Indy Pass Adds Just 2 Eastern Partners for 2025-26 - and That's OK

With 38 percent of the region's ski areas available on one low-cost pass, Indy has nothing left to prove in the East. Tenney, Buffalo Ski Center, Allied Conversions of Burke & more round out region.

Indy’s inaugural Northeast lineup, for the 2019-20 winter, featured a scrappy mix of town bumps and low-key steepsters: Magic, Bolton, and Suicide Six in Vermont; Black and Pats Peak in New Hampshire; Blue Knob and Shawnee, Pennsylvania; Greek Peak, New York; Berkshire East and Catamount in Massachusetts; and Mohawk Mountain, Connecticut. That’s 11 ski areas across the densely populated nine-state region, two days at each, for a debut price of $199. While the Epkonic Brobots roundly mocked and dismissed this upstart, more keyed-in skiers delighted in punchcard access to the rowdy, clandestine steeps at Magic, Berkshire, Bolton, and Blue Knob.

Popular sentiment shifted in an instant when, on Oct. 19, 2020, powder monster Jay Peak joined Indy Pass. With this aspirational anchor secured, dozens of regional independents followed. Operators understood that while skiers would buy the pass for Jay, the East’s snowiest ski area was remote and inconvenient and best saved for a full weekend, and that in the meantime, the turn-hungry masses would redeem their Indy Passes locally.

It’s possible that no single signing ever impacted the trajectory of a multimountain ski pass so significantly. When Pacific Group Resorts opted to keep Jay on the Indy roster after purchasing the resort in 2022, it cemented this two-day sampler as a must-have in the Northeast ski pass quiver. I doubt that Indy founder and Pacific Northwest native Doug Fish imagined this low-altitude realm would anchor his longshot pass when he gathered snowy West Coast gems like White Pass, Silver Mountain, and Brundage onto a we’re-doing-this press release in March 2019, but the Northeast rapidly began to account for approximately half of all annual Indy Pass sales.

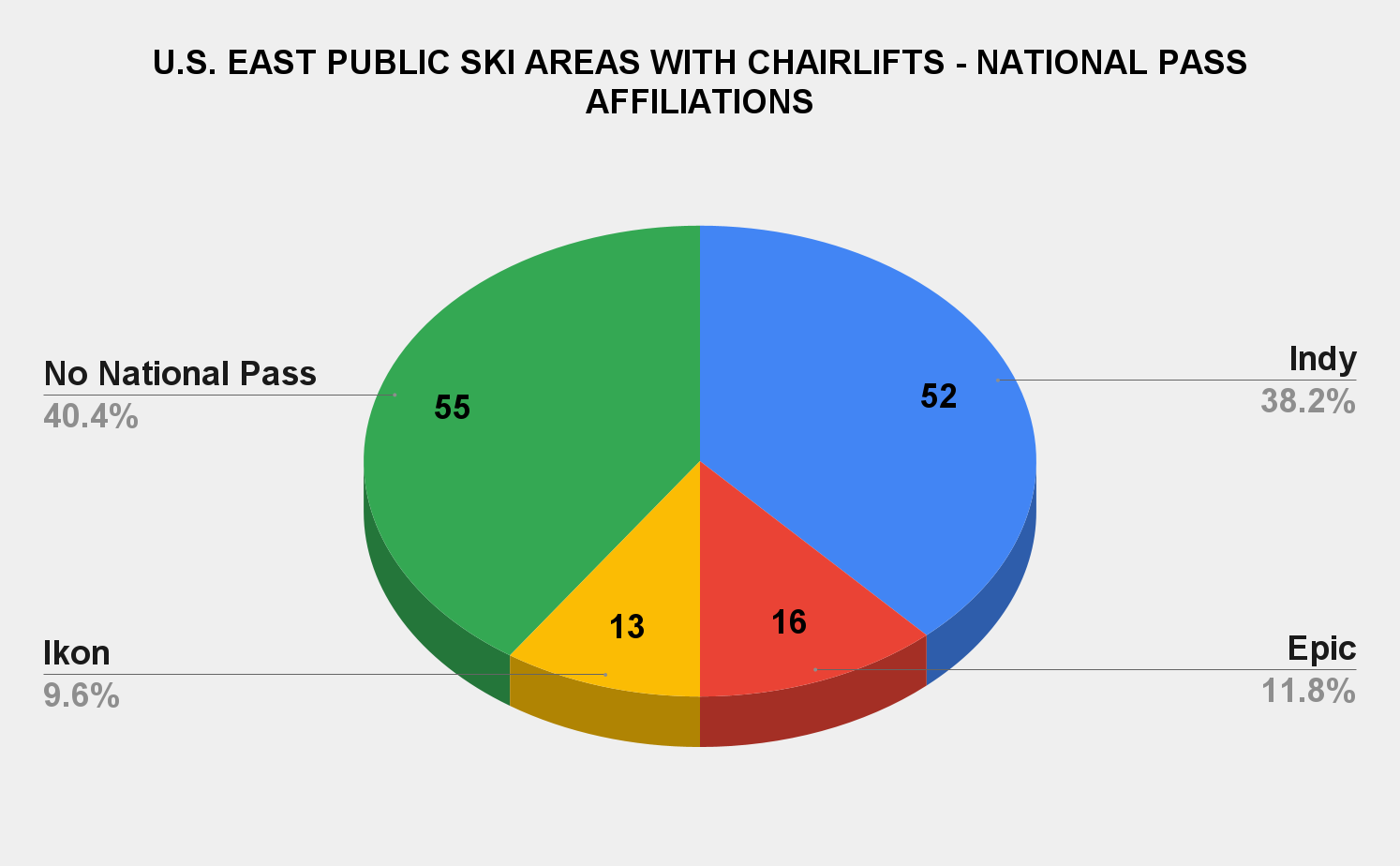

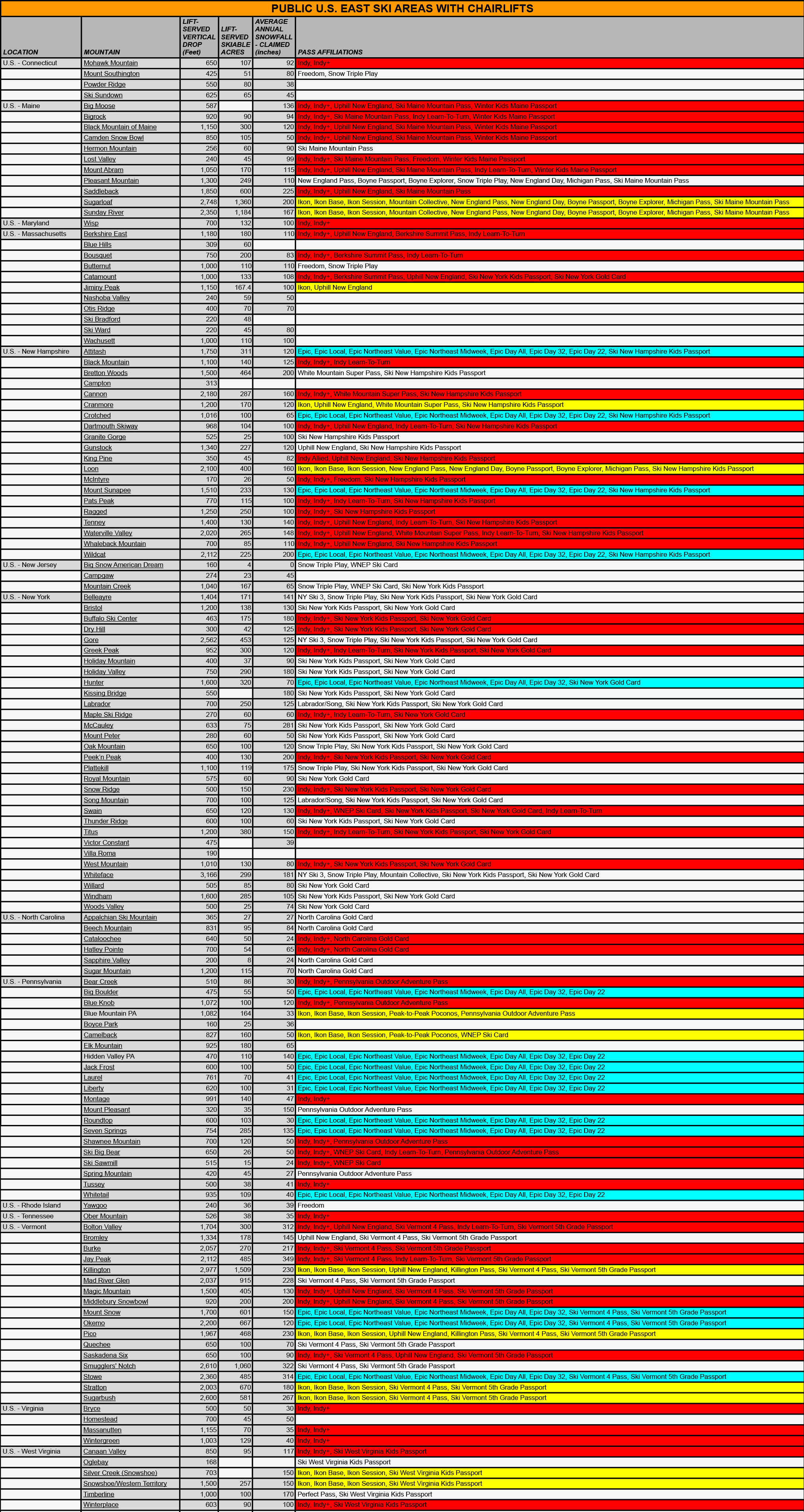

The thoroughness and quality of Indy’s eastern product offering is hard to overstate or even really quantify, but this gets at it: across the 15-state East region (New England, New York, New Jersey, Pennsylvania, Maryland, West Virginia, Virginia, North Carolina, Tennessee, and Alabama), Indy gives skiers two days each at 52 of the 136 public alpine ski areas with chairlifts – far more than Epic and Ikon combined:

Here’s what that looks like state-by-state:

Big Mountain Bros can argue, somewhat convincingly, that Indy, shut out of mainline Colorado, Utah, and California by Epkon first-movers, will never scale west of the Mississippi. That argument ignores Indy’s strength in the Upper Rockies, Pacific Northwest, and B.C., but it’s mostly correct. Indy, stuck scooping up the Eagle Points and Powderhorns of the world, will never compete with Vail or Alterra for Chicago Sherry or Atlanta Al, who get one ski trip per winter and are taking it in Summit County. But in the East, Indy’s topline offerings – Jay, Waterville Valley, Saddleback, Cannon, Burke, Wintergreen – are as good as anything on the competition’s marquee, and at far lower cost.

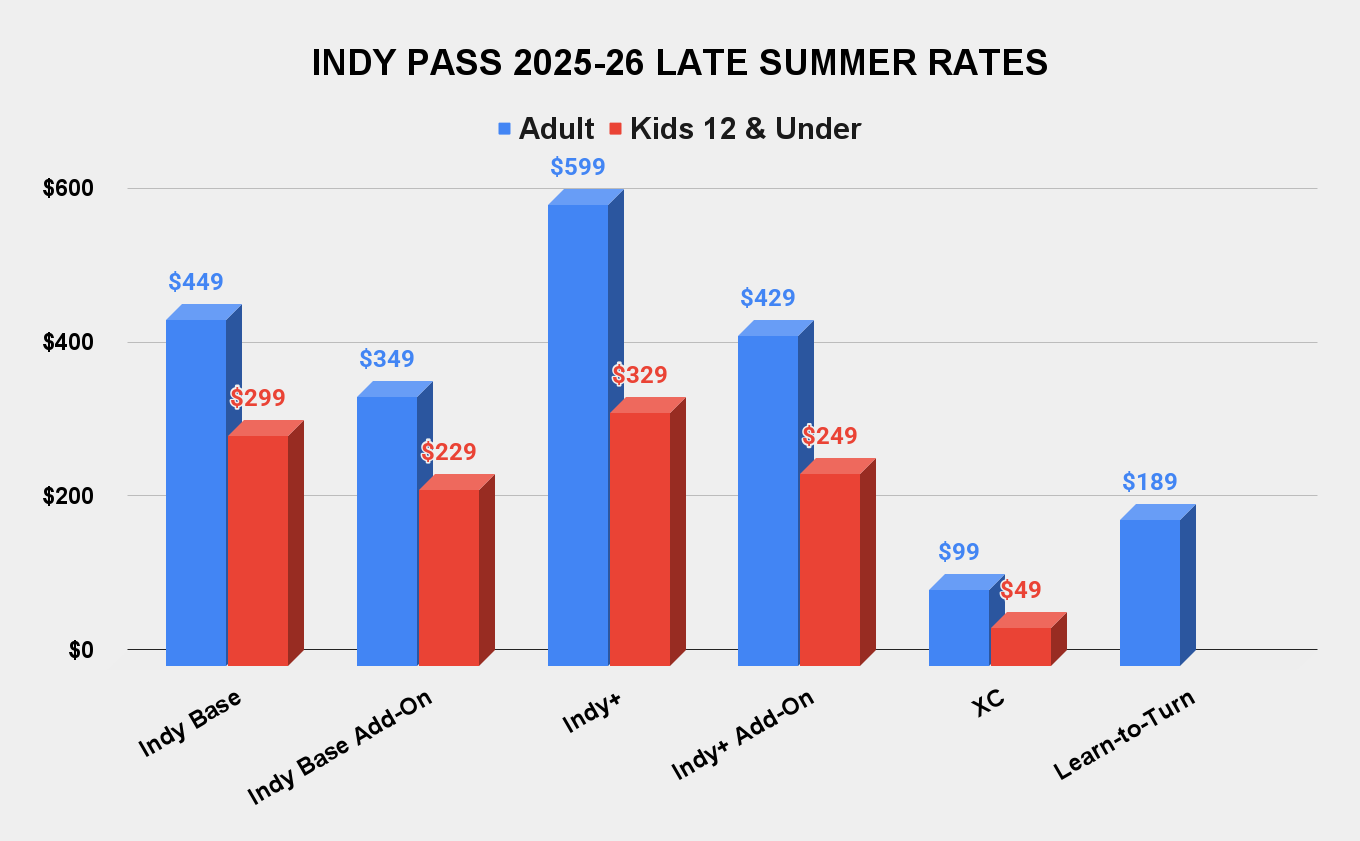

Unaffiliated eastern standouts remain: Wachusett, Smugglers’ Notch, Mad River Glen, Bretton Woods, Holiday Valley, Elk, Sugar Mountain, Timberline. A few of these could even be Jay Peak-level sales catalysts. But Indy can coast for a bit in the East, and the region’s 2025-26 roster additions are muted. The pass added just two all-new partners in the region for this coming winter: the strange Buffalo Ski Center, New York and resurgent Tenney, New Hampshire. Indy also converted three members of the Allied discount program to full partners: Burke, Vermont; Dry Hill, New York; and McIntyre, New Hampshire. Tomorrow, Thursday, Sept. 18 is your last chance to purchase a 2025-26 Indy Pass.

With that deadline standing in front of your low-cost winter like a cartoon brick wall stacked across the highway, here's the beginning of my long-promised deeper look at Indy’s 2025-26 roster additions. I’m going to release this in several parts: U.S. East, U.S. Midwest, U.S. West, Canada, Japan, and Europe (possibly in two installments). Probably in that order. It’s going to be a lot of posts in a short period of time, but it took me a couple of weeks to properly ground these write-ups in our current ski universe. With that work out of the way, here you go: