Win Smith Sold Sugarbush to Alterra; He Thinks Killington Is Different

“I think they do have a shot at making it on their own.”

It all changed so fast. Just eight years ago, 12 of the 18 Vermont ski areas that operate at least one chairlift were controlled by individuals or entities that owned just one mountain. Five of the other six were owned by conglomerates that either no longer exist (Triple Peaks, Peak Resorts, Intrawest), or sold their majority stake in their properties (POWDR). In 2016, Vail had yet to cross the Appalachians and Alterra Mountain Company didn’t exist. Neither did the Ikon or Indy Passes. The handful of Vermont mountains associated with multi-resort passes had stapled themselves to coalitions (the M.A.X. and Peak passes) that no longer exist.

Little by little, but also sort of all at once, everything changed. Vail purchased Stowe (2017), Okemo (2018), and Mount Snow (2019), and added them all to its Epic Pass. In 2018, Alterra climbed out of the murk with the ghost of Intrawest strapped to its back, and brought the Ikon Pass with it. Alterra then purchased long-independent Sugarbush in 2019. Indy landed quietly earlier that year, then blew up with the addition of Jay Peak in 2020. A couple of years later, Utah-based Pacific Group Resorts scooped Jay into its six-resort portfolio. The changes in ownership and pass affiliations in less than a decade are profound:

Everything seemed to point toward unstoppable consolidation of ownership and pass alliances. Until, suddenly, POWDR announced last month that they would sell Killington and Pico to a group of local investors, returning what had been conglomerate-owned mountains for 40 years to independence (albeit still as part of a two-mountain group). The company also announced that it would seek the sales of Mount Bachelor, Oregon; Eldora, Colorado; and Silver Star, British Columbia in the coming months. It seemed to be a seismic reset of the consolidation narrative driving the future of North American skiing.

But was it really? Or was the Killington sale just a one-off, an oddity in an industry that is bound to shrink to fewer and fewer highly specialized operators?

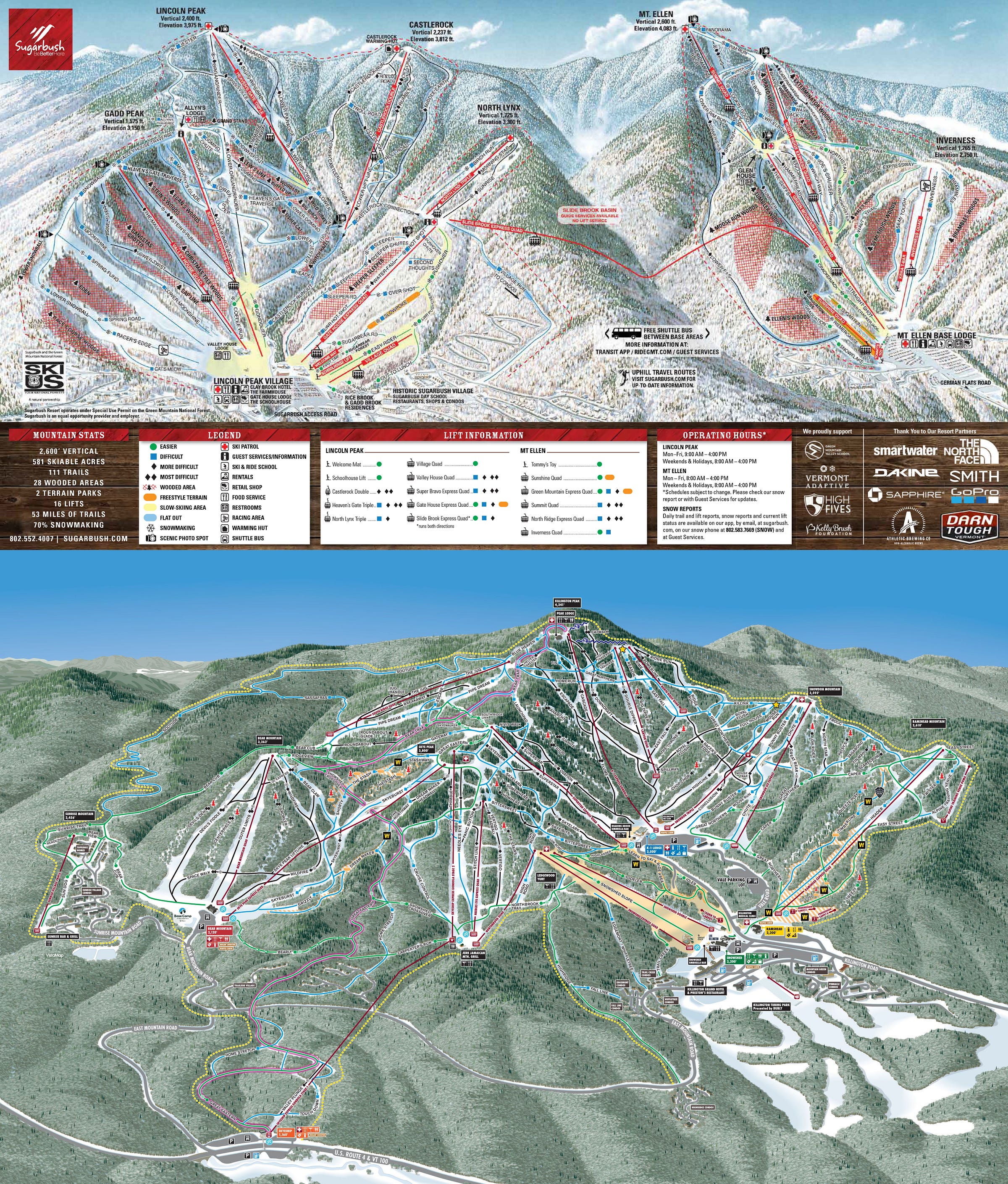

I have no idea. So I called Win Smith, who bought Sugarbush from the troubled American Skiing Company in 2001, ran it as an independent for 18 years, and then sold it to Alterra in 2019. When he announced the sale, Smith wrote in his Win’s Word blog that, “It will be increasingly difficult for ski areas like Sugarbush to compete alone against Vail Resorts, Alterra Mountain Company, and others like POWDR and Boyne Resorts. The recent acquisition of Peak Resorts by Vail was the tipping point in my decision to sell.”

Now we have another large Vermont ski resort going in exactly the opposite direction, deciding that the single life might be better. Did something fundamental shift in the market? Is Killington, bigger but not really any better – from a pure skiing point of view - than Sugarbush, different in some elemental way that makes it more capable of independence even when surrounded by corporate satellites? Is the cracking off of Killington just the first of a wave of such sell-offs?

Smith has some thoughts. This conversation has been edited for length and clarity.

“I think they do have a shot at making it on their own.”

The Storm:

There are so many echoes here of your situation with Sugarbush, but sort of in reverse. I keep going back to your Win’s Word blog post in 2019, when you announced that you were selling the mountain to Alterra, and you wrote, “It will be increasingly difficult for ski areas like Sugarbush to compete alone against Vail Resorts, Alterra Mountain Company, and others like POWDR and Boyne Resorts. The recent acquisition of Peak Resorts by Vail was the tipping point in my decision to sell.” Five years later, do you think that that calculus has fundamentally changed? Would you think about selling Sugarbush differently these days?

Smith:

No. I don't think it changed for Sugarbush. Killington is a much bigger resort. It's the Beast of the East. I think they have quite a bit more leverage than Sugarbush did in staying with Ikon on good terms than we would've had. Phill Gross has run a very successful hedge fund. He's made a lot of money. He’s a Killington skier who has been a homeowner there for nearly 40 years. That's in the calculus too. For Killington it makes a lot of sense. They've got somebody with good capital, they have more leverage just as a freestanding organization. I think they do have a shot at making it on their own.

The Storm:

So if you go back five years, would you have made the same decision with Sugarbush knowing what you know now?