Mountain Capital Partners to Acquire 4 More Ski Areas in Chile, Including El Colorado

Transaction would make MCP the largest U.S.-based operator of ski areas outside of North America, set stage for largest ski resort in western and southern hemisphere

When the judges of the Design-A-Country Contest opened the entry for Chile, they said “what is this dumb thing?” It’s taller than America is wide but narrower east-to-west than Lake Erie. It’s barely bigger than Texas and 80 percent covered by mountains. It’s 90 times the size of metro New York City but contains approximately the same number of people. If you’re going to submit something big and pointless, at least make it interesting like Australia and fill it with pouched animals that hop around on two legs like ninja deer. Application rejected.

Skiing in Chile is as odd as the mothership itself. With 23 peaks above 20,000 feet, the riding ought to rip. But Chile can’t decide if it wants to be a desert or an alpine Narnia. The country’s tallest mountain (and world’s highest volcano), Ojos del Salado, hits 22,615 feet at the summit, with a vertical drop greater than 9,000 feet, and averages about the same annual snowfall as Nashville (five inches). There is some good skiing, but the country is 31 times the size of New Hampshire and holds about half as many ski areas.

“OK who is this asshole American degrading my country?” Santiag-Bro is thinking in Spanish right about now. Welcome to the Storm, Amigo. Don’t be mad. Eighty percent of this newsletter is me making fun of my own country, where most citizens couldn’t find Chile on a labeled map. On the Ridiculous Continuum, Chile ranks well below the United States, home, after all, to Florida, where more than one criminal has been eaten by an alligator after leaping into the water during a police chase.

Anyway, if you’re still with me, I’m here because American ski area operator Mountain Capital Partners (MCP) intends to purchase a controlling share in Andacor S.A., longtime operator of four Chilean ski areas:

MCP already controls two ski areas adjacent to and interconnected with El Colorado: 2,400-acre Valle Nevado and 1,977-acre La Parva. Stapled together, these three ski areas total 5,400 acres, larger than Vail Mountain and the fifth-largest ski center in the western hemisphere after Whistler (8,171 acres), Park City (7,300), Palisades Tahoe (6,000), and Big Sky (5,850). Should MCP combine and expand the three, which the company’s managing partner, James Coleman, told me on the Storm Skiing Podcast in 2024 that he intends to do, they could form the largest ski area outside of Europe.

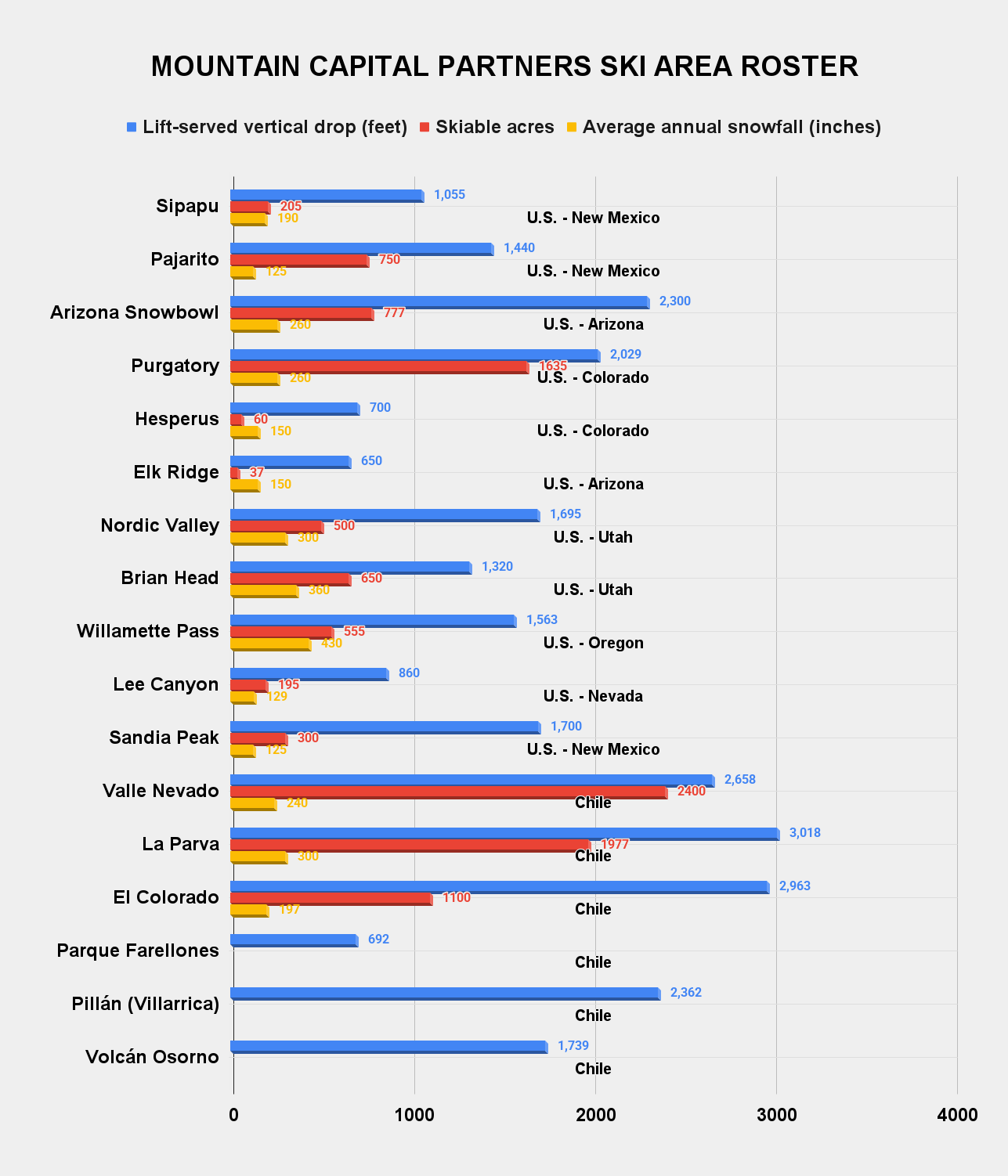

With the Chilean acquisitions, MCP will have picked up nine ski areas since 2022, more than Vail (2) and Alterra (3) combined. The additions would extend MCP’s lead over Boyne Resorts as the third-largest U.S.-based operator by number of resorts (though not in total skiable acres), and the largest by number of ski areas managed outside of North America, with six (Vail Resorts owns two in Switzerland and three in Australia). The remainder of MCP’s 17 ski areas (only 15 of which are operational), are in the United States, mostly clustered in the Southwest:

It is unclear how (or if) MCP will integrate its new properties onto the company’s Power Pass, which grants passholders unlimited access to the company’s U.S. mountains and 10 combined days to La Parva and Valle Nevado. The South American ski season stretches from May to October, and it seems probable that regulatory approval could arrive after or close to the end of Chilean winter, making Power Pass access more likely for 2026. MCP officials were not ready to confirm Power Pass access just yet.

“Last week’s announcement marks just one step in a broader review process, and it’s too early to speculate on future product offerings or capital projects,” reads an MCP statement provided to The Storm. “That said, to date, every resort that has joined MCP has been integrated into the Power Pass, and we will continue to prioritize making skiing as accessible as possible to everyone.”

MCP differs from other large U.S.-based operators in that it frequently acquires small, semi-functional, and oddly located ski areas. This Chilean portfolio is no different. The four resorts combined spin just nine chairlifts and more than 20 surface lifts. Farellones is less an independent ski area than a beginner-oriented footnote stapled to the bottom of El Colorado – somewhat like the Summit ski area below Timberline Lodge in Oregon. And both Volcán Osorno and Pillán, seated hundreds of miles south of MCP’s other resorts, appear to have shrunk considerably over the past two decades, shedding lifts and inbounds terrain.

Such a far-flung, rusty network will likely challenge an MCP that is attempting to grow rapidly on two continents. Among the projects the company is already navigating: a burned-down baselodge rebuild at Nordic Valley, Utah; permitting challenges that have kept Elk Ridge, Arizona shuttered since before MCP bought it; desperately needed snowmaking upgrades to bring consistent ski seasons to Sandia Peak, New Mexico; and a broken 60-ish year-old double chair that has kept Hesperus, Colorado dormant for two winters (MCP has said they will not re-open the ski area until they can add snowmaking).

Whether the company can modernize and manage such a far-flung, diversified, and in some cases beaten-up network remains to be seen. But if they can, the potential to build out a year-round, north-south, jetlag-proof skiing axis is huge, and could transform MCP into one of the world’s most important ski area operators.

Here’s a deeper look at these four potential acquisitions and what they could signal for the future of MCP, Power Pass holders, and the ski industry in general: