Ski Area Consolidation Flatlines in 2024: Pause or Omen?

Acquisitions hit lowest numbers since 2014 | 2024-25 season preview, part 2

It’s not so hard to imagine a near-future in which an Epic or Ikon Pass is part of your Amazon Prime membership. Blue Origin rockets parachuting you onto the top of KT-22 after a driveway pickup. Just hopefully you don’t get mixed up with the drones toting 82 tons of cat litter to Crazy Tim’s Ohio Tiger Sanctuary. Because either you land first and get crushed or land last and get eaten, and either way, ouch.

But barring some amazing development in these last two weeks of the year, we’ll finish 2024 without much change to the much-dreaded but probably-overall-healthy-for-the-future-of-skiing ski area consolidation story. Here’s what happened this year: Alterra bought Arapahoe Basin from a Canadian real-estate company and Mountain Capital Partners bought La Parva, Chile. And that’s it. Vail didn’t buy anything. Boyne didn’t buy anything. No one else who owns more than one ski area bought anything. And Park City-based Powdr blew up the entire plot by peddling monster Killington and sister resort Pico to a group of Vermont investors.

The result: for the first time since the modern consolidation era launched with Vail Resorts’ 1997 purchase of Keystone and Breckenridge, U.S.-based ski area operators will finish the year with net-zero acquisitions. Two bought, two sold. We do end up with one more multi-mountain operator, as the Killington-Pico crew hops onto the list of 28 other American entities overseeing one or more ski areas (click through for high-resolution chart; best viewed on desktop):

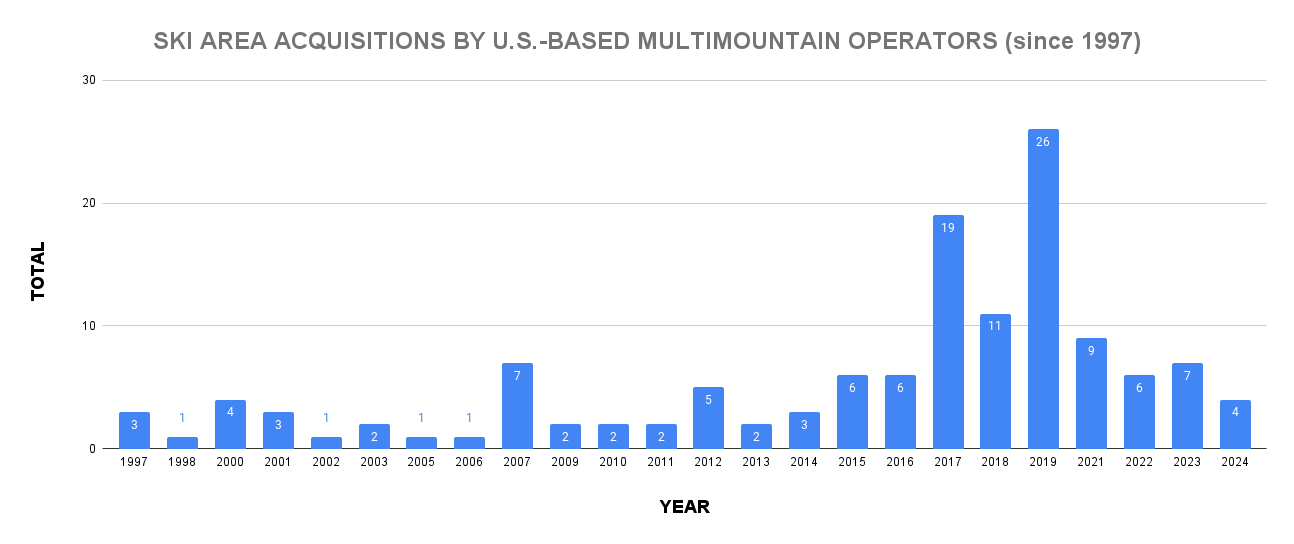

Even if we consider Killington and Pico an acquisition (by a small group), rather than a sell-off (by a large group), the number of ski area sales to multi-mountain companies this year reached its lowest total since 2014 (excluding 2020, when for mysterious reasons no one purchased any ski resorts):

That’s a dramatic drop-off from the ski area bull market of 2017 to 2019, when multimountain operators ingested 56 ski areas. This was probably a singular time – Alterra was emerging from the carcass of Intrawest, and Vail went Death Star, swallowing 19-mountain Peak Resorts like a boa constrictor ingesting a tractor. But after the 2020 break to stabilize civilization, acquisitions ticked back up, with 22 more from 2021 to 2023.

So what can we read from 2024’s acquisitions slowdown? Is U.S. skiing’s consolidation era ending? Could we, with Powdr’s sales listings of Bachelor, Eldora, and Silver Star, actually be on the cusp of a deconsolidation trend? With Rich Guys buying Powder Mountain (in 2023), Killington, Waterman, and Kissing Bridge, are we re-entering the era of swashbuckling proprietor, roving the base area with a walkie talkie strapped to his vest and the names of every season passholder memorized? Or is this year’s slowdown an anomaly, a pause as skiing stumbles toward airline-industry levels of consolidation?

I think the answers are, in short, no, no, sort of, and sort of to the slowdown and no to the airline comparison. Here’s a deeper look at what we know about the current state of industry consolidation, what 2024’s down year means, and where we could go next: