Why Did Ikon Pass Add 2 Days at Jiminy Peak, Cranmore, Buck Hill, and Wild Mountain?

And what does that mean for skiers, and for the future of the Ikon Pass?

Ikon dropped the news like a legal disclosure, tucked into page 34 of the 2025-26-Ikon-Pass-is-live press release. Tucked into the “passholder discounts and benefits” section, between the free-donut-if-it-snows-six-inches-the-day-of-your-visit coupon and the five percent discount at Food Truck Freddy’s Fenomenally Fantastic & Awesome French Fries* was this tidbit: full Ikon Pass holders would receive two days each at four new U.S. ski areas next season.

Alterra framed these as “bonus days.” “Free,” the press release read, which is a funny way to describe ski area access via a ski pass that retails for $1,329. But let’s call these ski areas what they are: new Ikon Pass partner mountains on a new two-day tier (valid on the full Ikon Pass only, holiday blackouts apply).

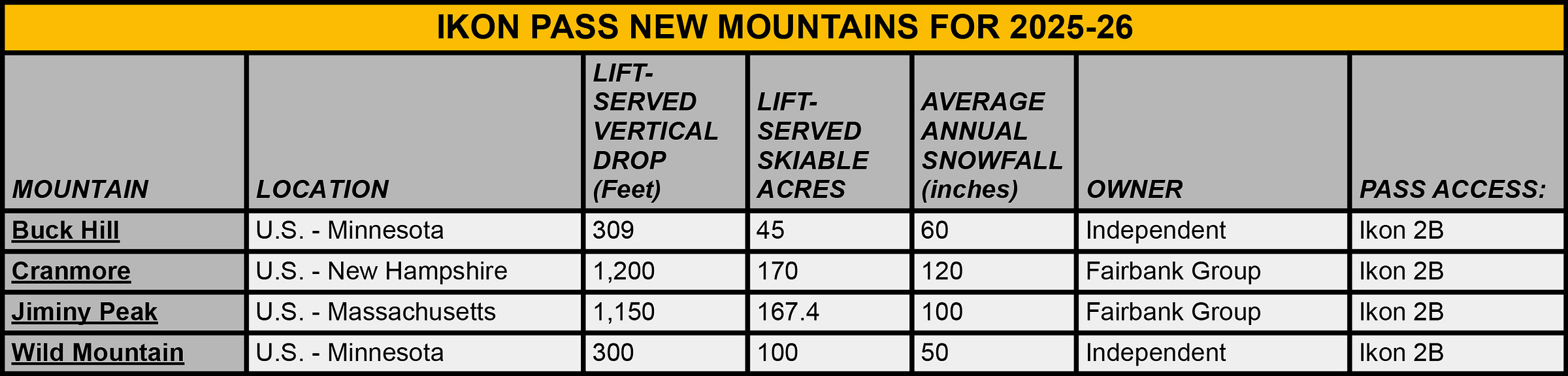

It’s a funny lot, at least from a distance. Joining Ikon from Minnesota are Buck Hill and Wild Mountain, two ski areas that would be the smallest on the Ikon Pass roster even if you combined them. In New England, Ikon added Jiminy Peak, Massachusetts and Cranmore, New Hampshire, regionally well-known mountains that spin high-speed lifts and blast bury-the-giraffes snowmaking. An overview:

Brobots throughout the Rockies yawn. But for Ikon Pass holders in the Midwest, this is an Awe-Dang moment – finally, something Twin Cities-local to burn a few laps between flights west. In the already-Ikon-dense East, these additions are less necessary but certainly welcome: Jiminy fills an Albany and NYC hole left by exiting Windham, and Cranmore adds a new ski area to an upper New England roster that has remained mostly unchanged since the pass’ 2018 debut.

So what should that matter to everyone else? Well, the addition of these humble-in-the-shadow-of-Palisades-Utah-Jackson ski centers could mark a tectonic shift in how Alterra builds, organizes, and markets its marquee product. Finally, we are seeing a response to Vail’s ski-near-home-vacation-amazing Epic Pass strategy. Finally, we are seeing Alterra respect the Midwest’s 6 million annual skier visits and the region’s place as a ski incubator and launchpad to higher realms. Finally, we see a compromise tier that may lure already-busy ski areas that can’t manage full five- or seven-day Ikon Pass access but are curious about whether the pass could be an espresso shot in their coffee cup.

Alterra is underselling this “benefit.” This new two-day tier could rapidly grow from four new partners to 40. It could anchor the pass in markets where the nearest 1,000-foot vertical drop melted with the last ice age. Suddenly, any ski area on the continent spinning multiple chairlifts within a tank of gas’ drive of a big city is a potential Ikon Pass partner.

This is Alterra continuing to innovate, to improve, to adapt the Ikon Pass to a maturing U.S. multimountain pass market that has captured the majority of chairlift-served ski areas. Since 2020, Ikon has added 25 new ski areas and made nearly as many individual mountain access changes, including the invention and eventual discarding of the Base Plus Pass. This is the sort of quiet, non-disruptive but impactful innovation that Alterra has perfected but that we haven’t really seen from Vail’s Epic Pass since the launch of Northeast regional passes in 2020.

It's also worth mentioning that season passholders at Jiminy Peak ($1,051 for an adult unlimited pass), Cranmore ($869), Buck Hill ($395), and Wild ($329) will be able to purchase a three-day Ikon Session Pass at half off.

There is a deeper story here, involving potential conflicts with Indy Pass, which Buck Hill has been a member of since 2020. I’ll examine that dynamic in more detail in a future post. For now, let’s look at what Ikon Pass holders are getting, and how these understated little mountains could make a big impact on their winters.