever thinks about. It’s an interesting operation, a nonprofit in a state park that’s still laced with five Riblet doubles, one of which dates to 1956.

It looks like a hell of a lot of fun. It’s not really close to any other Cooper partners: the nearest are Brundage and Great Divide, both of which are around six hours away. It’s surprising that Spokane is Cooper’s first partner in Washington, given the proliferation of reciprocal deals within the state (image from The Storms reciprocal pass tracker):

Throw in Loup Loup and Mission Ridge, and you’ve got yourself a nice little PNW starter kit.

Waving goodbye to some solid mountains

Four of the six partner exits (Seven Springs, Laurel, Hidden Valley, Powder Mountain) were expected, as mentioned above. Holiday Valley was a bit more of a surprise, but not really. Reciprocal partnerships are mostly unheard of in Western New York. Though Swain and Hunt Hollow have begun adding them in earnest, this Ski Cooper ticket-exchange was the only one Holiday Valley offered. This is a mountain with a very old-school business model: their 2022-23 season pass is $1,049, one of the most expensive single-mountain passes in the country. But it’s one of the best ski areas in New York, and it doesn’t have any meaningful competitors. Island life suits Holiday Valley just fine.

As for Lookout Pass – they’ve been a Cooper partner for several seasons, and they’ve never been listed on the early-season roster. Whether they will return this fall is unclear, but I wouldn’t count them out just yet. And if they do rejoin, the ski area is just two and a half hours from Mt. Spokane, considerably changing the calculus around that new partner.

So how does the 2022-23 version of the Ski Cooper pass stack up against the Indy Pass?

I offered a fairly extensive breakdown of Indy versus Ski Cooper last year, and large parts of that analysis hold. Cooper still provides more partner days and a simpler blackout grid, and it’s the budget pass to have if you’re riding the Colorado mainline or live in Ironwood, Michigan. Otherwise, the Indy Pass is going to serve you better in nearly all circumstances. Indy’s network has expanded so rapidly that it’s almost as though I’m talking about a completely different pass every three months. With the recent additions of the cross-country and Allied Resorts programs, Indy has become an extremely versatile product, and is the exact same price as last year, even as it’s added an average of 17 new downhill partners per season. Here’s the current Indy landscape:

The competition doesn’t end with Indy: while Ski Cooper’s pass is one of the cheapest of its kind in the Mountain West, any Western skiers who are seriously considering these passes based mostly on the reciprocals should take a deep look at Loveland’s ($499) and Monarch’s ($479) season passes before buying. Loveland’s reciprocals include three days each at power players Schweitzer, Red Lodge, and Whitefish, plus the whole Powder Alliance. Monarch’s reciprocals include Arapahoe Basin, Copper Mountain, Bridger Bowl, and five ski areas in New Mexico. Both mountains are aligned with Mountain Capital Partners, offering three days at each of their ski areas: Arizona Snowbowl, Purgatory, Brian Head, Nordic Valley, Hesperus, Sipapu, and Pajarito.

I’ll make one more point in Indy’s favor here. Other than the first time I tried to redeem the pass, at Caberfae in November 2019, when there were likely only a few thousand Indy Passes in circulation and only obsessed wackos like me were even aware the product existed, the redemption process has been flawless. That is hardly the case with reciprocals, where clerks often look bewildered when presented with any sort of reciprocal or specialty pass. I’ve never not gotten a ticket in this circumstance, but I have been met with barely subdued hostility when cashing in a redemption, as though I were some Grizzly Adams acolyte emerging bedraggled and bearded from the mountains, trying to barter beaver skins for a ride on one of them thar fancy chairlift contraptions, Sonny. As Indy angles toward an app-based pass for the 2023-24 season (and as the pass’ brand recognition and national scope grow), this advantage will likely harden.

This is really an amazing world we’re living in - can it last?

This ever-evolving world of handshake-deal free skiing continues to amaze me. The value that a typical mid-sized Rocky Mountain season pass now delivers to passholders would have been incomprehensible 25 years ago. But so would $269 lift tickets, the Ikon Pass, or the fact that Vail owns Whistler. These (typically) three-day exchanges between baffled independents were a somewhat logical response to the consolidation of the giants. But what started as a few deals here and there has spiderwebbed across the west into a giant, nearly incomprehensible chain of reciprocals.

I don’t know how many skiers pay attention to or care about these bonus tickets. Torsell, the Cooper GM, told me on the podcast last year that reciprocals accounted for around 8 percent of all skier visits in the 2020-21 ski season. Johnson, the mountain’s marketing director, confirmed to me earlier this week that that number had increased 17 percent this past season, suggesting that U.S. Americans are getting smarter about these things.

I’m not sure how sustainable it is for a mountain to give away nearly one out of every 10 lift tickets (though clearly the massive partner network is itself a revenue driver). It seems inevitable that these mountains will eventually acknowledge their own pricing power and figure out a way to monetize these massive networks. A few ski areas already do this: China Peak, Red Lodge, Monarch, and Little Switzerland all add a surcharge for skiers who want the partner-level pass. It’s not impossible to imagine a future where, say, a Powder Alliance add-on is $99 (rather than free, as it is now), and the partners all split that cash however they see fit.

I doubt these ski areas will un-network. It seems inevitable that they will only draw closer together, both for survival’s sake and because skiers like the benefit. But I also doubt that the current state represents ski area operators’ final and best idea. The rapidly growing Indy Pass has, so far, failed to destroy this world of pseudo-megapasses and their blizzard of free lift tickets, despite a per-skier payout that puts actual dollars into cash registers for each Indy visit.

“The comparison of reciprocals versus Indy Pass is a unique one, that’s for sure,” said Reed Weimer, marketing manager at Cooper partner Red River, New Mexico, which has built its own mini-network of reciprocal partners. “On one hand the guest wins with free skiing and the resorts risk a loss. On the other hand, [with Indy] the guest pays and the resort has potential to actually make a similar monetary payout to their rack rate.”

Weimer said the resort declined an invitation to join the Indy Pass a couple years ago. “At the time of being approached, it was before Sunlight was added and the most glaring thing we saw was that we would be an island in the middle of nowhere on the Indy Pass,” he said. “We are hard enough to get to already which added to that island feel. I also want to say it was right around the Covid seasons and, given our governor’s mandates on the ski industry at the time, it was not feasible to consider something along those lines.”

The resort’s season pass sales hit a record last season, Weimer said, nearly doubling the previous record, suggesting passholders find the current offerings satisfactory. Still, Weimer has not completely ruled out an Indy Pass partnership. “I believe Sunlight [Colorado, which joined Indy in February] will be a good case study for us as they are similar to that island feel in the Indy Pass map. I’ll be anxious to catch up with Troy [Hawks, Sunlight’s marketing director] next season as they will be able to get a full season under Indy. One unique and very sensible reasoning Troy talked about was the out-of-state marketing and reach they would receive. With Sunlight joining it has been more intriguing for us to consider, but overall we do not feel the need or want to rush into it just yet.”

I don’t know where this ends, but I feel as though there is potential for an Indy Pass 2, a copycat competitor that aggregates the West’s reciprocal-friendly independents that have so far avoided a cash-based coalition. There are some big ones out there: Whitefish, Bridger Bowl, Sugar Bowl, Sierra-at-Tahoe, Mt. Hood Meadows. They’re sitting on an untapped oil field, real money they could actualize with a finger snap.

Or Indy Pass could simply grow forever. Density is not turning out to be so existentially threatening as pass founder Doug Fish had originally supposed – he told me on the podcast earlier this month that he plans to add more full partners in New England, where the pass already offers days at a dozen ski areas, including seven of the top 10 for Indy Pass redemptions. And at least one major western destination – Powder Mountain – explicitly catapulted its reciprocal partnerships over the horizon in favor of Indy Pass’ cash-based model:

Whatever happens, I’ll be right here to break the whole thing down. Strap on your helmet and remove your pole straps – it’s gonna get gnarly.

The Storm publishes year-round, and guarantees 100 articles per year. This is article 54/100 in 2022, and number 300 since launching on Oct. 13, 2019. Want to send feedback? Reply to this email and I will answer (unless you sound insane). You can also email skiing@substack.com.

Great article Stuart, as always. I definitely see potential for another Indy style pass out there with some of these existing coalitions and other powder players that got left out of the party (ahem, ORDA). If someone could land the CO5 coalition (Loveland, Monarch, Powderhorn, Cooper, Sunlight) the ORDA beast, and one of the marquee monsters still hiding in its cave (Whitefish per se) they could sweep up a bunch of partners and use something similar to the 85/15 pricing model Indy thought-up to create a second monetized pass product. Competition would probably be good in this space, and these reciprocal visits turning into real dollars can be a huge difference maker. After all, if people are buying Ski Cooper or Loveland passes to supplement their Indy/Epic/MC already then the proof of concept is there. Perhaps the impetus for such a product could come from one of these groups, like the mid-western mountains mentioned in your article, or the Colorado coalition, similar to how a group of mountains formed the Mountain Collective to compete for skier visits.

Whoa. Snow Valley is my fourth favorite of the four “big” SoCal hills, and while Mt Baldy has all the side country, it doesn’t snow here anymore. But for the price, I might have been talked out of renewing Ikon.

As much as I’d like to get away from Big Bear as my “regular” day ski spot, of course I’m sticking with Ikon. Heading to mammoth in the morning for the last runs of my season.

Still, the wife was talking about doing a trip out to Powderhorn, her old home mountain…hmmm