U.S. Ski Area Consolidation Explained in 11 (more) Charts & Timelines

And then I think we're finally done with this topic Brah

Last week, Mountain Capital Partners (MCP) announced its intended acquisition of four more ski areas in Chile, adding to the two they already own. This may end up a very big deal, uniting El Colorado with La Parva and Valle Nevado to create what could soon become the largest ski area in the western hemisphere. I’ve been working on that MCP story, but it’s like wandering drunk around one of those giant frat houses trying to find a bathroom, and finally giving up and pissing in the corner of the laundry room (I never did this*) – there are too many diversions and distractions, all of them somewhat mysterious and interesting, but none answering the essential question of why the architects of 1907 decided that one toilet was sufficient for a 42-bedroom house.

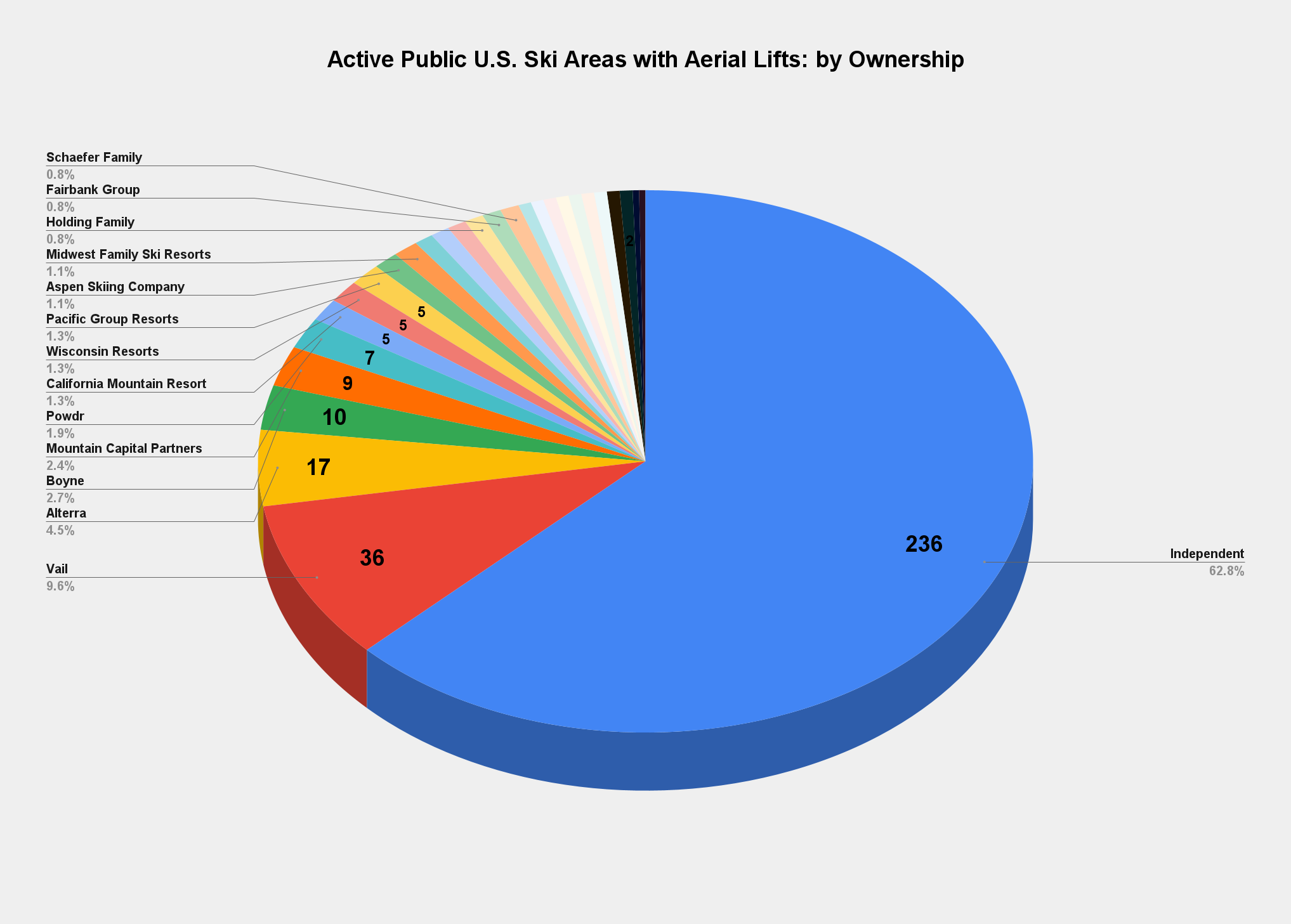

In the case of skiing, the house I’m wandering around is the history of ski area consolidation by U.S.-based operators. I spend a lot of time writing about this house, but I focus mostly on the renovations – who’s buying what right now. I also somewhat downplay the consolidation trend, arguing that 63 percent of public, chairlift-served U.S. ski areas are still independently owned and operated. Vail and Alterra combined control just 53 U.S. ski areas – just over 14 percent of the total:

But consolidation is and has been accelerating for decades. Before the Ikon Pass dropped in 2018 and Vail Resorts more than doubled in size the next year, I doubt most skiers were aware of or thought about who owned which ski areas. Entities like the American Skiing Company and Intrawest seemed to be forever buying and selling mountains, fumbling around but never really accomplishing much more than suggesting that this wasn’t a very good business model. Bear Mountain, California shuffled through six ownership groups between 1996 and 2017. When Vail purchased Breckenridge in 1997, the company became the fourth steward of America’s busiest ski area in a decade. At its height, American Skiing Company owned 11 resorts. By the time the company dissolved in 2008, those resorts had been sold to seven distinct operators.

But rapid change hit around 2017. Consider that just 10 years ago, in 2015, the largest ski area operator by number of resorts was a Missouri-based company called Peak Resorts that no longer exists. Vail owned just 10 ski areas (the company operates 42 today), and the Epic Pass had yet to enter New England. Alterra Mountain Company and its Ikon Pass did not exist. Whistler was an independently operated, publicly traded company.

Well. The Epic and Ikon passes have infiltrated North America and, increasingly, Europe, fundamentally transforming how many people visit which ski areas and when. And while pass membership is not directly tied to ownership, Epkon’s aggressive omnipresence has stoked a hyper-awareness of the corporate deed shuffling that once would have bored participants of a sport ostensibly preoccupied with jumping off things.

So I want to really nail this furniture to the boat deck before we set out to sea with yet another consolidation story. Who is driving ski area consolidation today, and where? A look in 11 charts:

*I totally did this. Sorry Michigan Tech Bros circa 1999.

A simple timeline will do, Brah

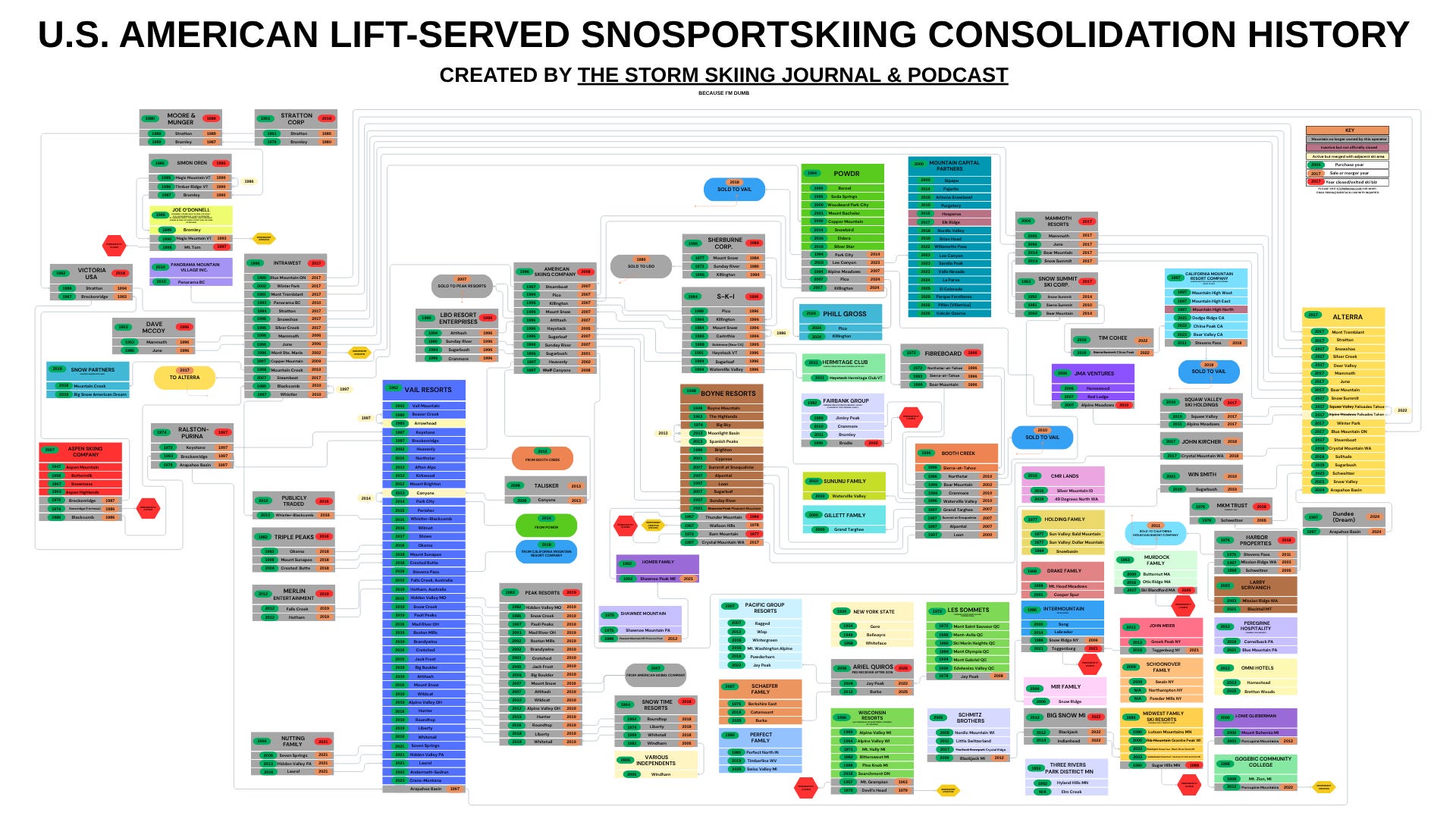

The U.S. American Lift-Served SnoSportSkiing Consolidation History Chart that I published a couple days ago provides a nice snapshot of where the industry stands and how we got here. But to minimize flow-chart overlap, I couldn’t really arrange the companies in a chronological timeline. I tried:

Poor ASC. Some major plumbing yielded this:

But that flowchart emerged from my attempts to create a simple consolidation timeline, which turned into a very ugly and not-simple timeline.

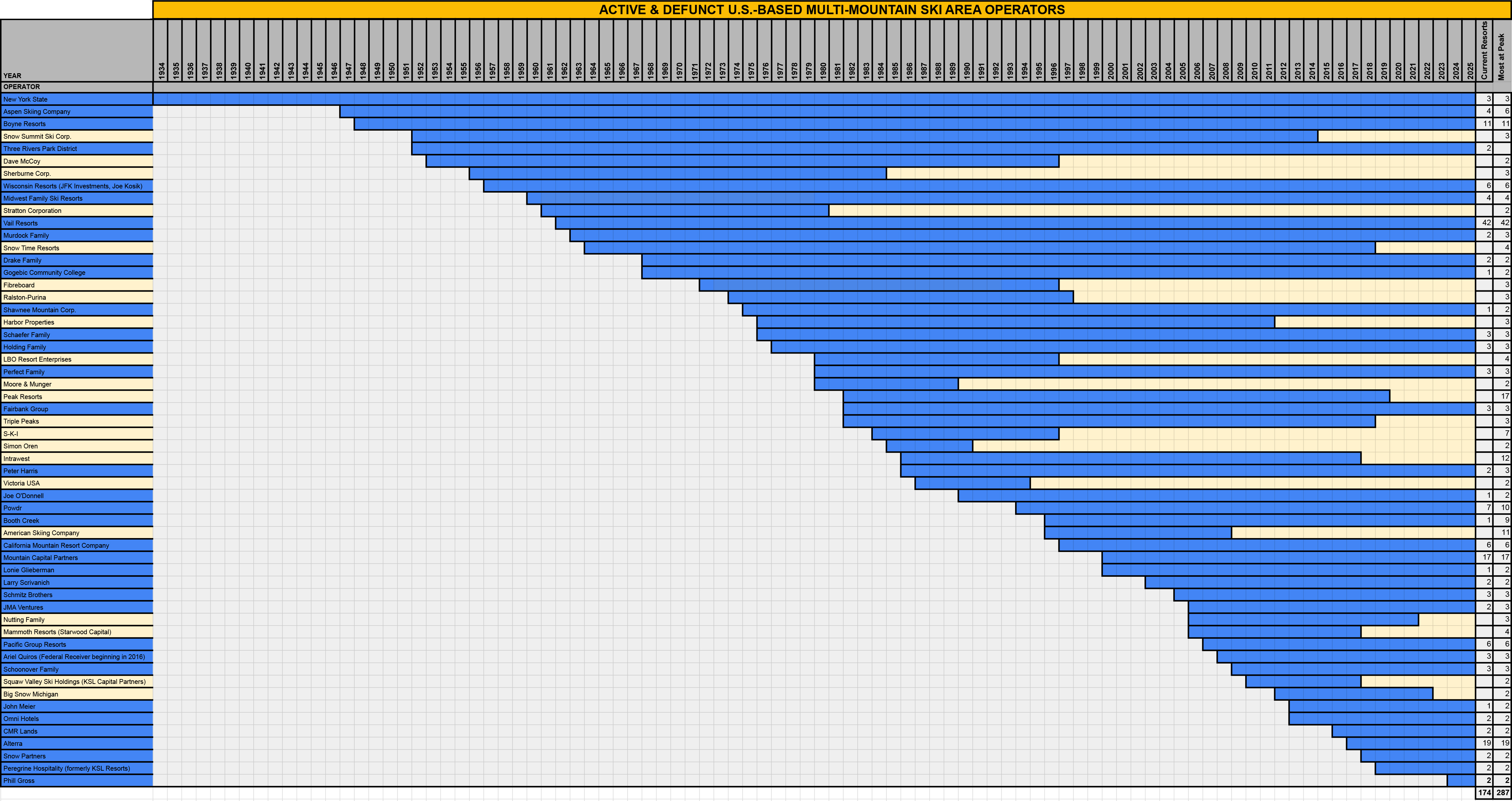

So here’s a simpler version, which shows the active years of every U.S.-based multimountain operator:

It’s a bit more digestible if we cut out the first four decades, when pretty much every ski area was still run by some dude with a hatchet, a Panama hat, and a satchel full of beers, driving around in a bulldozer and cursing at people. So starting around 1975: