Mountain Capital Partners says, “More Things Going Right Than Not” as Fire, Broken Lifts Stunt Operations

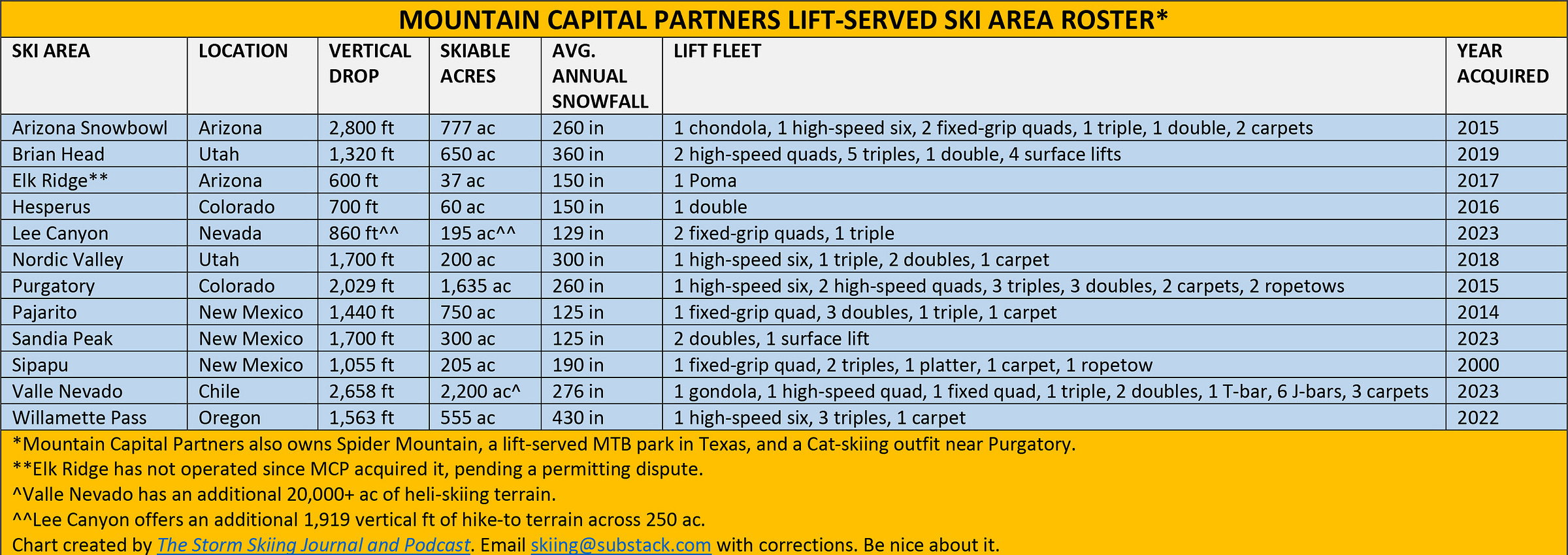

With four of 11 North American ski areas idle earlier this week, MCP stays focused on long-term.

“There are many more things going right than not this season.”

If each big U.S. ski company were a ship and their resorts sailors, Vail would be a carrier swinging into port with 42 dress blues lined along the deck saluting into the sun. Alterra may be some sort of super yacht, with sporting chums wagering ivory and gold bars ‘round the baccarat table while feasting on pterodactyl eggs. And Mountain Capital Partners would be a pirate ship, sailors hanging one-armed from the mast while knuckling a whisky jug, others firing cannons, a few making funny poses as they walk themselves repeatedly off the plank. The captain stands at the forecastle, surveying his ragtag gang, and asks his parrot what he ought to do. Instead of answering, the bird poops in the captain’s hatbrim and flies off.

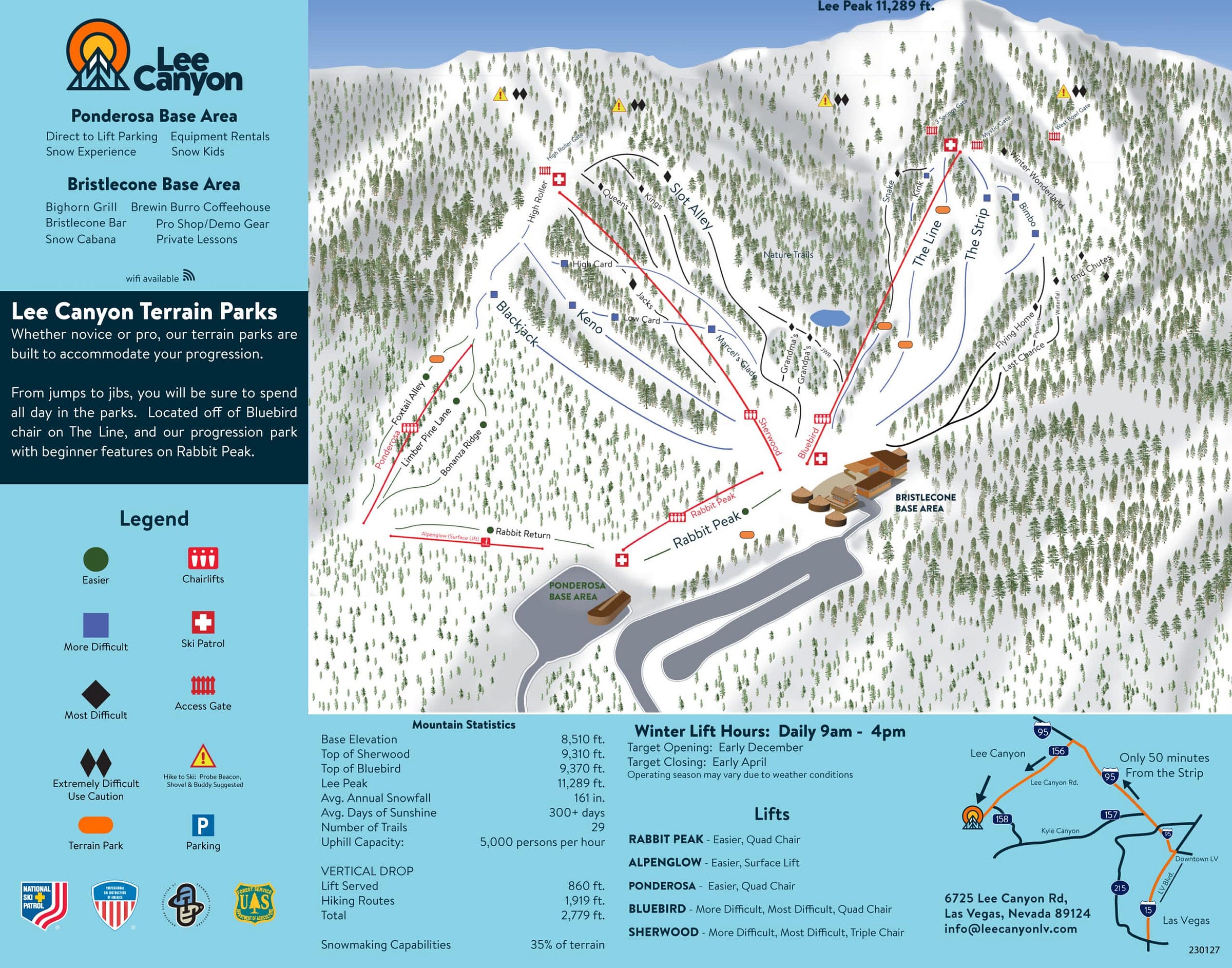

A few months ago, the great ship MCP blew into a storm. Literally: the remnants of Hurricane Hilary rolled off the Pacific and buried Lee Canyon in mudslides, just a few months after the company had recruited the mountain from Powdr. In December, Hesperus cancelled its ski season after the mountain’s only chairlift – a circa 1960s Riblet double – dropped dead. That was less than two weeks after Nordic Valley’s 54-year-old Apollo chair similarly failed, and two weeks before a baselodge fire closed the entire resort. Meanwhile, MCP had just loaded the hold with a treasure chest containing Sandia Peak, a New Mexico ski area that has not operated since 2021. And Elk Ridge, which had joined the crew way back in 2017 but never punched in for work, was posted up in the breakroom, eating Doritos and playing Switch as the ship began swirling into the gyre.

Or at least, that’s what I saw through my binoculars, comfortably aboard the S.S. Peanut Gallery: a ship floundering in an already turbulent winter, with four of its 11-man North American crew passed out drunk on the deck.

Concerned, I checked in with MCP. Captain James Coleman wasn’t available, so I called on my go-to, Stacey Glaser, MCP’s head of strategy and marketing, for an update.

“There are many more things going right than not this season,” Glaser wrote. Continuous snowmaking investments have mitigated the impact of a low-snow early-season at many of MCP’s properties. Willamette Pass opened its Midway lift for the first time in nine years, and is spinning lifts daily for the first time since 2007. In New Mexico, Pajarito re-activated its Townsight quad for the first time since 2019. And last week, in spite of the mudslides that had buried its other chairlifts up to their nostrils, Lee Canyon opened a brand-new quad chair and carpet serving a three-trail beginner expansion.

Glaser did not deny that this has been a challenging ski season, and she addressed the challenges at each of the currently closed resorts. In brief:

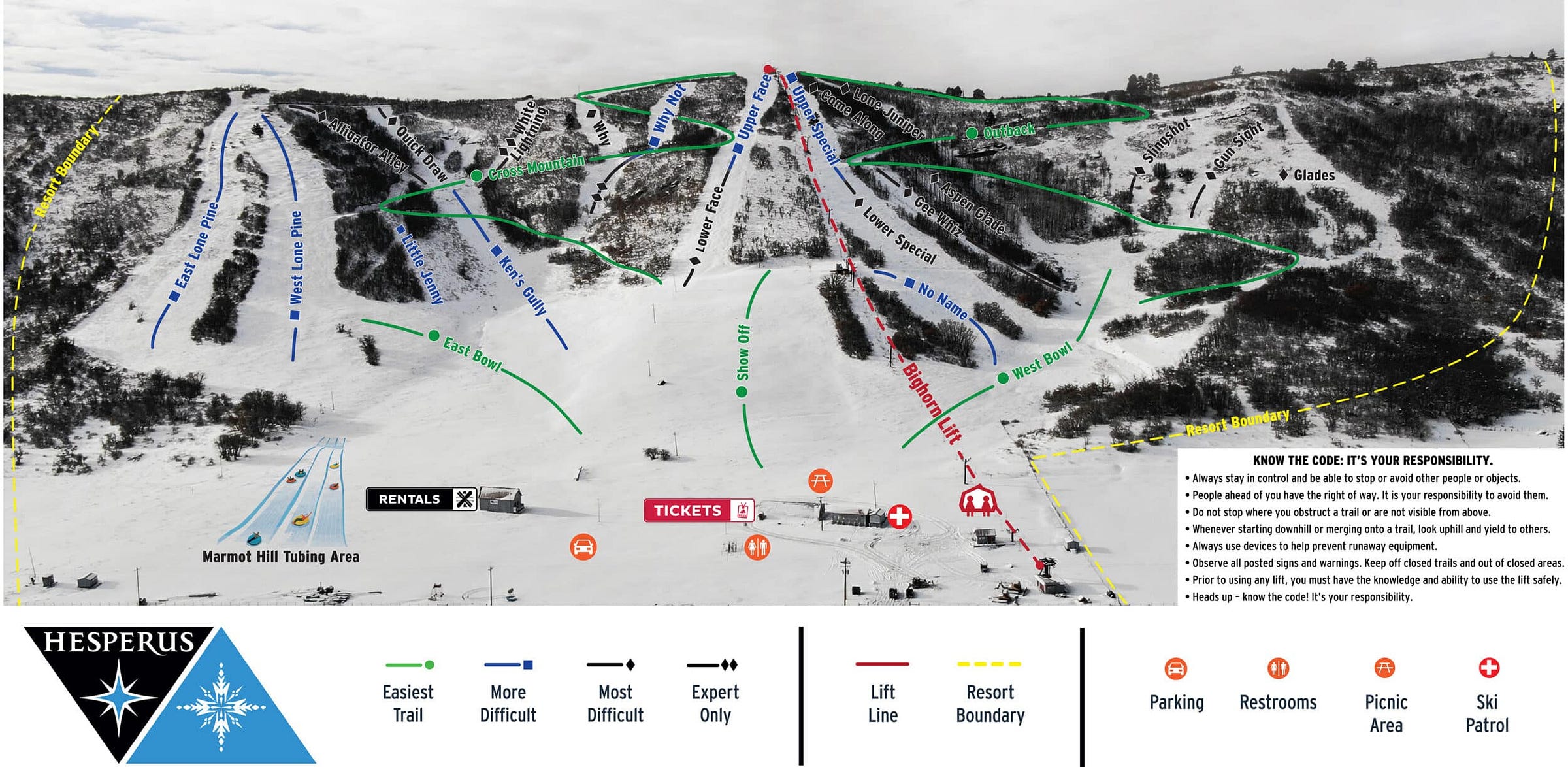

Hesperus

Closing Hesperus “hurt,” Glaser said. The decision marked the first time in the company’s 20-plus-year history that it had failed to open one of its ski areas (Elk Ridge notwithstanding). While Glaser couldn’t provide clarity on plans to either repair or replace the broken Bighorn lift, she affirmed MCP’s commitment to operating the ski area in future seasons, positioning Hesperus as a vital learning center in a state dominated by megaresorts.

“It doesn't shake our commitment to Hesperus and small ski resorts like Hesperus: we're passionate about skiing and the future of skiing, and we firmly believe that Hesperus (and other ski areas like it) are critical to the growth and sustainability of our sport,” Glaser said.

Sandia Peak

The Abruzzo family, who still operate Ski Santa Fe, ran Sandia Peak from the 1950s until they stopped spinning the lifts in 2021, citing labor shortages and bad weather. When MCP assumed operations late last year, they promised to re-open the joint, but wouldn’t commit to a timeline. The main priorities, Glaser said, are securing a new operating permit with the Cibola National Forest (required with an ownership change), and repairing the aging lift fleet. Ben Abruzzo told me in October that Chairs 2 and 4 were “in good working order,” but that Chair 3 – a 1980 Riblet double that is the only top-to-bottom lift on the 1,700-vertical-foot mountain – needed a new drive.

“Opening is not a matter of ‘if,’ but ‘when,’” Glaser said. She could not comment on whether that may be this winter.

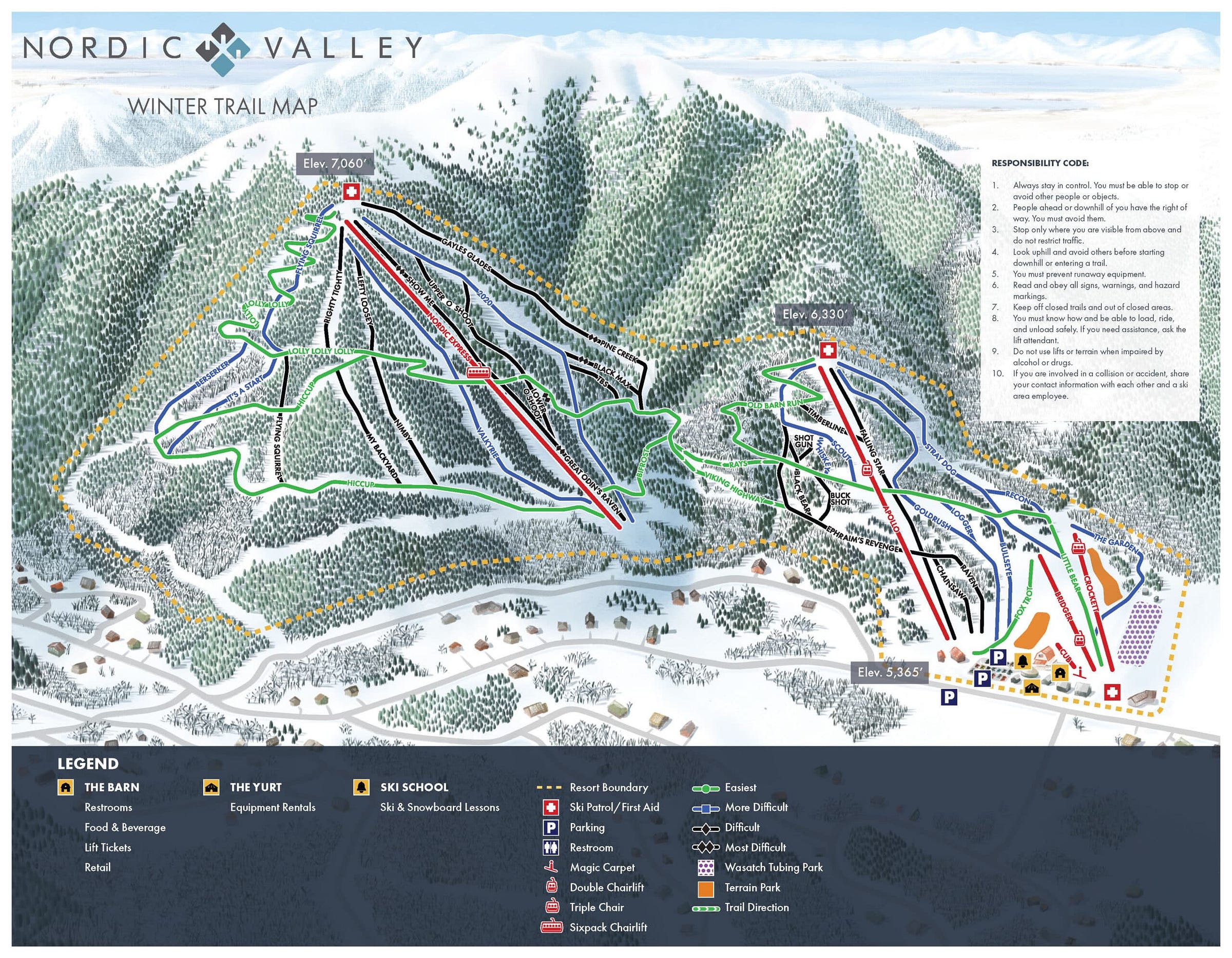

Nordic Valley

We’ll start with the Apollo chair, a 1970 Hall double that serves two crucial functions: transporting skiers to the top of Nordic Valley’s original summit, and positioning them so they can ski down to the massive 2020 expansion and associated six-pack, an area larger than the legacy resort and home to most of its advanced terrain.

“We have not yet made the decision on if Apollo can be salvaged or needs to be replaced,” Glaser said. Skiers will move along that line again, she promised. “This lift is obviously critical to Nordic's long-term success.”

Apollo had consumed the team’s energy until Monday’s fire, which lashed the ski area’s Odin Hall – home to its ticketing, retail, food service, restrooms, and administrative offices – with extensive smoke and water damage. The fire gut-punched Nordic’s community, as the building, locally referred to as “the barn,” had been built in the 1960s by Arthur Chistiansen, the ski area’s founder. But surrounding buildings and lifts suffered no damage, and Nordic re-opened to season passholders yesterday.

“We expect to open to the general public again soon,” Glaser said.

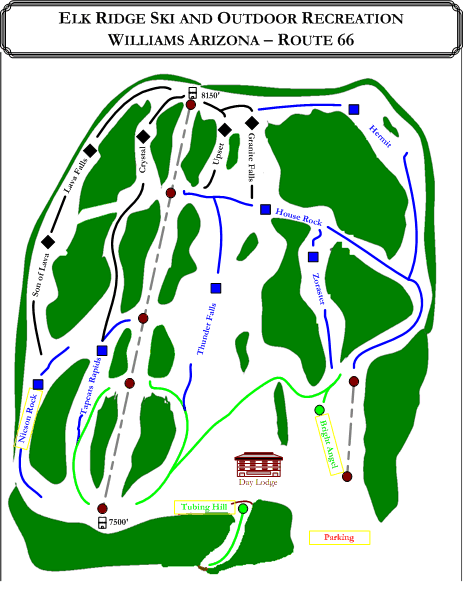

Elk Ridge

I was going to ask about Elk Ridge, a two-lift 600-footer parked down the road from MCP flagship Arizona Snowbowl, but I saw it floating on an inflatable raft surrounded by empty Corona bottles. Classic Elky.

Seriously, though, despite sitting on Forest Service land, Elk Ridge has been lost in some sort of permitting hell for years.

“I would call us more mission-focused than concerned”

MCP knows it is piloting a pirate ship, and that the mates won’t always arrive with shirts-tucked discipline.

“Most of the resorts within our collective serve fewer than 100,000 skier visits each year,” said Glaser (while MCP owns some of its mountains outright, the company operates others via partnerships with the deed owner). “These are small resorts, frequently owner-operated, with aging infrastructure and limited teams.”

Providing backup to help them survive long-term, Glaser says, is one of Mountain Capital Partners’ core missions. That includes figuring out how ski areas that are worth less than the cost of a new chairlift can keep moving people uphill when their antique machines break down.

“We believe in these small resorts, and we're willing to take on the challenges that come with them,” Glaser said. “It's a pretty simple but honest answer: we love skiing and we want our kids and their kids to be doing it, too. Small resorts are the solution.”

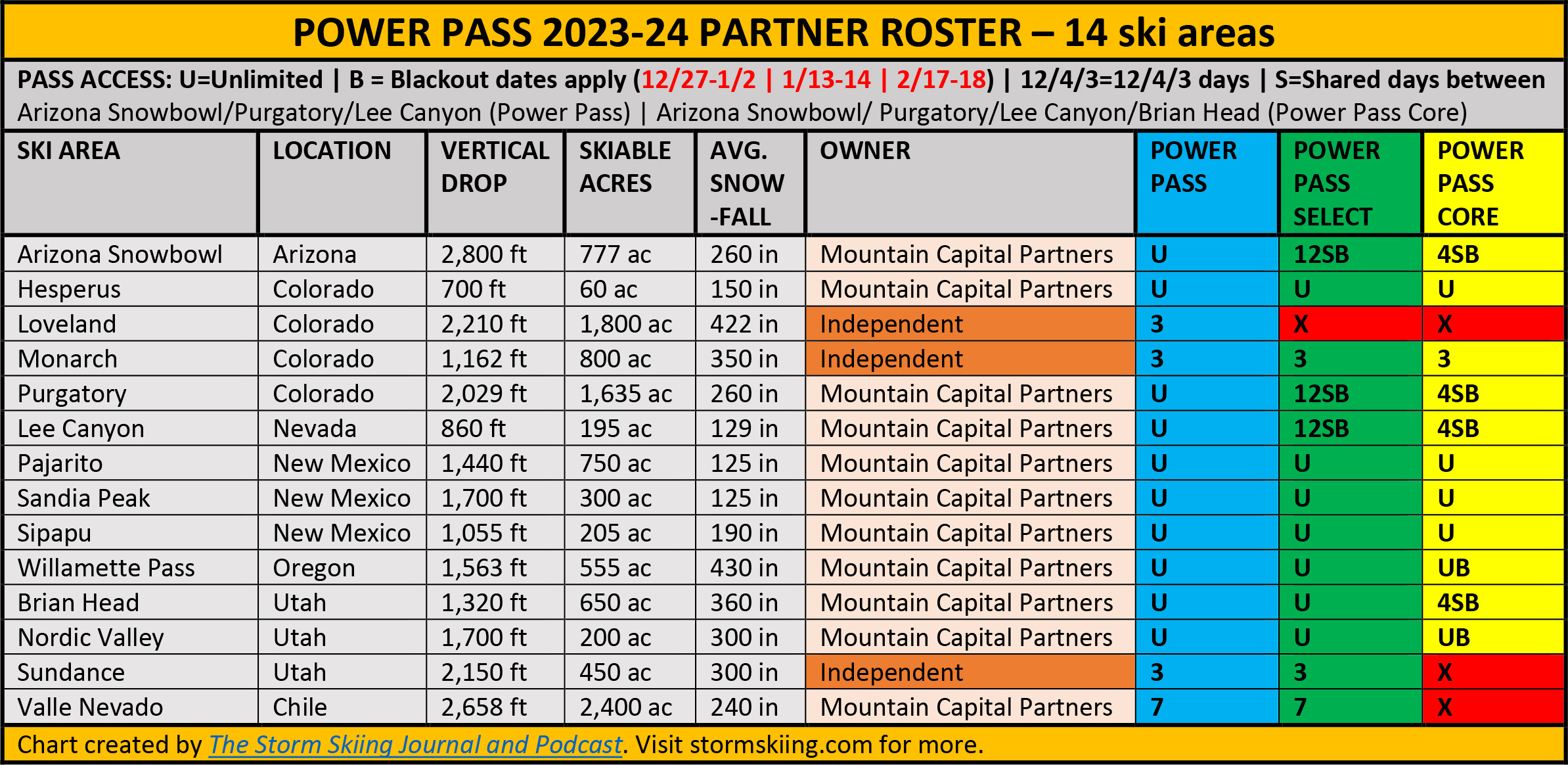

MCP has pumped more than $75 million in capital improvements into its properties. Skiers have reacted to the corresponding increase in quality and reliability by pushing sales of the company’s Power Pass – good for unlimited access to all of its U.S. ski areas – to record levels each year.

This year will test MCP’s resolve and their juggling skills. Twelve ski areas is a lot of ski areas, especially when four of them are sitting on blocks in your yard. If the company can patch them all together, they’ll get a hero’s welcome back at shore.

Glaser doesn’t seem concerned. “I would call us more mission-focused than concerned,” she said. In other words, I walked in on the renovation and asked why the house was a mess. They told me I had the date of the housewarming party wrong, and to go away until they’re ready. Fair enough.

Is a bad winter good for Vail and the Epic Pass?

Yesterday, Vail Resorts reported a 16.2 percent year-over-year decline in skier visits through Jan. 7. Twenty years ago, that would have directly translated to a roughly equal decline in lift-ticket revenue. But we live in the future, and Vail instead reported a 2.6 percent year-over-year increase in lift ticket revenue, which includes “an allocated portion of season pass revenue for each applicable period.”