Mt. LaCrosse, Sunburst, Hyland Hills Fill in Indy's Best-in-the-Midwest Ski Network

Operator raises concerns that "oversaturation" of resorts could impact season pass sales

Ask me to point to the quintessential American ski area – the one that best captures the essence of alpine skiing as translated and expressed through the peculiarities of our national culture – and I won’t show you gilded Deer Valley or raucous Jackson Hole or mine-town relic Telluride. This ski area is not a destination ski resort, or really a ski “resort” at all. It is not in the West. It is not steep or high or big or snowy. It’s not even scenic. The terrain is limited, average, un-nuanced – a mostly clear-cut bump arching tepidly over an undersized parking lot in a county park a couple miles off the interstate. Unless you grew up nearby, you’ve likely never heard of the joint, because it’s not a place that anybody goes to on purpose – you ski there because it’s there and so are you.

That quintessential American ski area is Hyland Hills, Minnesota. Thirty-five acres on a 175-foot-vertical drop in the dead-ass center of the 3.9-million-resident Minneapolis-St. Paul metroplex. Three quads, four ropetows, two carpets. Lift tickets top out at $44, nights and half days are discounted. It swarms with teenagers and terrain parks. The municipally operated ski area’s 25-year average is 109 operating days, right around the national average. Some days, too: Hyland spins lifts 9 a.m. to 9 p.m. on weekends, and starts just half an hour later during the week. That’s 82 operating hours per week – among the highest in the country. In a typical winter, this microdot accounts for around 15 percent of all skier visits in Minnesota, more than its share in a state that counts 18 chairlift-served ski areas. Everything – the baselodge, the chairlifts, the snowguns – is glimmering and modern.

It is this quiet, consistent competence, hyper-adapted to its local market, that makes Hyland Hills both an exceptional business and a completely average American ski area. Big, snow-blessed beauties such as Vail or Snowbird are the outliers in American skiing, even if they are its billboards. Far more common – and more representative of the typical U.S. ski experience – is the community bump that has survived successive modernization waves and annually pumps out a reliable December-to-March snowland.

I wrote in my recent analysis of Indy’s new eastern U.S. ski areas that pass founder Doug Fish must have been surprised by the passion of eastern skiers. Well he was probably even more surprised to learn that the Midwest had ski areas at all, and that the madmen there soon accounted for around 25 percent of his pass sales. Yes, some of them were traveling east or west, but a good number were simply chasing the OMG-finally network of intra-regional destinations that no one had ever thought to assemble on a pass before. Places like Nub’s Nob, Caberfae, Shanty Creek, and Crystal Mountain in Michigan’s Lower Peninsula – four well-developed, sprawling and diverse ski centers all within reasonable driving distance of one another and begging for sampler-pack access. And it was the focus on places like these four – and like Hyland Hills, a new but nonetheless completely on-brand addition – that makes Indy the quintessential American ski pass.

Indy was the first multi-mountain ski pass to focus on volume over frequency. Meaning the first to give skiers a little bit of access to a lot of ski areas rather than a lot of access to a handful of ski areas. Instead of targeted saturation, then, Indy empowered dispersed exploration, becoming, in the process, a superspreader of American skiers beyond the marketing moats of the Steamboats and Park Citys and Sun Valleys – a ski product that could truly show skiers the astonishing breadth and variety of the nation’s developed hills.

Nowhere is this truer than the Midwest, where Indy has quickly swept up 43 percent of all public ski areas with aerial lifts (38 of 89 total) in the 10-state region, and giving passholders access to nearly half (5,522) of its 11,894 skiable acres:

Indy lost two Midwest ski areas ahead of this winter (Buck Hill, Minnesota and Swiss Valley, Michigan), but the pass added three as well: Hyland and Mt. La Crosse and Sunburst in Wisconsin (Indy announced the additions in August; I promised a longer write-up, which is what you’re reading now).

While unquestionably beneficial to skiers, at least one operator is concerned with the growing size of Indy’s regional network.

“We were early adopters and believers in the Indy pass and in its founding vision,” Rick Schmitz, who owns three Indy Pass ski areas in Wisconsin, including Little Switzerland, which is just 23 minutes down the road from Sunburst, told me. “However, with recent additions to the pass, we are concerned about the oversaturation of the product in our region that could negatively impact our own product sales. We will be monitoring usage closely and are evaluating our continued participation in the pass.”

I flipped these concerns back to Indy Pass officials, who said that they understood operators’ concerns, but that exhaustive data analysis of similarly close ski areas in New Hampshire had shown that Indy’s negative impacts have been limited. “Once we got over guessing and actually looked at the data, we realized that cannibalization is non-existent or extremely marginal,” Indy Pass owner Erik Mogensen told me.

Here’s a deeper look at Indy’s current standing in the Midwest, how these additions bolster what is already the region’s best pass lineup, and how Indy retained a key New Hampshire partner that was similarly concerned with resort density:

Hyland Hills, Minnesota

Owned by: Three Rivers Park District, covering the suburban Twin Cities

Located in: Bloomington, Minnesota

Year founded: 1952

Pass affiliations:

Indy Pass - 2 days, holiday blackouts

Indy+ Pass - 2 days, no blackouts

Closest neighboring Indy Pass ski areas: Powder Ridge (1:14), Trollhaugen (1:14), Mount Kato (1:14)

Base elevation: 900 feet

Summit elevation: 1,075 feet

Vertical drop: 175 feet

Skiable Acres: 29

Average annual snowfall: 60 inches

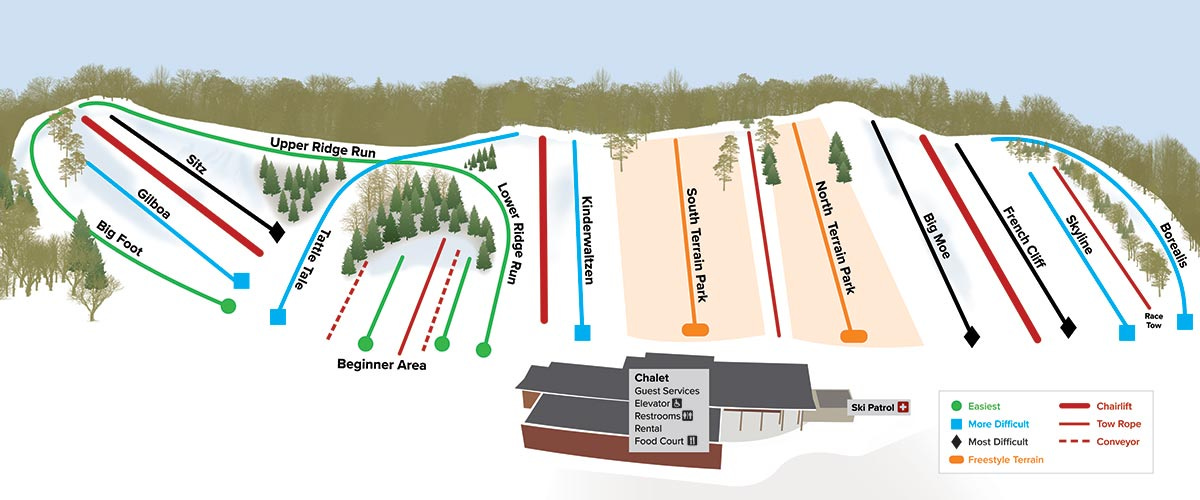

Trail count: 12 (4 easiest, 5 more difficult, 3 most difficult) + 2 terrain parks

Lift count: 8 (3 fixed-grip quads, 4 ropetows, 2 carpets)

Midwest Skiers says

If you want an incredible trail-by-trail overview of Hyland, Midwest Skiers has it locked:

Midwest Skiers founder Matthew Zebransky calls the terrain park tows his favorite ropetows in the Midwest. I emailed Zebransky to ask what makes Hyland stand out. “Hyland is top-notch when it comes to volume, lessons, and their park scene,” he wrote. “A lot of pros originated from Hyland, and a lot of pros continuously circle back there throughout the season.”

Here’s another Hyland vid Midwest Skiers cut a couple years back:

My take

OK here’s what really amazes me about Hyland: it is the absolute king of the small-mountain, bullet-train-fast park tow. The tow in the beginner area, running alongside the carpets, is a slow-moving progression lift to help novices adapt to tows (man I coulda used that progression circa 1992). But the red line slicing between the North and South terrain park is what makes HH the prototypical small-mountain, big-air Do-It-For-The-Kids ski center. That one line is actually two side-by-side ropetows, which absolutely hammer up the incline. Fast laps all night = phenomenal lifelong skiers in a place that would otherwise have a hard time keeping them interested. And at very low cost compared to chairlifts.

I’ve played that record before, and in the hot-laps-on-a-molehill category, Hyland really just replaces departing-Indy Buck Hill, right down the road, which is more racer-oriented but accommodates Park Brah just fine. So Hyland isn’t like some genius addition. But I led with Hyland because it’s the sort of unheralded spot that Indy specializes in: a regional pool hall where ski folk gather and debate the hills beyond. Taken one by one, each is cute, an awe-shucks ain’t-that-neat-for-them curiosity, like a patch of grass in a Tucson subdivision. But stack them together, and you have what makes Indy special: it is the first multimountain ski pass to assemble non-destination resorts, geographically bundled, into destinations. In other words, skiers may not buy a pass just to score a couple days at Hyland Hills, but they’ll be more enticed if you group two days at Hyland with two days each at Trollhaugen and Powder Ridge and Mt. Kato and Andes Tower Hills and Lutsen and Mt. La Crosse and Granite Peak. So configured, the destination evolves from a specific place to a season, around which skiers can craft a ripping adventure.

Mt. La Crosse, Wisconsin

Owned by: Waloon Industries (owned by the Mathy Family)

Located in: La Crosse, Wisconsin

Year founded: 1959

Pass affiliations:

Indy Pass - 2 days, weekend and holiday blackouts

Indy+ Pass: 2 days, no blackouts

Closest neighboring Indy Pass ski areas: Bruce Mound (1:30)

Base elevation: 594 feet

Summit elevation: 1,110 feet

Vertical drop: 516 feet

Skiable Acres: 100

Average annual snowfall: 41 inches

Trail count: 15 (4 green, 7 blue, 4 black) + 3 terrain parks

Lift count: 4 (3 doubles, 1 carpet)

Midwest skiers says

Steeps, rocks, bluffs, Mississippi River views:

My take

La Crosse definitely presents like New England, with its boulder-buffed wraparound trails and underfoot grind on the morning turns. Vertically, the ski area fails its Northeast entrance exam, but it’s all context man: of the 17 Midwest ski areas with a vertical drop over 500 feet, Indy, with La Crosse added, gives skiers 10 of them. Again: the region-as-seasonlong-destination effect.

Here’s another cool feature at La Crosse: even though its three chairlifts are Hall doubles that predate the invention of photosynthesis, all carriers appear to be equipped with safety bars. Midwest skiers don’t typically bother, but those of us who are uncomfortable with heights sure appreciate them, as do most folks skiing with little kids.

From Indy’s launch, I’ve hoped for some combination of Wisconsin’s Cascade, Devil’s Head, and La Crosse to join. For all the Midwest density that Indy has built, this one is surprisingly marooned – the next-closest partner is little Bruce Mound, an hour-and-a-half-ish north. Still, LaCrosse is a nice little pin-drop to fill in a passionate ski region that’s just waiting for an excuse to buy a ski pass.

Sunburst, Wisconsin

Owned by: Rob and Jennifer Friedl

Located in: Kewaskum, Wisconsin

Year founded: 1961

Pass affiliations: Indy Pass, Indy+ Pass: 2 days

Closest neighboring Indy Pass ski areas: Little Switzerland (:23), Crystal Ridge (:43)

Base elevation: 974 feet

Summit elevation: 1,171 feet

Vertical drop: 197 feet

Skiable Acres: 30

Average annual snowfall: 11 inches

Trail count: 11 (17% beginner, 50% intermediate, 33% advanced)

Lift count: 9 (3 doubles, 4 ropetows, 2 carpets)

My take

Sunburst pins the top end of the Milwaukee small-ski-area asteroid belt that start with Vail’s Wilmot and progresses north through tiny Grand Geneva, Wisconsin Resorts’ detachable-laced Alpine Valley, and co-owned Crystal Ridge and Little Switzerland.

The 200-footer sits closest to Little Switzerland, owned since 2011 by the Schmitz Brothers, who in addition to Crystal Ridge operate Nordic Mountain, 90 minutes northwest. Sources familiar with the regional ski scene tell me that Sunburst enjoyed a brief surge after Switz closed in 2007, then waned as the new owners brought the ski area back online in 2012 and built up its park scene and beginner facilities. Other than the antique centerpole Riblets with no safety bars, Switz skis like a fully modern resort, laced with fast ropetows, long carpets, well-maintained parks, Terrain Based Learning, and overwhelming snowmaking. I wrote about that here:

This is a fun addition for local Indy Pass holders, who find themselves with a convenient new bump to burn a couple lift tickets. It’s less fun for Schmitz Brothers officials, who increasingly view Indy as a cannibalization threat to their low-cost, three-mountain season pass.

Mogensen, Indy’s owner since 2023, said that he’d managed to calm similar concerns from longtime Indy Pass partner Pats Peak, New Hampshire, which approached Indy with cannibalization fears after the mountain’s pass sales dipped following the 2022-23 ski season.

“We had some very serious conversations with them after we determined that a number of our former passholders had migrated to Indy Pass,” longtime Pats Peak GM Kris Blomback told me. “We had to make sure that any sales channel we’ve added isn’t sabotaging existing sales channels, and is doing a good job of raising the tide for everyone.”

After analyzing Indy’s data, Blomback determined that Indy skier visits and revenue helped offset (though not completely replace), any season pass sales losses that may be connected to Indy.

And they may not be connected. Pats Peak’s 2023 pass-sales decline mirrored national trends, as National Ski Areas Association data show season pass sales decreasing industrywide following the 2022-23 winter, despite record skier visits driven by huge western snowfalls. And Pats’ sales decline appears to have been temporary: despite another industrywide sales drop ahead of the 2024-25 ski season, Blomback says that Pats Peak season pass sales have ticked upward each of the past two years (including for the 2025-26 winter), even as Indy has continued adding New Hampshire and New England ski areas. It helps, he says, that Indy Pass payouts – and total redemptions – continue to increase each season, even after Pats Peak shifted from a no-blackout Indy redemptions structure to extensive blackouts a few years ago.

“Maybe the sales dip was a one-off thing,” Blomback says. “We’re not entirely convinced the problem is solved, but it does not seem to be getting worse. We’re going to definitely continue to monitor it this year.”

Blomback, who has led Pats Peak for 30 years, would like to see Indy push the per-ticket redemption rate up, something he thinks could be accomplished by raising the price. “I think they price it too low,” he says. “But Indy brings a tremendous number of people to Pats Peak that have never been here before. Overall, we’re very happy with Indy and what it has done for us.”

Indy seems unlikely to add density in New Hampshire, where the pass is already good at nine of 20 chairlift-served ski areas, and Epic (four) and Ikon (two), account for another six.

Which means what, exactly, for Little Switzerland? Mogensen says that Indy will continue to analyze any impacts of resort density, and that he takes resort’s concerns seriously. “We believe that the benefits of being on a national pass that can be that third wheel over Epic and Ikon far outweigh the perception of something going wrong,” he says. “And in reality, nothing’s really going wrong. We’re not going to be belligerent about adding more resorts, and if we make a mistake, we’ll correct it.”

I'll be interested if you think Mt. La Crosse has a New Englandish layout after you've skied it. After skiing extensively at both, I wouldn't say it does. The downside of the trails is that they were often bulldozed from what was exciting terrain, but the upshot is that they have steep pitches and headwalls that are unmatched in the Midwest south of the Northwoods.

Also, I realize you always use the ski area's own numbers, but Mt. La Crosse is not in the 500' league. It's 420' if you include the 20' hike to the race start above the top of the lift.

All that said, it's a great ski area and has gotten so much better in the past three or so years under new management. The owner is a person who actually loves to ski and ski race, and he's actually investing in the place after a couple decades of status quo. The snowmaking in particular has gotten so much better with the addition of their first real snowmaking pond, which was added at the top for increased water pressure.