Indy Pass Breaks Into Eastern Canada with Calabogie Peaks, Loch Lomond; Also Adds Mt. Crescent, Iowa and Arctic Valley, Alaska

Four new Allied partners also join: Sleeping Giant, Snowstar, Dry Hill, and Whitecap Mountains; plus four new cross-country partners

These days it’s like we’re all ski fans seated in stacked arena seats, waiting for the T-shirt cannons to pump new resorts into the sky. Just since March, this cartoonish blizzard has gifted us with:

Ikon Pass: Sun Peaks, Grandvalira, Panorama, Lotte Arai, Sun Valley, Snowbasin, Chamonix

Mountain Collective: Sugar Bowl, Marmot Basin, Le Massif, Sun Valley, Snowbasin

Epic Pass: Andermatt-Sedrun (plus a Telluride renewal)

Power Pass: Willamette Pass

But nothing in the history of lift-served skiing has matched Indy Pass’ treasure-collecting quest over the past six months. Since April, the three-year old pass has signed Bluewood, Kelly Canyon, Sawmill, Nub’s Nob, Marquette Mountain, Treetops, Mount Kato, Big Rock, Black Mountain of Maine, Meadowlark, Aomori Springs, Mt. Hood Meadows, Mountain High, Dodge Ridge, Snowriver, Chestnut, and Bluebird Backcountry, plus a stack of cross-country ski areas. In May, the pass also introduced an Allied discount lift ticket program for resorts situated in dense Indy regions.

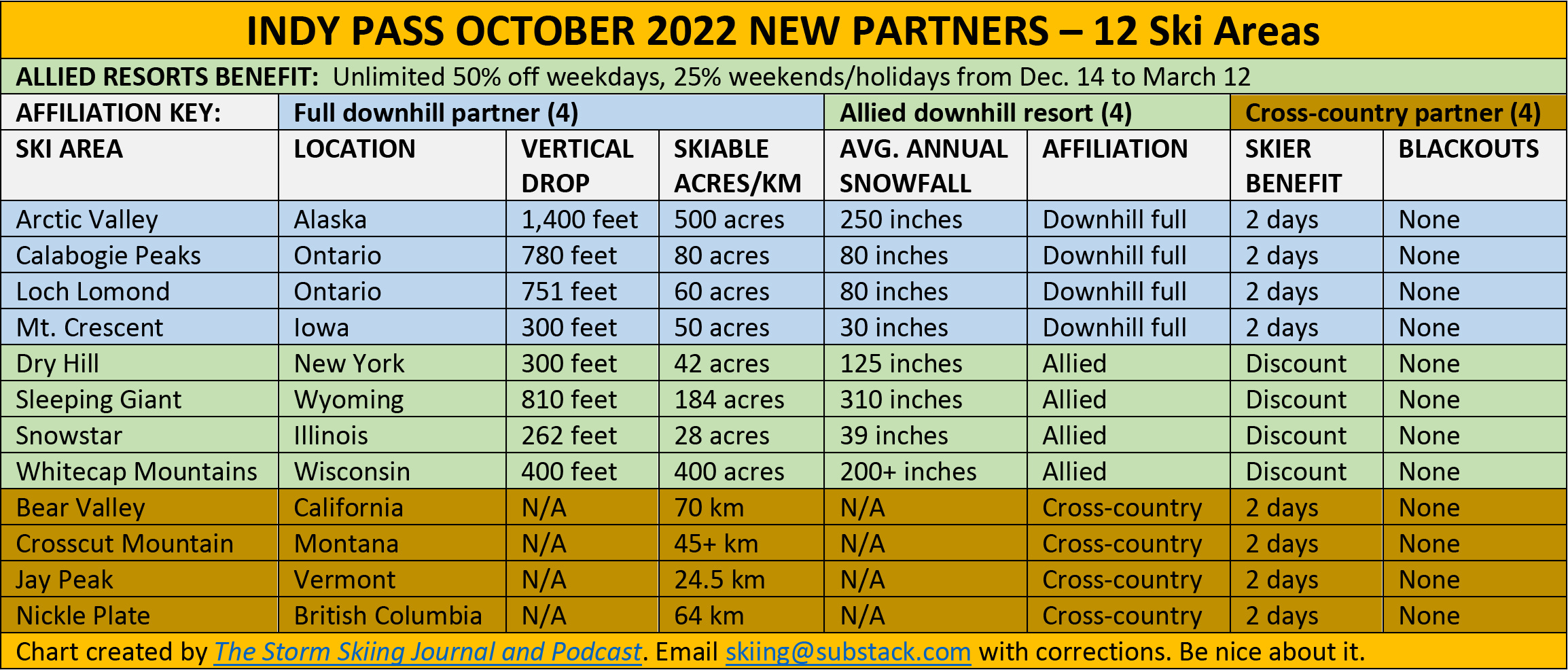

Indy’s resort-collecting binge continues today, as the pass adds a dozen more ski areas to its collection: four full downhill partners, four new Allied mountains, and four cross-country ski areas. Here’s what’s new:

Put those together with Indy’s existing roster, and you get this: an astonishing 133 ski areas spread across three tiers: 101 downhill, 18 cross-country, 14 Allied. It’s like “Yes Sir I’m sure getting my money’s worth for this one”:

Since this thing blew past complicated a long time ago, here’s a look at just the downhill partners:

And just the Allied partners:

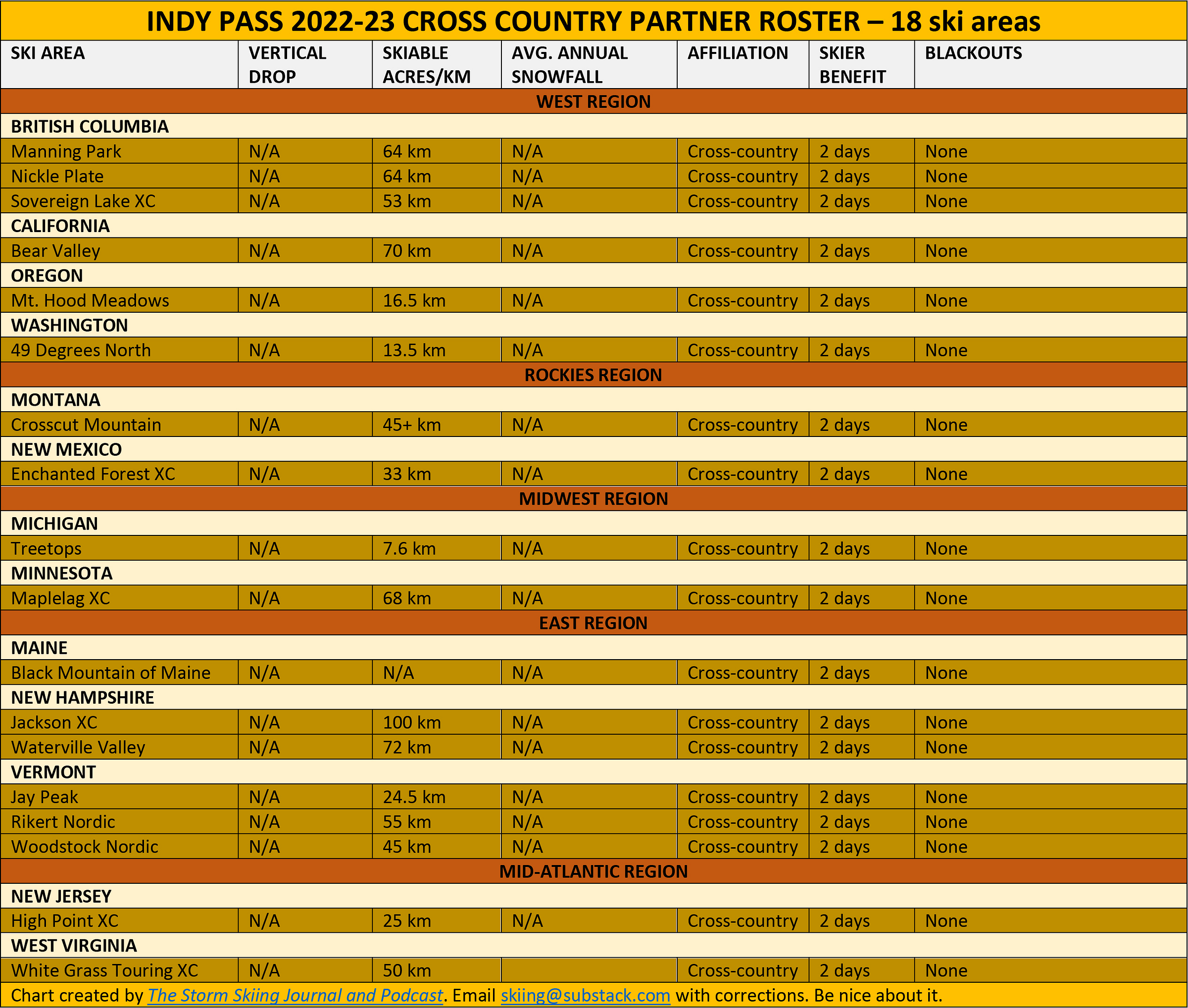

And just the cross-country partners:

And may I remind you that the basic version of this pass is currently priced at $329 (the no-blackout vertion is an extra $100)? Subtracting the 14 Allied resorts, that gives skiers two days each at 119 ski areas. That’s 238 days of skiing. Too many to feasibly use. “Yeah Brah but I ride 700 days per year.” Brah I don’t believe you, but if you love the game that much then this is an automatic pickup. “Yeah Brah 238 is like half of my 700 right there.” OK Brah I’m just glad you were born in the epoch of packaged food because you seem like the type that would starve to death if you got stuck in an apple tree. “Brah that basically happened to me once it was hella scary.”

Anyway I mean what the hell? How is this pass real and how does it keep adding mountains like a 5-year-old filling his trick-or-treat bag? And why does it seem like each new partner announcement only underscores how much potential growth remains for this pass that didn’t exist until 2019?

One hundred and thirty-three partners, and we’re just getting started. Indy’s entrance into Eastern Canada – home to more than 125 ski areas and very few megapass affiliations – portends a New England- or Midwest-style Indy invasion that could number two dozen ski areas with very little effort. The Allied program could one day be larger than the full-partner roster - the pass will accept “any ski area in North America that wishes to participate,” says Indy Pass founder Doug Fish. And then there’s Europe, and more Japan, and the whole Southern Hemisphere.

The Indy Pass model is simple, repeatable, appealing for skiers and ski areas alike. Whether the thing begins to crack under its own logistical strain remains to be seen: Indy has added 51 partners since April (19 downhill, 17 cross-country, 14 Allied – the pass also lost Marmot Basin, but, eh, 51-1 is not a bad scoreboard). Growth can be rocket fuel, but it can also be poison. But that analysis can wait. Today, let’s take a look at Indy’s dozen new partners, and see what their additions mean for the pass, for its skiers, and for North American skiing in general: