Mountain Collective Is the Budget Ikon Pass for Trophy Hunters

With zero blackouts and 5 resorts excluded from Ikon Base, and at half the cost of Ikon, it’s time to reconsider this formerly left-behind pass

Ikon has a budget tier, and it’s called Mountain Collective

Ikon burst from the earth like a snowy knight, an anti-Vail hero at last, schussing across the kingdom, bringing balance to skiing, a counterweight to Epic’s bulky end of the teetertotter. It’s roster was ferocious, it’s prices so low that they seemed accidental: $899 Ikon, $599 Base. Everyone had joined the Resistance: Boyne, Powdr, Jackson, Aspen, and this new Megatron known as Alterra Mountain Company, an improbable rapid rollup of Mammoth, Squaw, Steamboat, Winter Park, and Deer Valley.

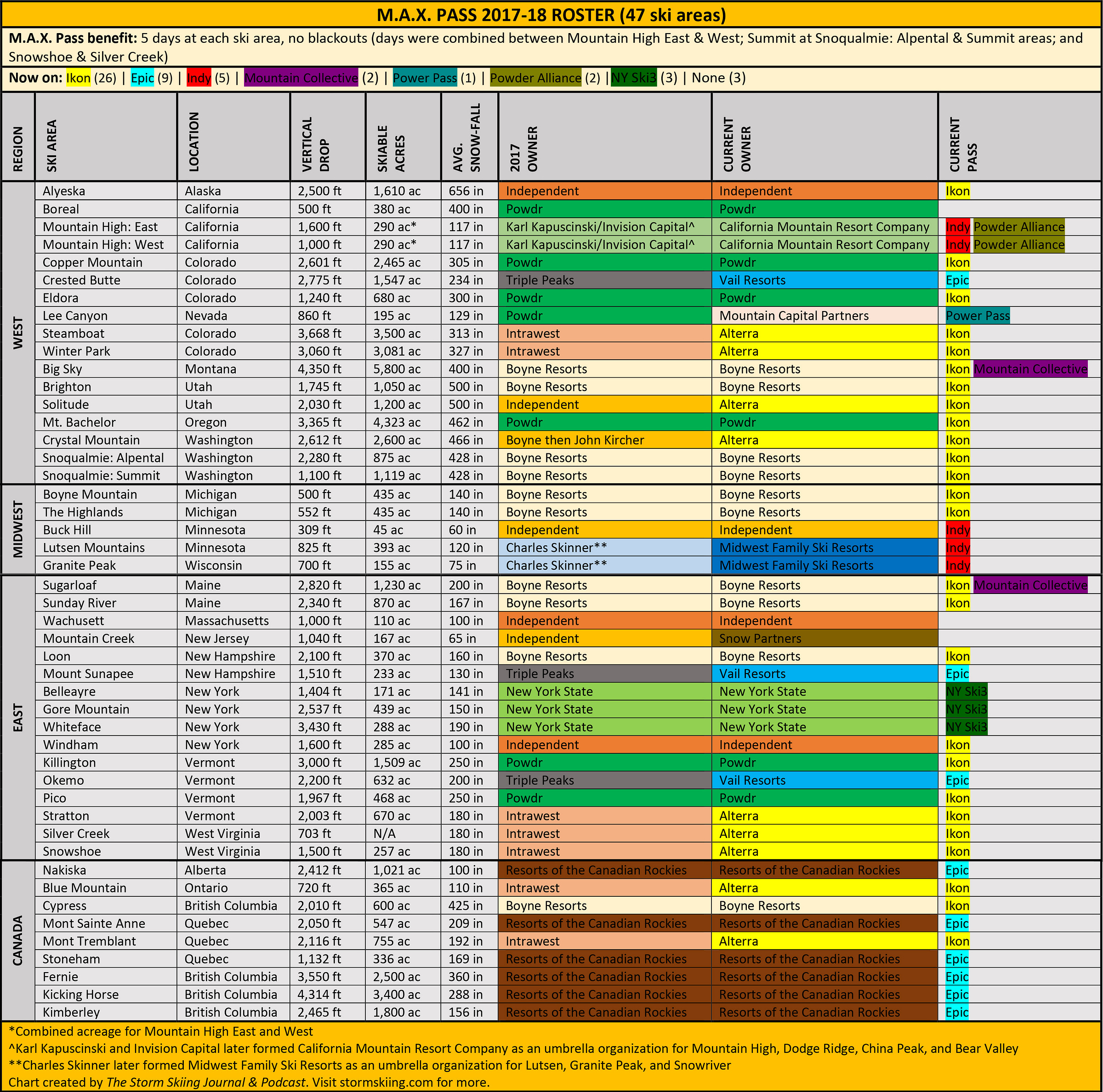

But Ikon was not some benevolent Good Guy, for our hero’s first act was the violent slaying of the nascent M.A.X. Pass. Introduced just a few years earlier, this five-days-per-mountain product included an idiosyncratic mix of destinations and day-trip options that was arguably better positioned against the 2018-19 version of the Epic Pass than that year’s inaugural Ikon and its wagonload of gladiators.

M.A.X.’s sudden death was surprising. Sure, there was Ikon overlap, especially among Boyne, Powdr, and Intrawest (absorbed by Alterra) resorts. And a lot of the coalition wasn’t returning for 2018-19 anyway: Resorts of the Canadian Rockies had defected to Epic, and Crested Butte and friends weren’t returning anyway given Vail’s Triple Peaks purchase in June 2018. But the chop-and-run strategy left skiers without multi-mountain access to a host of regional standouts. While some (Mountain High, Lutsen, Granite Peak, Windham, Bachelor, Alyeska) later made their way to Ikon or Indy, others (Mountain Creek, Wachusett, Gore, Whiteface, Belleayre), quit the national multimountain pass game and never returned.

Mountain Collective seemed doomed. That first year, the $409, two-days-per-resort Mountain Collective shared 20 of its 23 partners with Ikon, and all of them were five-day partners on the $599 Ikon Base Pass. The only two that MC claimed as exclusive – Sun Valley’s two mountains and Snowbasin – fled for Epic the following year. Vail had just swiped Telluride, after buying Whistler and Stowe off the pass in 2017. If M.A.X. Pass was toast, Mountain Collective was an ash heap.

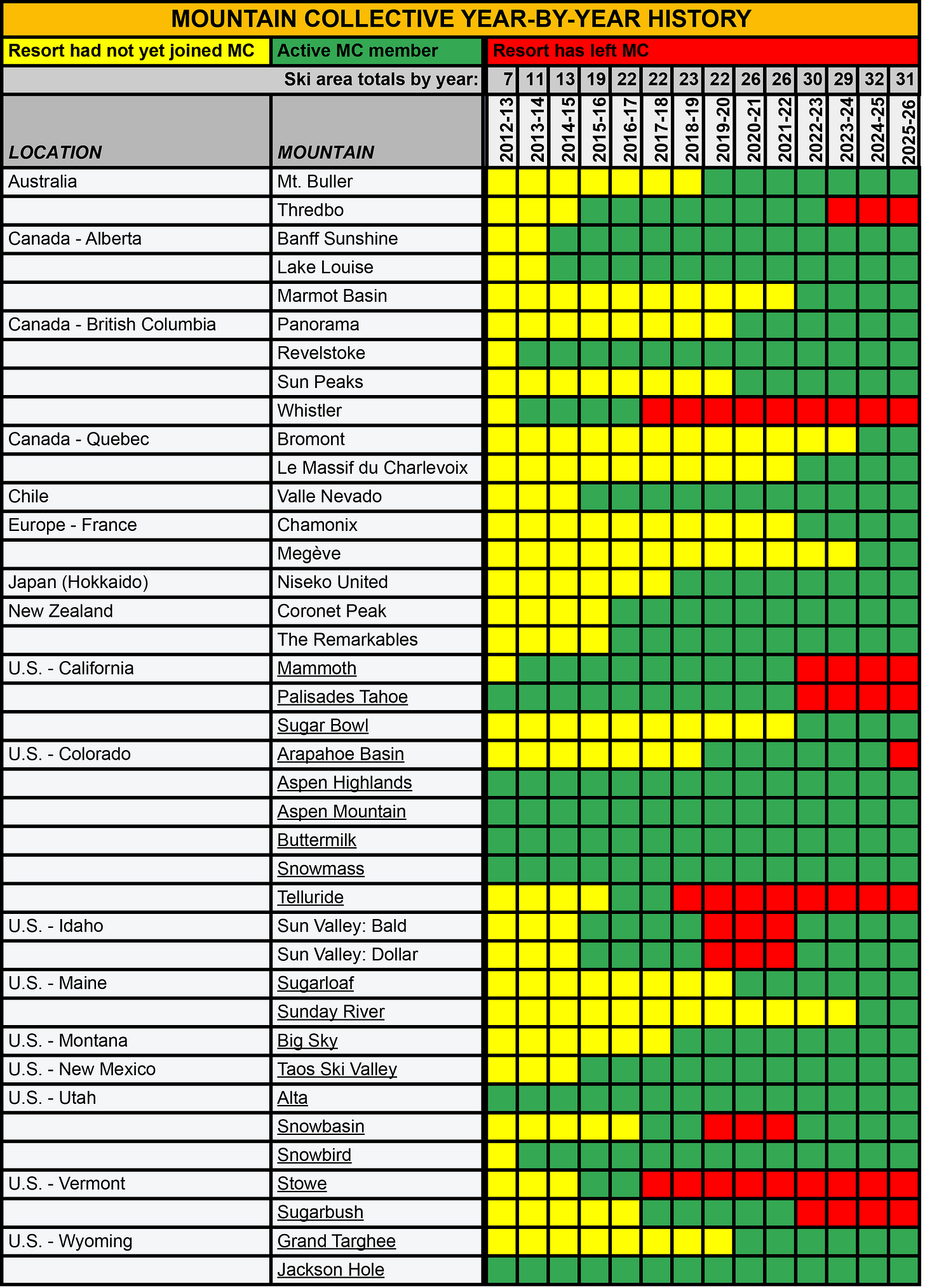

But here we are in 2025, with Ikon and Mountain Collective entering their eighth winter of co-existence. MC has more lives than a wartime alley cat. Nothing could kill it – not Sun Valley and Snowbasin departing (they later returned); not Alterra ripping Mammoth, Palisades, and Sugarbush off in 2022; not mass-market recognition of the Ikon Pass as a Thing. Mountain Collective methodically added A-Basin (since departed), Grand Targhee, and Sugar Bowl in the West; Sugarloaf and Sunday River in the East; and Panorama and Sun Peaks in B.C.; and entered new markets in Quebec (Le Massif, Bromont) and France (Chamonix, Megève). Mountain Collective enters the 2025-26 season with 31 ski areas (26 destinations), eight more than it had at Ikon’s 2018-19 debut.

Mountain Collective and Ikon still have huge overlap, sharing 25 partners. But that number drops to 16 for Mountain Collective and Ikon Base (Alta, Jackson Hole, Snowbasin, Sun Valley’s two mountains, and Aspen’s four mountains are on the former but not the latter). And as Alterra has steadily raised the price of Ikon Base while removing top-shelf partners, Mountain Collective has grown more attractive for the fly-in-fly-out skier looking for a quick rip on a badass mountain. Alterra’s decision to kill the Ikon Base Plus upsell, which gave skiers a back door into Aspen, Jackson, Alta, Snowbasin, and Sun Valley without having to pay full freight for Ikon, only helps MC’s position.

Let’s take a deeper look at Mountain Collective versus Ikon, and why the OG pass increasingly makes sense as a budget alternative.