Epic Pass Adds Access to Five More Ski Areas in Austria

Vail pushes all the chips in on Europe

Over the past few days, Vail Resorts has quietly added a total of 15 Epic Pass days across five Austrian ski resorts:

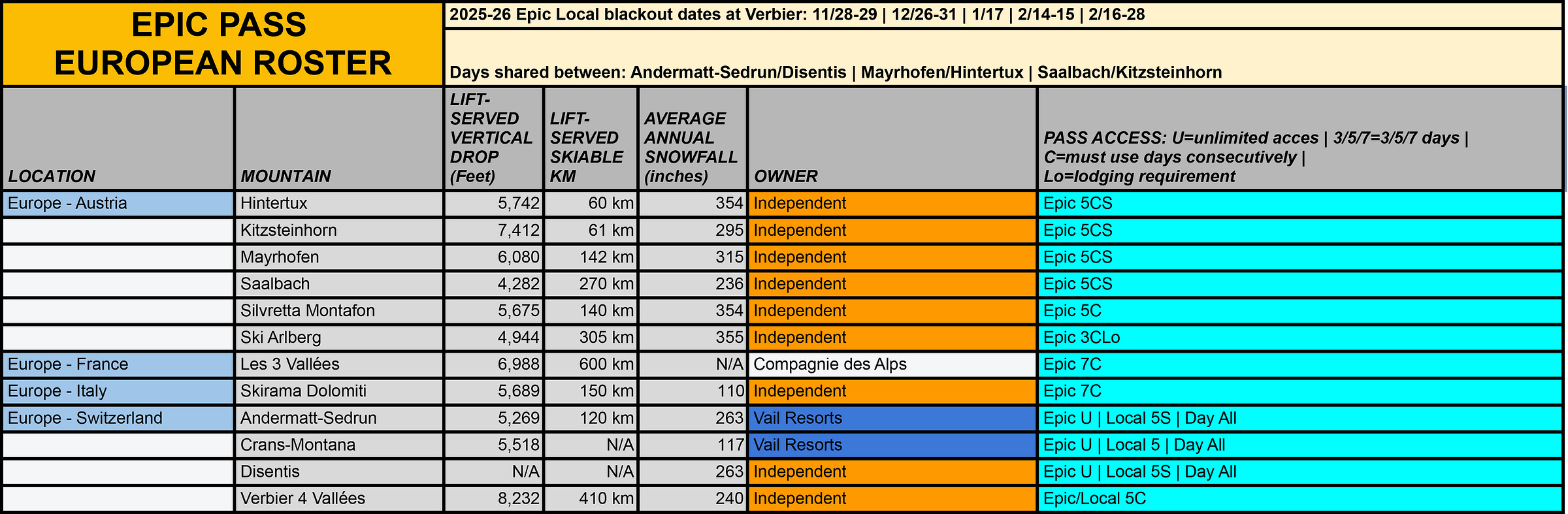

That gives Epic Pass holders access to six resorts in Austria, including longtime Epic partner Ski Arlberg (whose three Epic ski days are attached to a confusing lodging requirement). Taken together with Vail’s owned Andermatt and Crans-Montana ski areas in Switzerland and partners across the central Alps, Epic Pass holders will be able to access a dozen resorts in four countries for winter 2025-26:

Here’s your overall 2025-26 Epic Pass lineup. Prices are still sitting at early-bird levels until May 26 (which probably means May 28):

The addition of five batched partners ends a modest resort growth slump for Epic Pass, which had added just four new destinations since 2022, compared to 19 for Ikon, 10 for Mountain Collective, and an astonishing 108 for Indy:

While we’re still in the first half of 2025, U.S.-based ski pass partner additions for next winter are so far continuing last year’s trend toward international growth:

This lean toward international partners is unsurprising, given the maturity of the U.S. multimountain pass market and the extent of the world’s vast untapped mountain regions (and their tens of millions of skiers).

But for Vail, in particular, this aggressive expansion into Austria underscores the company’s full-bore commitment to replicating the ultra-successful Epic Pass strategy in the enormous and enormously complicated European Alps. Vail has not added a North American partner since purchasing the Pennsylvania trio of Seven Springs, Laurel, and Hidden Valley in 2021.

It remains unclear whether the Epic Pass will resonate with the European market. Despite purchasing two Swiss ski areas over the past three years, Epic Pass unit sales fell for the first time ever for winter 2024-25. And Vail is no longer acting in the vacuum of its hyper-growth 2010s, when competitors mostly stood aside as the company rolled up an enormous North American roster. Alterra’s Ikon Pass has blown by Epic in overall number of high-quality destination partners, and has grown steadily in Europe. And while Epic’s Euro partners often come attached to consecutive-days or lodging requirements, Ikon has been able to maintain its seven-on-Ikon, five-on-Ikon-Base, use-the-days-whenever model that applies across its roster. The two-days-per-resort Indy Pass has also begun adding Euro mountains at a steady rate:

That adds up to 31 EuroResorts - a small number on a big continent. Vail and everyone else have plenty of available land to grab.

So what do these big-time additions mean for Vail, for the Epic Pass, and for the U.S.-based multimountain ski pass universe at large? How do we begin to decode and understand ski areas with a 7,400-foot vertical drop (Kitzsteinhorn) or 180 ski lifts (Mayrhofen and its environs)? Could “Skicircus Saalbach Hinterglemm Leogang Fieberbrunn” possibly be a real resort name, or am I just inventing things to be funny? And where are all the Euro jokes anyway? All below. Keep reading: