The Western U.S. Has Added 54,598 Acres of Skiable Terrain Since 1994

That’s like adding another Colorado (and then some)

If ski “supply” is “flat to shrinking,” then how did we add another Colorado’s worth of terrain since 1994?

Let me say off the top that I like, respect, and use Motley Fool’s investment advice. This is not an attempt to flame them or Brobot call-out a #FakeSkier. But I groaned when I read this snippet in a recent Fool article ($) analyzing Vail Resorts stock (ticker: MTN):

During the 1992 ski season, there were 546 ski areas operating in the United States compared to about 486 today. Supply is flat to shrinking. On the demand side, 3 of the top 5 busiest ski seasons on record occurred each of the last three years. Demand is up. Furthermore, a key revenue driver for Vail, the EPIC Pass, is nearly $400 cheaper than the rival IKON Pass despite providing access to more ski resorts. That should give Vail considerable pricing power for years to come, including its 7% price hike to the EPIC Pass for the 2025-2026 ski season.

Some of this is just wrong:

Skiers will be able to access 75 ski areas on their 2025-26 Ikon Passes, compared to 65 on Epic (I’m counting individual ski areas, not Ikon’s “destinations,” which often group several ski areas, lumping, for example, the four Aspen mountains into one).

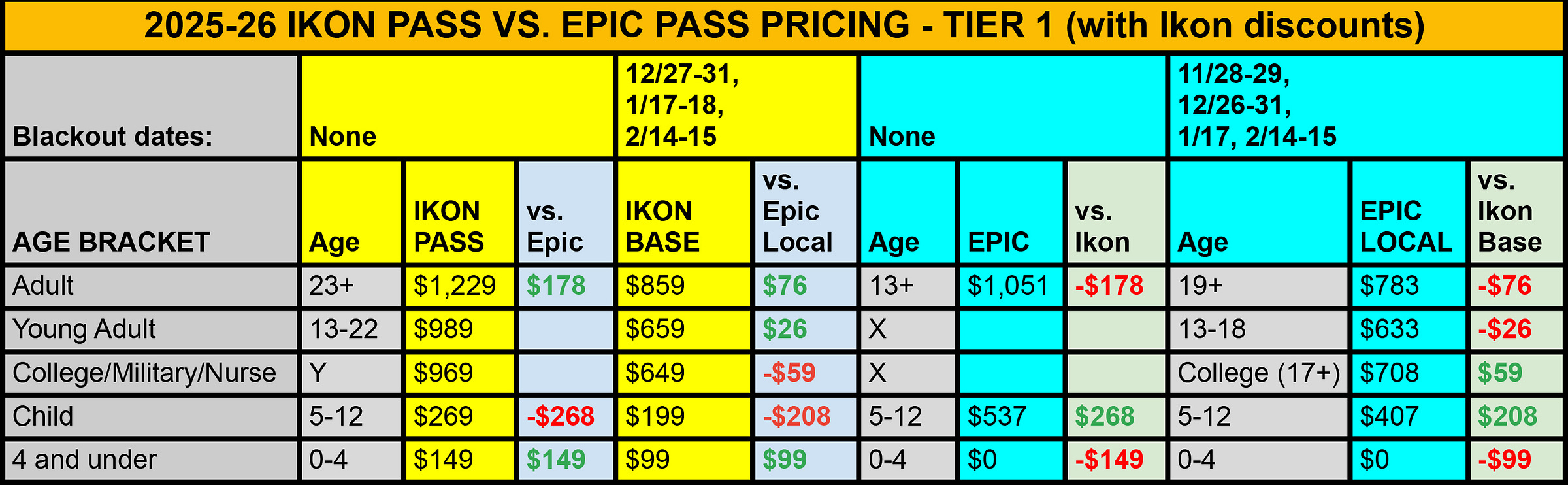

Epic retails for $1,051, just $278 more than the $1,329 Ikon Pass; Ikon’s renewal discount drops that to $1,229 – a $178 premium to Epic. I’m no finance genius, but neither of those price differentials count as “nearly $400” around these parts.

Pricing nuances abound between the two product suites – Ikon’s child passes are much cheaper than Epic’s, and are discounted with the purchase of an adult pass; the difference between Ikon Base and Epic Local is also quite small. Chartage:

And here’s the difference across the main Epkon product suites if you consider Ikon renewal and child pass discounts:

But those are minor issues, easily untangled by anyone with an internet connection and a calculator. The real problem with the above paragraph is the first two sentences, pointing to the shrinking number of U.S. ski areas as evidence that the “supply” of lift-served skiing is declining.

Right about now, you’re saying, “Bro, the numbers!” And I’m saying, “Bro, I know. Just hang on.” I know where these numbers come from: the National Ski Areas Association’s fact sheets:

And what could possibly be a better source than the trade association that represents the American ski industry, right?

Right. I agree. The raw numbers of ski areas are accurate enough (though I keep a separate list and count 505 active ski areas for the 2024-25 ski season, nine more than the 496 I counted last year, which was 10 more than the NSAA’s 2023-24 count of 486; we’ll deal with that discrepancy in a future column). But let’s just say that approximately 10 percent fewer ski areas are operating in America this winter than in 1992. That’s bad, right?

No. And here’s why: while the raw number of operating ski areas declined rapidly through the 1980s and ‘90s, that number stabilized around 2000, and the skiable acreage at the surviving U.S. ski areas is, cumulatively, far larger than it was in 1992.

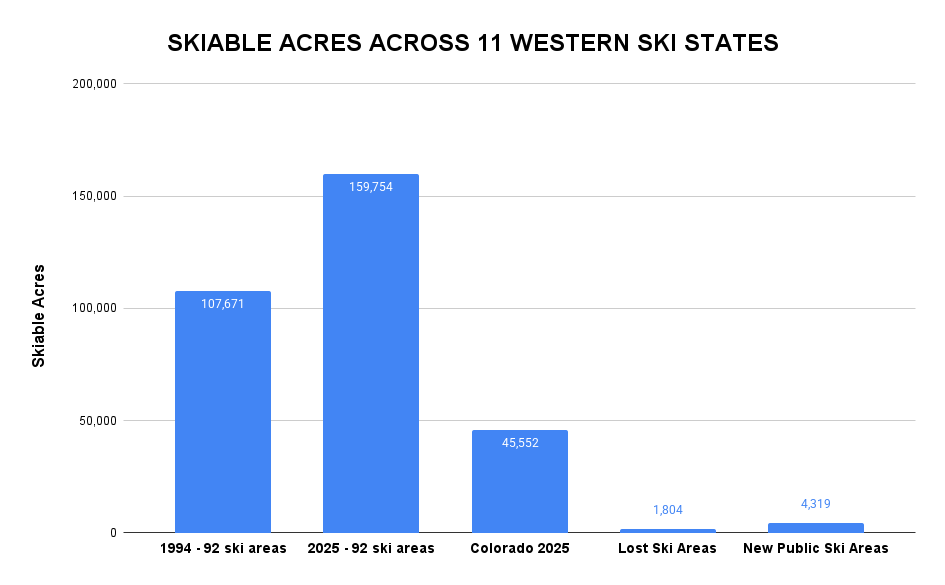

How much larger? I haven’t calculated exact figures (a likely impossible task), nor have I examined the entire nation. But I did compare and total the current skiable footprint in the 11 contiguous western ski states (Colorado, Utah, Arizona, New Mexico, Nevada, California, Oregon, Washington, Idaho, Wyoming, Montana) to their listed acreage in 1994’s Peak Ski Guide & Travel Planner, which billed itself as “the official ski areas guide of U.S. skiing.” In that analogue era (the guide’s 440 pages don’t list a single website, not even in the ads), many ski areas did not advertise a skiable acreage total. I set those facilities aside (I’ll address them down the post), and tallied up the 92 mountains that Peak listed a skiable footprint for and that are still in operation today.

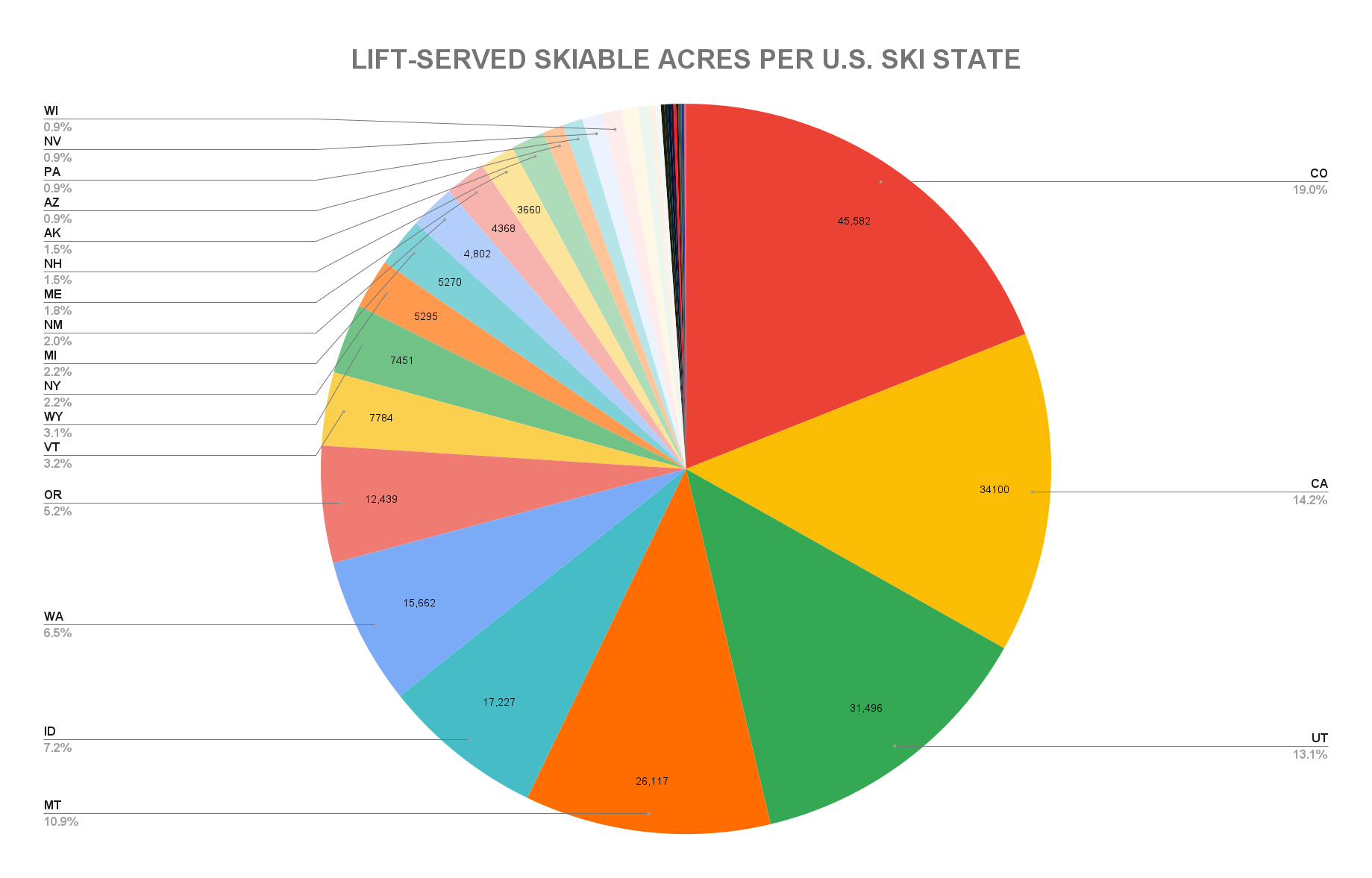

Here's what I found: those 92 ski areas have grown by a combined 52,083 acres since 1994. Acres are difficult to visualize, but check out this itemization of current skiable acreage by state:

Colorado, king of U.S. skiing, responsible for approximately one in four skier visits in an average ski season, offers 45,552 acres of skiable terrain for the 2024-25 ski season. That means that the United States has added the equivalent of another Colorado to its skiable footprint since 1994.

“Bro why are you writing in italics so much today? ARE YOU GOING TO START WRITING IN ALL CAPS WITH BOLDFACE AND QUESTIONABLE UNNECESSARY PUNCTUATION NEXT??!??”

You’re right, Grammar-and-Style Bro, I am pushing it. But I really need to make this point, because non-ski media reaching for Death-of-Skiing narratives are going to continue pointing to the raw ski-areas-in-existence stats and declaring, with no context or additional evidence, that CLIMATE CHANGE IS KILLING SKIING!!!

The actual narrative is more complex: most of the ski areas that have failed since 1992 were small and mismanaged (climate change hasn’t helped, but snowmaking works). The ski areas that survived did so in part because they funneled their profits into expansions and snowmaking. The result is fewer, but healthier, businesses serving more skiers in a more streamlined fashion than they could have done in the mostly-fixed-grip lift, energy-intensive-and-inefficient snowmaking, wicket-tickets-and-lines-for-everything cash-economy no-internet early 1990s.

To underscore the point that ski “supply” is expanding, not shrinking: the 52,083 acres cited above leaves out 76 western ski areas that presently total 39,069 acres. Most existed in 1994, but Peak did not provide a contemporary acreage stat. Six of these 76 ski areas have came online since, including 1,819-acre Silverton, opened in 2001; 1,100-acre Tamarack in 2004; 1,000-acre Blacktail in 1998; and 400-acre Cherry Peak in 2015. Those four ski areas’ 4,319 acres more than offset the combined 1,804 acres lost when the 10 ski areas that Peak listed as active in 1994 ceased operations. Here’s how that all sorts out:

To add all that up: 52,083 acres of new terrain at existing mountains PLUS 4,319 acres at new public ski areas MINUS 1,804 acres worth of lost ski areas EQUALS 54,598 acres of new ski terrain in 11 western ski states since 1992.

Here’s a deeper look at how I compiled this data, why the total of new acreage is likely even higher, where ski area growth has been concentrated over the past three-plus decades, and the ski areas that have failed. Lots of chartage, Brah: