Town of Nederland, CO Intends to Purchase Eldora from POWDR

Eldora would be first Colorado ski area sold from a conglomerate to an independent entity since 1997

The town of Nederland, Colorado signed a letter of intent today to purchase Eldora ski area from POWDR, which has owned the mid-sized ski area since 2016.

Eldora will remain on the Ikon Pass indefinitely, according to a Nederland press release. The town, which has fewer than 1,500 residents, will finance the purchase through bonds backed “solely” by ski area revenue. The town partnered with 303 Ski, a “coalition of Front Range ski-industry veterans” to plot out operating and financial models. Nederland will hold a town hall meeting to discuss the sale at 6:30 MT this Thursday, July 10.

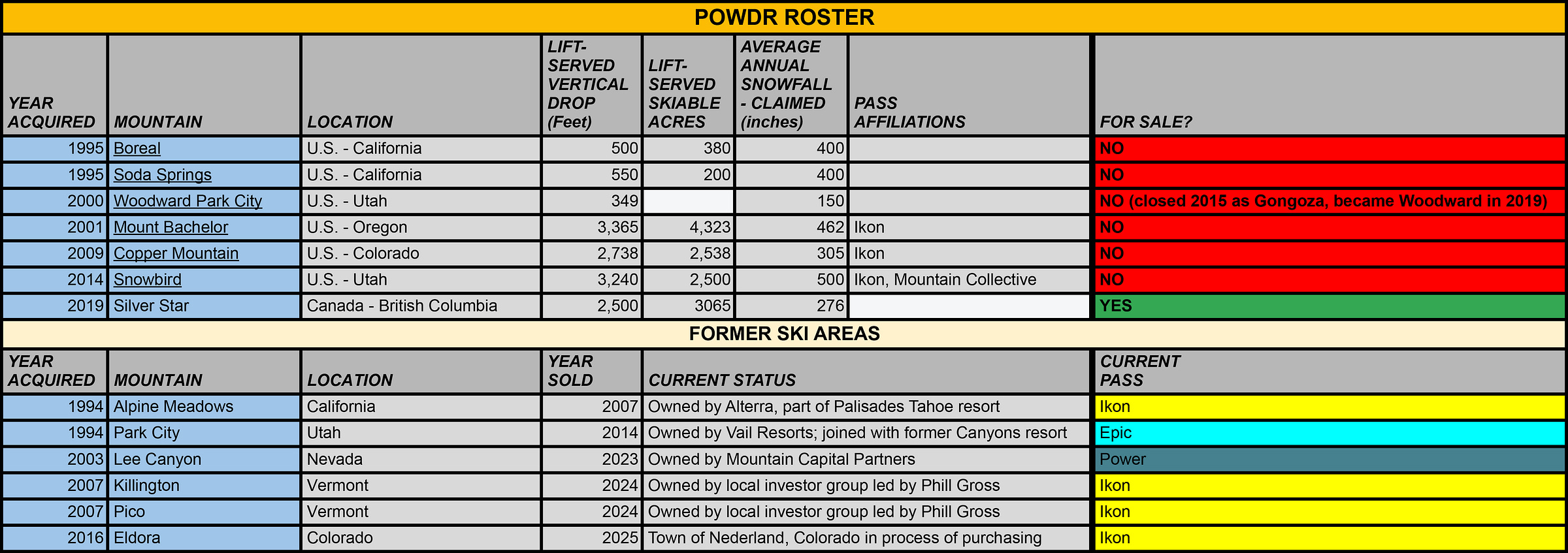

The transaction will be POWDR’s fourth ski area sale in three years, following local investors’ 2024 purchase of Killington and Pico, Vermont, and ski conglomerate Mountain Capital Partners’ 2023 pickup of Lee Canyon, Nevada. The sale will be the sixth in company history. POWDR dispatched Alpine Meadows, California (now part of Alterra’s Palisades Tahoe) in 2007, and (involuntarily) sold Park City, Utah to Vail Resorts in 2014.

POWDR, which as recently as 2022 was the third-largest U.S.-based ski area operator by number of resorts, with 11, retains control of seven ski areas, including some of the largest and snowiest in America:

Silver Star, British Columbia remains for sale. POWDR announced its intent to sell the B.C. ski area, along with Eldora and Bachelor, when it sold Killington last year. The company reversed its decision to sell Bachelor in April. A sale of Silver Star would leave POWDR with six ski areas, in a three-way tie for largest operator with fellow Park City-based Pacific Group Resorts and Michigan-based Wisconsin Resorts. Of the 28 U.S.-based entities that manage two or more ski areas, only 10 manage four or more (one of California Mountain Resort Company’s ski areas, Mountain High North, has not operated in nearly a decade):

Eldora is probably an exception to the consolidation rule

The transfer of Eldora from a multimountain ownership group to an entity that manages just one ski area would be an anomaly in Colorado and in American skiing, where ski areas have consolidated steadily since the 1970s.

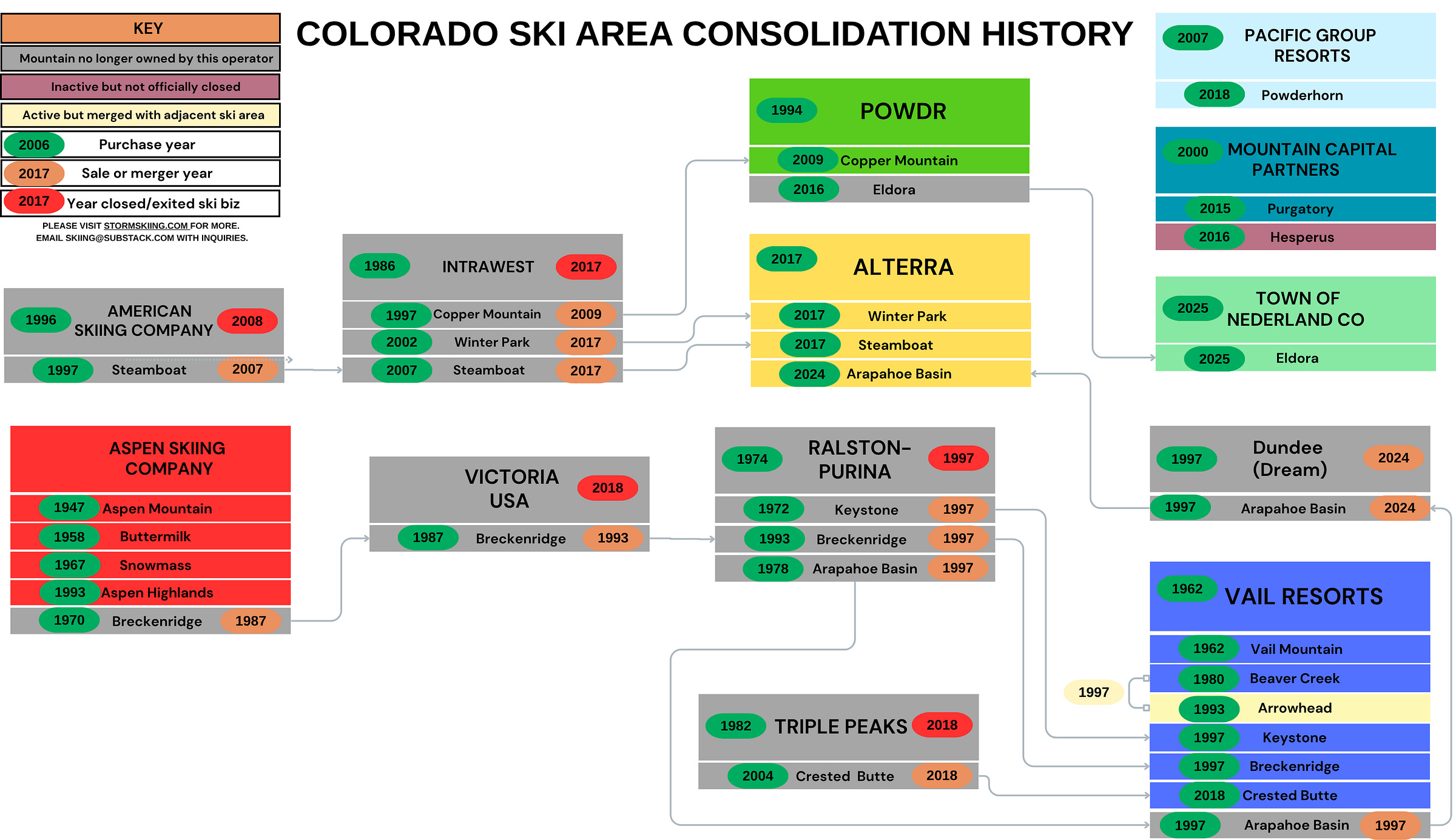

Eldora would be the first Colorado ski area to follow this reverse trajectory since the U.S. Justice Department forced Vail Resorts to sell Arapahoe Basin in 1997. Ralston-Purina had owned the ski area since 1978, and also owned Breckenridge and Keystone. Had Vail purchased all three, it would have controlled five of the six major ski areas (all but Copper) in adjoining Summit and Eagle Counties.

But the spin-off didn’t last forever, and A-Basin never truly separated from the ski conglomerate sphere. The mountain would spend the majority of the next two decades in pass partnerships with Vail, before leaving for the Ikon Pass and Mountain Collective in 2019. Last year, Ikon owner Alterra purchased A-Basin, seeming to continue Colorado’s consolidation trajectory.

Only a handful of U.S. ski areas have transferred from conglomerate to independent ownership, and most have ended up back with a multi-mountain operator after a few years, including Sugarbush, Vermont; Crystal Mountain in Washington; China Peak, California; Schweitzer, Idaho; and Canyons, Utah (now part of Park City). Only Windham, New York; Grand Targhee, Wyoming; Haystack, Vermont (now Hermitage Club), and Waterville Valley, New Hampshire have gone independent and stayed independent (a few local ski areas have as well).

Ski area rollups into larger groups still outnumber selloffs most years. In the first half of 2025, U.S.-based operators have purchased or announced their intent to purchase six new ski areas: the operators of Berkshire East and Catamount joined a group that picked up Burke, Vermont; Perfect North, Indiana assumed operations at Swiss Valley, Michigan; and MCP it bidding for four more ski areas in Chile.

Excluding 2020, when there were zero transactions, purchases by multimountain companies have outpaced or equaled spinoffs every year since 1984, with the exception of 2010, when Booth Creek and Intrawest sold off a number of ski areas, and 1991, which had one minor selloff (Shawnee Peak, Maine by Shawnee Mountain, Pennsylvania), and no pickups.

And even as acquisition numbers fluctuated, the sheer number of ski areas controlled by multimountain operators has steadily climbed for decades:

And Colorado skiing will remain mostly under the control of larger operators even with the Eldora sale. Fifteen of the state’s 28 ski areas that operate at least one chairlift are under management by Vail (5), Aspen (4), Alterra (3), Powdr (1), Pacific Group Resorts (1), or Mountain Capital Partners (1). Nearly as many – 14 – have joined Vail’s Epic Pass or Alterra’s Ikon Pass, including, of course, Eldora. Multi-mountain operators own eight of the state’s 10 largest ski areas, nine of which are on Epic or Ikon. And this is not a major sale in the vein of Killington, which has been the busiest ski area in the eastern United States for decades. Eldora, with 680 skiable acres, is just the 21st-largest ski area in Colorado:

A partial history of how Colorado arrived at its current state:

A common ownership model

Eldora joins a long list of U.S. ski areas owned by local, county, or state governments, including Eaglecrest, Alaska (owned by the city of Juneau); Gunstock, New Hampshire (Belknap County, New Hampshire); Cannon Mountain (State of New Hampshire); Gore, Whiteface, and Belleayre (State of New York); Spirit Mountain, Minnesota (City of Duluth); Ski Cooper, Colorado (Lake County); the Porkies (State of Michigan); Diamond Peak, Nevada (a public agency in Incline Village); Canaan Valley (State of West Virginia); and Hogadon Basin, Wyoming (city of Casper). Many of these entities operate their ski areas as the equivalent of public parks, but it’s not unusual to lease them out to a professional operator: the City of Denver contracts Winter Park’s operations to Alterra, the State of New Hampshire leases Mount Sunapee to Vail, and the State of Pennsylvania does the same with Laurel (also to Vail). Municipalities own dozens more small ski areas across America, many of which run only surface lifts, have little or no snowmaking, and run mostly or entirely on volunteer labor.

Several additional large and mid-sized ski areas are owned and operated by nonprofit associations, including Bogus Basin, Idaho; Bridger Bowl, Montana; Mt. Spokane, Washington; and Mt. Ashland, Oregon. Mad River Glen, Vermont, has been owned and operated by a cooperative since 1995, and Black Mountain, New Hampshire is in the process of setting up a similar entity. Colleges or universities also own a handful of ski areas: Middlebury Snowbowl, Vermont; Dartmouth Skiway, New Hampshire; and Mt. Zion, Michigan (Gogebic Community College, which runs one of the nation’s few ski area operations specialties).

Some of these ski areas – Bridger Bowl and Bogus Basin, especially – are uber-successful, with aggressively established practices of hiring professional ski area managers and re-investing every dollar of profit into improving and modernizing their operation. Others struggle to secure financing – Casper voters last year rejected a $4.2 million ballot measure that would have funded a new quad, among other improvements. Independent operators in New York, meanwhile, almost universally resent the state’s relentless upgrades at its three owned ski areas. Others present cautionary tales – Eaglecrest is sitting on a used gondola, the installation of which the city may never fund.

While the town’s intended management structure remains vague, today’s release said that Nederland hoped to “reinvest excess cash flow into community infrastructure such as streets, sidewalks, and water systems after bond obligations are met,” deflating hopes, at least for now, of a Bogus/Bridger model of 100 percent re-investment.

Nederland is far smaller than Juneau, population 31,555, with just under 1,500 permanent residents. It’s difficult to understand how such a small jurisdiction could afford such a huge asset, and absorb Eldora’s 700 peak-season workers as town employees, which today’s press release says they intend to do. The town will create an “executive director of mountain operations” position to “serve as a liaison between the mountain and town government.” The town will finance the purchase through bonds, “backed solely by Eldora’s earnings, including lift tickets, Ikon Pass revenues, food and rental sales,” according to the press release. “This structure protects local taxpayers by ensuring no tax dollars are used to service the debt. The Town will also pursue grants and private-sector partnerships to reduce overall debt.”

About Eldora

Click here for a mountain stats overview

Located in: Nederland, Colorado

Year founded: 1962

Base elevation: 9,200 feet

Summit elevation: 10,600 feet

Vertical drop: 1,400 feet

Skiable Acres: 680 acres

Average annual snowfall: 300 inches

Trail count: 61

Lift count: 10 (1 six-pack, 2 fixed-grip quads, 1 triple, 3 doubles, 1 platter, 1 ropetow, 1 carpet – view Lift Blog’s inventory of Eldora’s lift fleet)

So what does Eldora need?

In spite of its elevation, Eldora has built up an extensive snowmaking system, which covers, according to the mountain’s website, “100 percent of groomed terrain.” That system is no doubt a direct result of the 25-year ownership tenure of Bill Killebrew, whom POWDR purchased the ski area from in 2016. Killebrew was a frontrunner in western snowmaking when he plastered Heavenly, on the shores of snowy Lake Tahoe, with pipes and guns in the 1970s and ‘80s.

What I’d imagine Eldora skiers are after is a modernization of the lift fleet. POWDR’s 2017 replacement of a double and a triple with a sixer was a good start, but the rest of the fleet looks creaky in hyper-modern Colorado, whose 119 high-speed chairlifts are by far the most of any state in the country (number two Utah spins 75). Eldora’s beginner area is a mess of low-capacity fixed-grip chairs and surface lifts, the oldest of which (the Little Hawk double) is a Denver-Miner machine built in 1968. The backside Corona and Indian Peaks fixed-grip quads, built in the late ‘90s, rise 1,370 and 1,111 vertical feet, respectively, and each stretch more than 4,000 feet – not an unreasonable setup, but more difficult to justify as the larger ski areas all around Eldora commit mostly to faster machines on similar lines.

But chairlifts are expensive and growing moreso. If Nederland’s priority is for Eldora revenue to fund sidewalk repairs, the lifts may have to wait.

You update the chart yet??? 🤪

“Eldora’s beginner area is a mess of low-capacity fixed-grip chairs and surface lifts, the oldest of which (the Little Hawk double) is a Denver-Miner machine built in 1968.”

Hit it on the head with this. Teaching our kid to ski mostly at Eldora and while it’s amazing to be able to back the car up to the magic carpet

And Little Hawk lift, the whole setup is really just an odd one.

And in terms of the backside for corona lift, a detachable quad could make the experience so much better, but I do wonder if flooding with more capacity may be more harm than good. There’s a reason why a-basin chose to put in slow chairs on good terrain in recent years. That said, damn it’s a slow chair!