POWDR to Sell Killington, Pico to Group of Locals; Seeks Sale of Bachelor, Eldora, Silver Star

POWDR to retain Snowbird, Copper, Woodward brand; Killington to return to independence after 40 years of conglomerate ownership; will remain on Ikon Pass

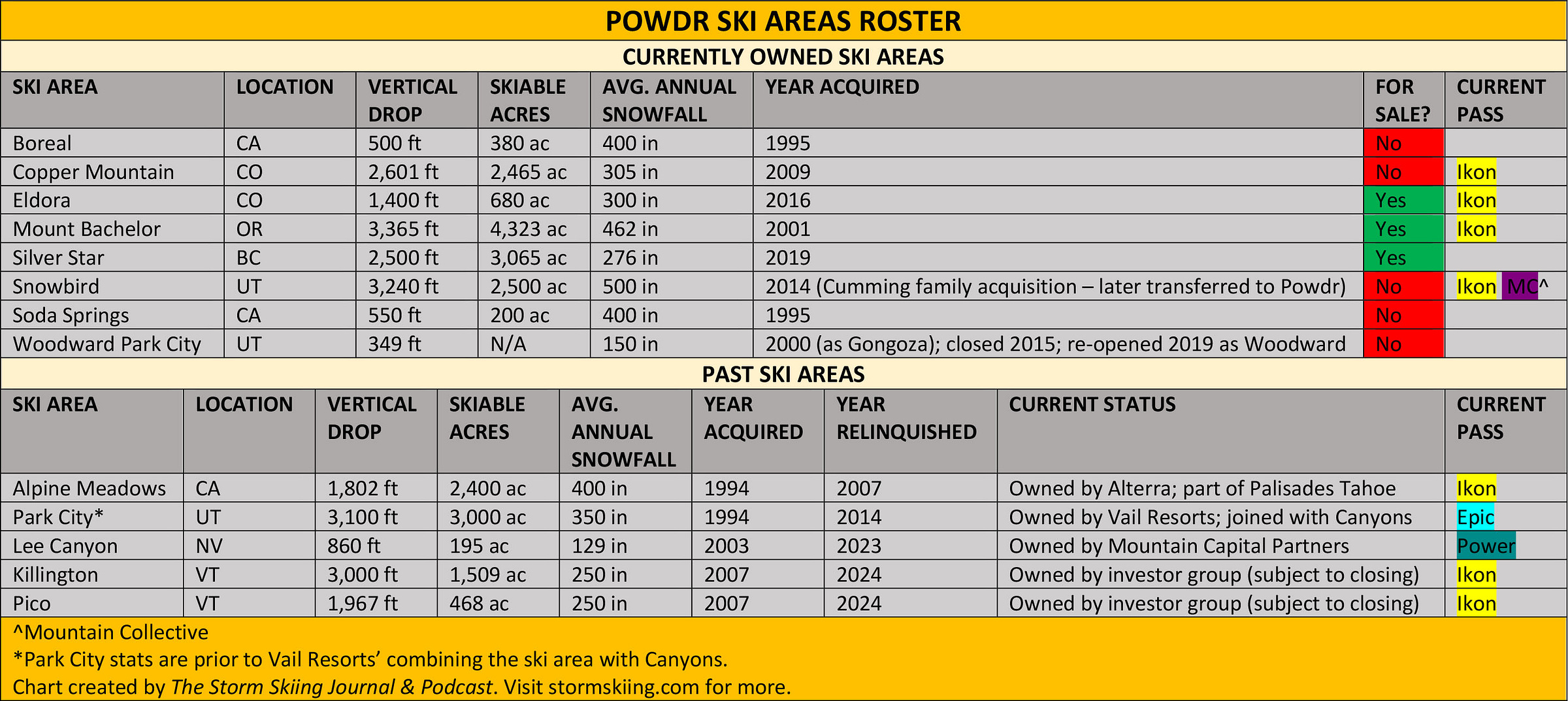

POWDR, owner of 10 ski areas in the U.S. and Canada, will sell its Killington and Pico ski areas in Vermont to a small group of local investors, the company announced today. Both ski areas will remain on the Ikon Pass. The sale price will remain private. POWDR will retain a minority ownership stake in the two mountains and will hold a board seat, but will no longer operate the resorts.

The sale is the first in what will likely be a large sell-off of resorts by POWDR, company officials confirmed to The Storm. The company will put Mt. Bachelor, Oregon; Eldora, Colorado; and Silver Star, British Columbia for sale “over the coming weeks,” company representatives confirmed. The Mt. Bachelor sale will include the Sun Country Tours rafting outfit.

“We'll look for the best possible owner and steward of these great mountains,” said POWDR Vice President of Communications and Government Affairs Stacey Hutchinson, who confirmed that other multi-mountain ski companies were welcome to bid on the three resorts. JP Morgan Chase will manage the sales process.

POWDR plans to retain Snowbird, Utah (which the company manages but does not fully own); Copper Mountain, Colorado; and the Woodward brand, which includes the Woodward Park City, Boreal, and Soda Springs ski areas, a massive terrain park complex at Copper, scaled-down (often pop-up) terrain parks throughout its portfolio, and several non-ski facilities scattered across the United States.

The sell-off, POWDR officials say, is driven by a desire to both focus and diversify the business. That means expanding a national parks concessions division that the company launched earlier this year at Death Valley, a seasonal complement to winter workers at POWDR’s ski areas. At the same time, POWDR will, company representatives say, “amplify” its Woodward brand.

“This move complements our existing mountain resort operations at Snowbird and Copper, creating a diverse ecosystem of outdoor and action-sports experiences,” POWDR CEO Justin Sibley said in a statement provided to The Storm. “By balancing the seasonality of our traditional ski resorts with year-round attractions like Woodward and National Park concessions, we're building a more resilient and dynamic company.”

With 20 lifts serving 1,509 acres across six peaks, Killington is the largest – and busiest – ski resort east of the Rockies. The resort has been officially tied to 468-acre, 1,967-foot Pico, just a few miles west on US highway 4, under shared management since 1989 (with a break in the mid-90s), and has been a centerpiece of major ski conglomerates S-K-I, American Skiing Company, and then POWDR since 1984.

POWDR has owned the Vermont duo since 2007, and has invested millions into the ski areas, including the $30 million-plus K1 baselodge that opened in 2022, Killington’s Snowdon high-speed bubble six-pack lift, and extensive snowmaking upgrades across the two mountains. In today’s press release, the new owners committed “to increase capital investment,” welcome news for two ski areas with lift fleets anchored by first-generation high-speed quad chairs that date to the 1980s.

The new owners include longtime Killington homeowners and passholders Phill Gross and Michael Ferri. Gross learned to ski at Killington and has owned a home in the town since 1986. He is managing director of Adage Capital Management, a money-management firm that he co-founded in 2001. He has served as a board member of the U.S. Ski and Snowboard Association and the World Cup Dreams Foundation, and is a founder of both Share Winter and the Killington World Cup Foundation. Ferri, a partner and owner of East Coast Valvoline Instant Oil Change franchises, has served as a Killington Mountain School trustee since 2008. His family has owned a home in Killington since the 1970s.

Neither has direct ski area management experience, but the new owners intend to retain all staff, including longtime Killington and Pico President and General Manager Mike Solimano.

“We don't pretend to know how to run a mountain,” Gross said in an interview with The Storm. “Mike and his team are going to be given free rein to operate the business and do what they need to do to make it the best resort in the East. Nobody in the buyer group is going to be involved in making operational decisions in any way, shape, or form. We’re going to be focused on providing resources and letting that team do what they need to do to operate the mountain.”

Gross praised, and pledged to continue, POWDR’s legacy of capital, cultural, and community investment in both the press release and in his conversation with The Storm, while underscoring the new ownership group’s commitment to maintaining Killington’s essence. That, Gross said, means continuing to aim for the longest ski season in the East (which can run from October to June), and to host the Stifel World Cup on Thanksgiving weekend. Development of a pedestrian-oriented base village alongside developer Great Gulf will continue.

POWDR has sold resorts before. The company owned Alpine Meadows, now part of the sprawling, Alterra-owned Palisades Tahoe ski area (which includes the former Squaw Valley), in California from 1994 to 2007. Last year, POWDR sold Lee Canyon, Nevada, which it had owned for 20 years, to Durango, Colorado-based Mountain Capital Partners (MCP). And in 2014, Colorado-based Vail Resorts orchestrated what amounted to a hostile takeover of Park City Mountain Resort, which POWDR had operated for 20 years (a POWDR representative told The Storm that “there is no lasting animosity” between the two companies, and that Vail Resorts was welcome to bid on the available ski areas). POWDR’s last ski area acquisition was Silver Star, a 3,065-acre monster in British Columbia, in 2019.

But a sudden mass sell-off of five of POWDR’s 10 ski areas could have wide-ranging impacts on the North American ski industry.

Killington’s sudden return to independence after 40 years as part of multi-mountain resort companies is – along with POWDR’s intent to sell Bachelor, Eldora, and Silver Star – a seismic reset of what had seemed like the unstoppable consolidation of North America’s 750-ish ski areas.

POWDR’s partial sell-off - which follows the failure, dismantling, or decline of previous ski conglomerates such as American Skiing Company, Booth Creek, and Intrawest - raises questions about the long-term viability of the multi-mountain business model. POWDR is one of 26 U.S.-based entities that currently operates two or more ski areas, and one of five that runs 10 or more (Vail oversees 42, five of which sit outside of North America; Alterra runs 19; Mountain Capital Partners operates 13, only 11 of which are active, nine of which are in North America; and Boyne Resorts owns 11).

And six of POWDR’s 10 mountains are members of Alterra’s Ikon Pass, with two of them – Copper and Eldora, both in Colorado – providing passholders with unlimited, no-blackout access on the Base and full passes. Bachelor, Eldora, Killington, and Pico could decide, at the expiration of their contracts, to leave Ikon and join a rival pass, or no pass at all.

In Vermont, the shift to local ownership for Killington and Pico will mean a subtle but potentially potent identity change as the resort asserts itself as a we-don’t-need-nobody counter-lever to New England’s ever-consolidating ski industry. Killington loyalists, never entirely comfortable as load-bearing beams for a succession of national ski conglomerates, will likely relish joining the rowdy club of Vermont forever-indies that includes Ski-It-If-You-Can Mad River Glen, snowy Smugglers’ Notch, family-owned Bolton Valley, and scrappy Magic Mountain.

Here's a deeper look at POWDR’s sell-off and its potential ripple effects across New England and North American skiing: