Alterra to Acquire Arapahoe Basin, Company’s 19th Ski Area

How will they make sure it doesn’t become Epic-era A-Basin all over again?

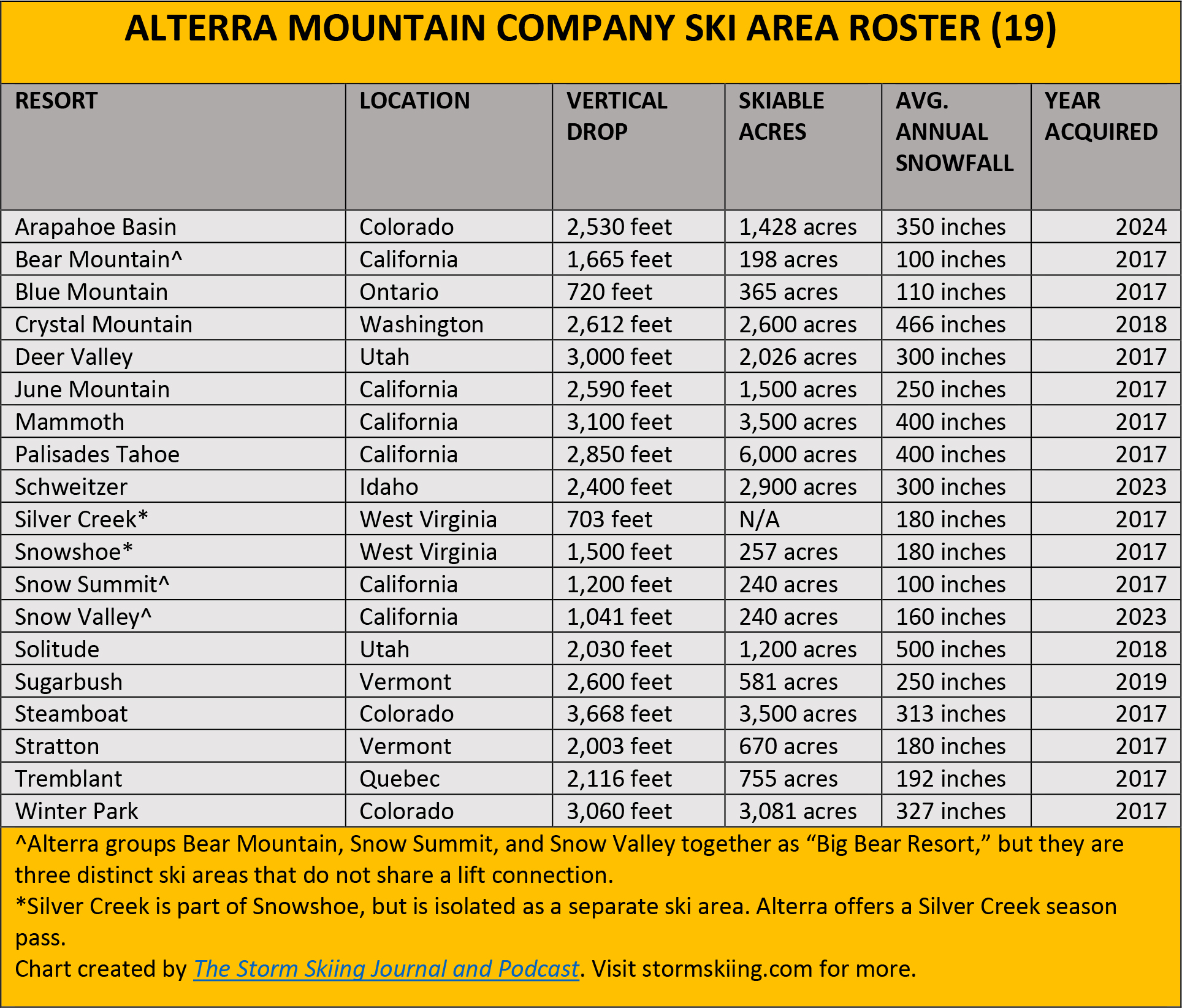

Alterra Mountain Company, owner of the Ikon Pass and 18 North American ski resorts, today announced its intention to purchase Arapahoe Basin from longtime owners Dream Unlimited. The acquisition will be Alterra’s third since January 2023 and its third overall in Colorado, and is the first ski area purchase by a U.S.-based multi-mountain operator in 2024.

Rough-and-rowdy A-Basin, stationed at the howling top of America, lacks the Family Circus appeal of nearby Keystone, Breckenridge, and Copper Mountain. Defined by long seasons, fierce terrain, and a locals’ grit diluted at its more famous neighbors, A-Basin is in some ways a living throwback, a high-altitude realm where there’s nowhere to stay the night and nothing to do but ski. Seventy-three percent of the mountain’s 1,428 acres are rated black or double-black diamond. A parking lot-adjacent zone known as The Beach may host North American skiing’s most notorious tailgate.

But Arapahoe Basin shines beneath that grit. The mountain boasts the newest top-to-bottom lift fleet in Colorado – its oldest chairlift is the Zuma quad, built in 2007. Once on the brink of cracking from Epic Pass overuse, A-Basin has evolved into a model mainline ski area, a case study in how to make more money with fewer skiers even as its peer resorts buckle under megapass overload.

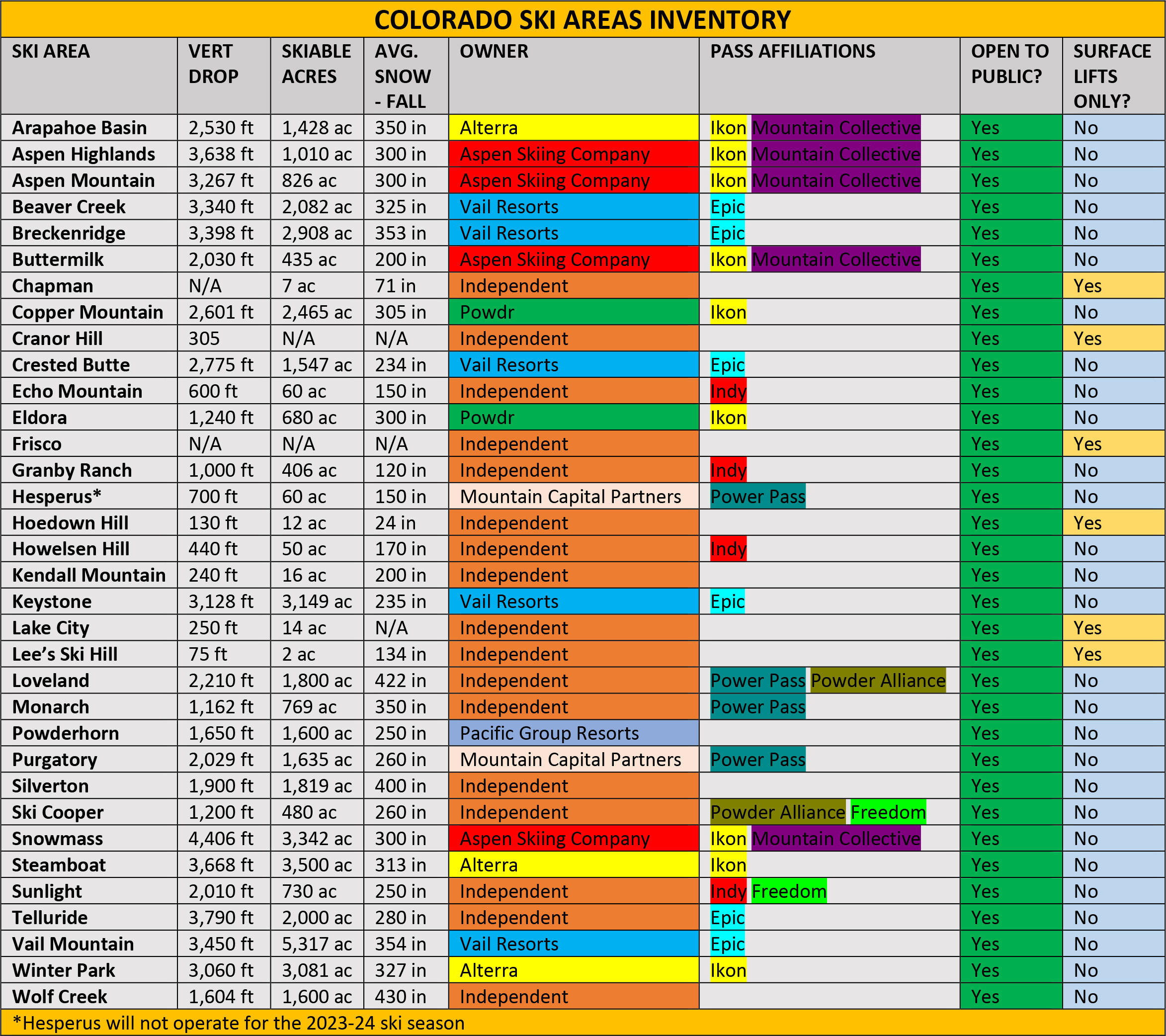

The purchase, which Alterra expects to close later this year, sets a milestone for Colorado: exactly half of the state’s 34 active ski areas will now be owned by a multi-mountain operator.

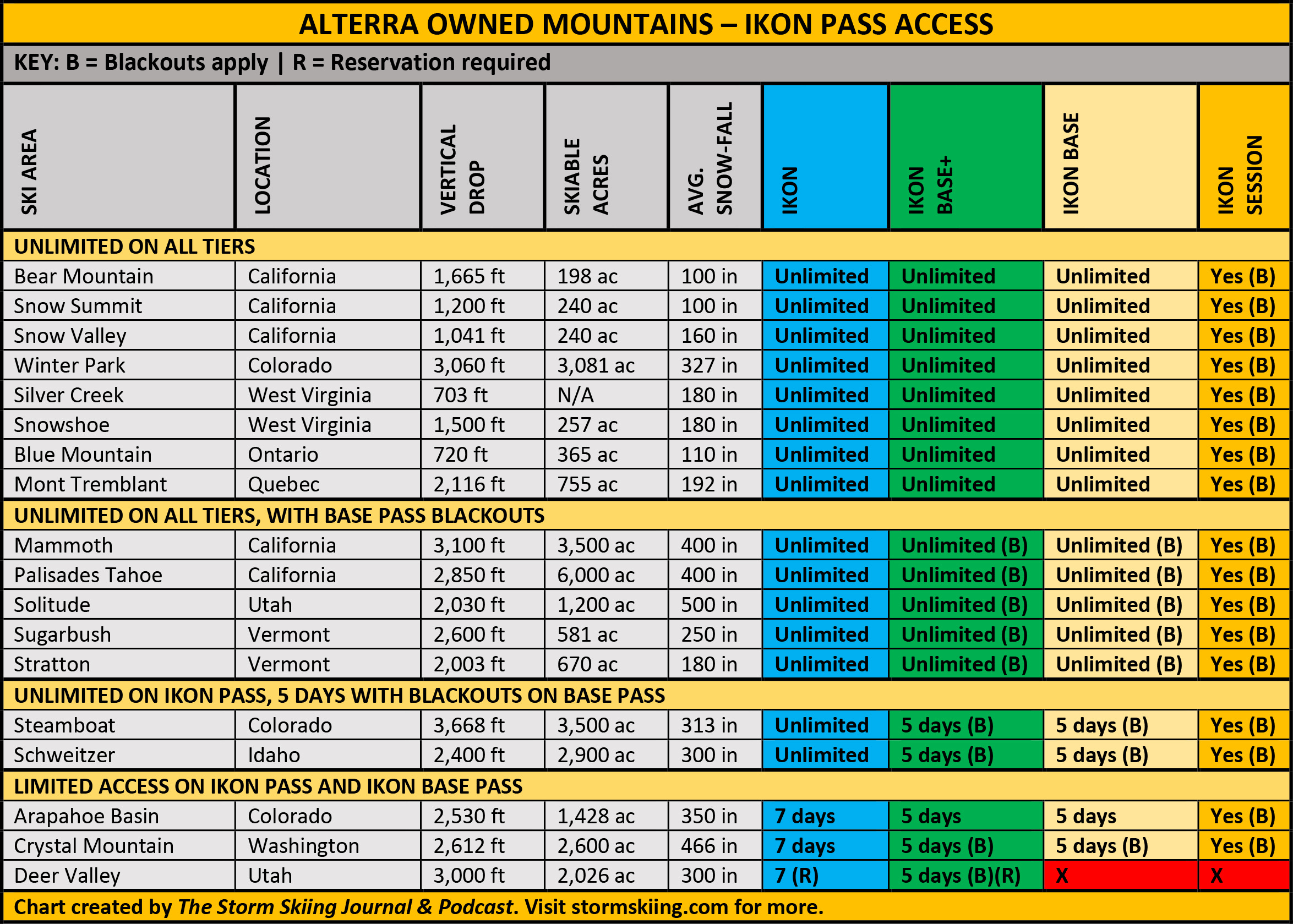

Ikon Pass access is, for now, set to remain unchanged for the remainder of the 2023-24 ski season, though I wouldn’t be shocked to see Alterra add some bonus access toward the end of A-Basin’s long season, which often stretches into June and July. While Alterra sets its owned mountains on a variety of Ikon Pass access tiers, A-Basin, given the low cost of its current pass suite, seems likely to land on the most-permissive tiers (unlimited on Ikon and Ikon Base, like Copper and Winter Park), for the 2024-25 campaign.

Also uncertain is the fate of A-Basin’s single-mountain passes, which are available in a variety of early- and late-season, holiday-restricted, and unlimited versions – all of them at a lower cost than the Ikon Pass. And while Alterra has continued to offer discounted single-mountain passes at most of its ski areas, the company is almost certain to push the cost of A-Basin’s daily lift tickets up considerably, as it has done at all of its properties.

What is more certain is that Arapahoe Basin will leave the Mountain Collective Pass. While Alterra is still willing to share independent Ikon Pass partners with the Aspen-owned alliance, the company yanked its last remaining owned partners – Mammoth, Palisades, and Sugarbush – off the pass two years ago.

Overall, A-Basin to Ikon is a deal that looks good for everyone. Alterra gets the equivalent of a brand-new ski area with one of the best management teams and strongest brands in skiing. Arapahoe Basin gets a local owner with cash falling out of its bootbag that understands the impossible act of running a modern ski area in Colorado.

But the existential question for A-Basin skiers will be this: how will Alterra, with its marketing might and its more-is-more sales strategy, prevent a rollback to the bad old days of peak Epic, when the mountain regularly parked out and liftlines strung down to I-70? How will Alterra position the mountain so that it’s not just an overflow lot for its other four unlimited Ikon mountains in Colorado? And how, in an era when record skier visits and the ubiquity of multimountain passes are pushing ever-more skiers onto the same set of Selected Mountains, will Alterra capitalize on A-Basin’s shimmering renovation and easy-access location without losing the place beneath an I-70 tsunami? Let’s discuss: