11 Ski Areas Flee Ski Cooper Pass as Indy Delivers Ultimatum: Drop Cooper or We Drop You

“Their brand represents not a small resort, but rather a national, multi-mountain pass that is a direct competitor to Indy Pass” – Indy Pass founder Doug Fish

In a flurry of calls, texts, emails, and video conferences over the past several weeks, Indy Pass representatives have delivered an ultimatum to 14 of their ski area partners: drop out of Ski Cooper’s reciprocal pass coalition, or we will remove you from Indy Pass.

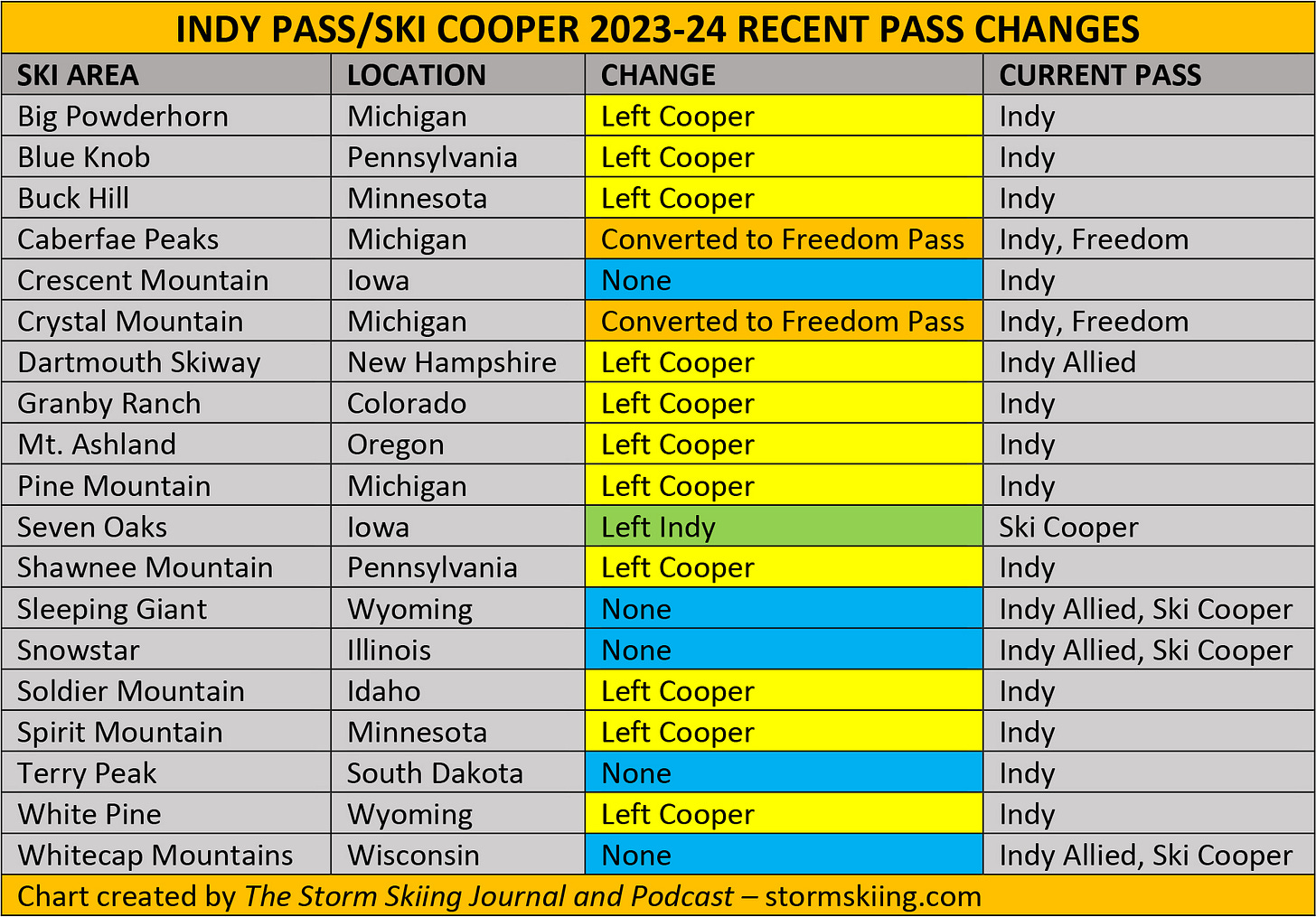

Eleven chose Indy. One chose Cooper. Two effectively dodged the issue by joining Freedom Pass (of which Cooper is a member). Five more, which Indy has yet to meet with formally, remain in limbo. Here’s a summary:

At issue is Ski Cooper’s $379 season pass, which offered three lift tickets each at 73 ski areas when it went on sale July 1. Reciprocal agreements among ski areas are common. The majority of Indy’s partners have established at least a handful as a benefit to their season pass holders. But Indy Pass officials say that the scale of Ski Cooper’s coalition has created a shadow multi-mountain national pass masquerading as a small-mountain pass.

“Indy Pass does not have a problem with reciprocals,” said Indy Pass founder and President Doug Fish. “We have a problem with Ski Cooper manipulating the reciprocal system that was originally created to help small resorts compete. Their brand represents not a small resort, but rather a national, multi-mountain pass that is a direct competitor to Indy Pass.”

Each time an Indy Pass holder redeems one of their two days at participating ski areas, Indy sends that mountain a paycheck. But Cooper’s business model, Fish says, allows the mountain to enjoy the benefits of providing access to a national network of ski areas, without the inconvenience and hassle of sharing revenue among partners.

“Ski Cooper keeps 100 percent of the money, pays no taxes, and enjoys millions in revenue while dozens of other small resorts deliver their hard-earned valuable product for free,” Fish said. “We don’t think this is right and we are not going to support it.”

Ski Cooper and Indy Pass had been set to share 39 partners for the coming ski season. Twenty-six of those are also part of the Freedom Pass and/or Powder Alliance reciprocal coalitions (Ski Cooper belongs to both). Indy reserved its ultimatum for ski areas outside of these partner groups, and included both its full partners (where passholders get two days each), and Allied Resorts (where passholders get a discount).

The two passes have existed side-by-side since Indy’s 2019 debut, and they have always shared some partners. Indy’s newly aggressive stance can likely be traced to its recent acquisition by Entabeni Systems, a small tech company that specializes in ski area software.

“Ski Cooper is a gem of small ski area, which we would of course welcome on the Indy Pass,” said Entabeni and Indy Pass owner Erik Mogensen. “Our issue does not lie with the ski area or its mission, our issue rests solely on a season pass product that turned beneficial cooperation into a one-sided loss felt by many of Indy's partners. Most of the ski industry is very center of the road, Indy Pass is not. We are going talk about the hard issues head on, and take a position that supports our independent operators each and every time.”

Cooper’s public response has been reserved.

“At this time, I shall refrain from getting involved in this purported ‘war,’ as I see no value in it,” said Ski Cooper General Manager Dan Torsell, playing, most likely, off the headline of a recent Storm Skiing Journal article titled “Indy Pass Declares War as Ski Cooper Joins Powder Alliance, Supercharging Its Season Pass Coalition” (neither Indy Pass, or any other entity I cover, has editorial input into The Storm, and no one from Indy Pass suggested, condoned, approved, or even frankly liked or appreciated that headline).

“For us, we’re carrying on business as usual,” Torsell continued. “I believe that ski area/resort operators are competent and intelligent business people who are capable of making responsible business decisions on their own, based on the individual circumstances within which each operates. Cooper is always happy to engage directly with our reciprocal partners, to share data and discuss ideas.”

To extend the war metaphor that absolutely no one liked in the first place, Indy appears to have won this battle: Ski Cooper is down 11 partners and is likely to lose at least some of the remaining five that it shares with Indy. In U.S. America, money usually wins, and Indy’s $80,000 average partner payout trumped the congenial swaperoos that Ski Cooper has orchestrated over the past decade.

But this scuffle has tarnished Indy’s good-guy reputation, alienating and confusing some longtime partners. The Indy Pass may be a tremendous wealth-generation engine for independent ski areas, but membership now requires compromises to the individual autonomy that the pass champions. Indy’s ultimatum also complicates the free-for-all matrix of thousands of reciprocal agreements, which involves hundreds of ski areas, two official coalitions, and numerous other passes that could be considered national in scope.

“It is quite unfortunate that the new leadership at Indy Pass felt the need to issue an ultimatum, particularly without any advance notice,” said Caberfae Peaks co-owner and GM Pete Meyer. “Contracts had already been signed, marketing was in place, and we had promoted a spring season pass sale based on this information. The current Indy Pass Agreement specifically allows reciprocals, so their sudden change of position mid-contract was disheartening. Not to mention Indy Pass had already sold out for the 2023-24 season, which made the timing of the ultimatum that much more perplexing.” (Indy Pass does in fact plan to offer an unspecified number of passes for sale later this year.)

Such conflicts were perhaps inevitable as Indy Pass grew from startup to important player in lift-served skiing. It’s hard to expand the house without breaking down a few walls, sometimes using heavy equipment. But, taken too far, brutal tactics can backfire. Ski coalitions are notoriously difficult to keep intact, and if Indy pushes too hard, it could break what it’s built, or inspire a national competitor in an already-crowded multi-mountain pass market.

“As the Indy Pass matures and the pass market evolves, we will continue to work hard for our independent resort partners and passholders,” said Fish. “It’s those constituencies that come first as we negotiate this complex terrain.”

What, about Ski Cooper’s pass in particular, spurred such a strong reaction from Indy? Why were there so many defections from Cooper’s portfolio, and what do they mean for the small Colorado mountain’s season pass? Why did Seven Oaks choose a handshake over a paycheck? And do the paths of Caberfae and Crystal – competitors but also down-the-road allies who are powerful players in the Michigan ski machine – lead to a neutral landing zone or a pause as Indy tightens rules around what it deems the appropriate scope of reciprocals? Here’s a look: